Products

We offer a wide range of trading products.

Extended Settlement Contract Product Overview

Definition

Acceptable Collaterals

Cash : Minimum S$2,000/-

Shares* : Minimum S$10,000/-, subject to a minimum cash deposit of S$2,000/-

Margin Requirements (IM and MM)

Initial Margin (IM) is required for opening of both long and short ES positions. Maintenance Margin (MM) must be maintained subsequent to the deposit of IM for outstanding positions in ES contracts.

IM: (SGX Margin Rate + 5%) x Value of Underlying Securities

MM: SGX Margin Rate x Value of Underlying Securities

Leverage

Initial leverage ranges from 4 to 10 times as follows:

| SGX Margin Rate* | Initial Margin Rate | Leverage |

| 5% | 10% | 10x |

| 10% | 15% | 6.6x |

| 15% | 20% | 5x |

| 20% | 25% | 4x |

| 25% | 30% | 3.3x |

The ES trading limit will be set by LTS and this may be varied by LTS in its sole and absolute discretion.

* For list of ES contracts and corresponding SGX Margin rates, please refer to this page.

Maintenance Requirements

| Initial / Maintenance Margin | Action |

| Net CAV = IM | No new ES positions shall be initiated unless additional cash or securities are deposited. |

| Net CAV < MM | Margin Call - Top up with acceptable collaterals to IM level within 1 business day from date of margin call. Failure to top up may result in closing off outstanding ES positions and/or liquidating of share collaterals by Company to IM level. |

| Net CAV < 60% of MM | Margin Sellout - Closing off outstanding ES positions and/or liquidating of share collaterals without notice. |

| Customer Asset Value (CAV) | Cash and market value of securities in a client's account subject to such hair-cut as specified by LTS. |

| Net CAV | CAV +/- (Realised + Unrealised*) Profit/Loss |

| Maintenance Margin (MM) | SGX Margin Rate x Last Done Price of Underlying Security x Quantity |

| Initial Margin (IM) | (SGX Margin Rate + 5%) x Last Done Price of Underlying Security x Quantity |

*Unrealised profit/loss refers to mark to market gains and losses from the daily valuation of ES positions based on the valuation price of ES contracts as determined by SGX at the end of each day.

Tenure / Rollover

Tenure (approximately 35 days)

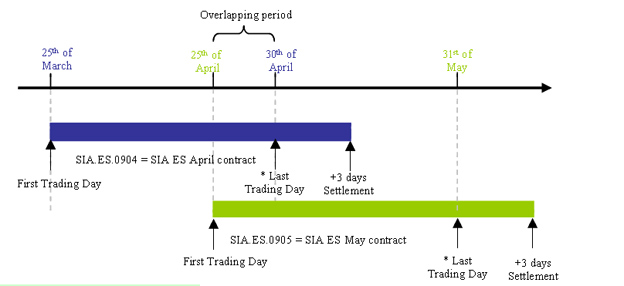

ES has a defined First Trading Day (FTD) and Last Trading Day (LTD).

FTD is defined as 25th of the month that is immediately preceding the contract month i.e. "April 09 ES contract" will start trading on 25 March 09.

LTD is defined as the last market day of the contract month ("market day" is a day on which the SGX-ST is open for trading in securities).

Rollover

An investor may 'roll over' his positions in ES contract by entering into an offsetting trade in the ES contract and initiating a new position in the ES contract concurrently in the overlapping period. Please see illustration below.

Settlement of ES Contract

Settlement Basis : Physical delivery of the underlying securities*

Settlement Date : Last Trading Day (LTD) + 3 market days

Buying-in of underlying securities

If the seller of the ES contract does not have any or sufficient underlying securities of the ES contract on Settlement Date (ie. LTD + 3), CDP will commence buying-in of the underlying securities on LTD + 4.

Selling out of underlying securities

If the buyer of the ES contract does not settle the underlying securities of the ES contract on Settlement Date (ie. LTD + 3), LTS shall commence force selling of the underlying securities.

*For client with share collaterals, it is his/her responsibility to ensure that the underlying securities reside in the ES Sub-Account under LTS. If the underlying securities are held in the client's other securities accounts, instruction to the Trading Representative to transfer the said securities to the ES Sub-Account should be made latest by LTD. LTS shall not be held liable for any delay or failed transfer.

Commission

|

|

Additional charges:

SGX Trading Fees of 0.0075% on the value of the contract

CDP Clearing Fees of 0.0325% on the value of the contract, subject to a maximum of S$600; and Prevailing Goods and Services tax (GST) on brokerage, trading and clearing fees.

Interest Chargeable On Share Collateral

Interest is chargeable at 6% per annum, calculated on daily rest, on the value of share collateral required as Net Maintenance Margin (Net MM).

Net MM = MM +/- (Realised + Unrealised) Loss/Profit – Cash Balance

Corporate Action For Underlying Securities

Whenever there is a corporate action on any underlying securities, such as dividend, share split, bonus issue etc, SGX may adjust the corresponding ES contracts, which may include early expiration of the ES contract and listing of a new ES contract with an obligation to deliver or take delivery of the underlying on an ex-basis, to replace the expired ES contract.

Please refer to www.sgx.com/es for updates and details on corporate action adjustments to ES contracts.

Fees*

TRANSFER FEES (CHARGED BY CDP)

S$10/- per counter for transfer of securities from/to a client's direct account to/from the ES sub-account.

QUARTERLY SUB-ACCOUNT MAINTENANCE FEES (CHARGED BY CDP)

S$15/- for each sub-account with securities.

Fees will be debited to the ES Account at month-end. (LTS may waive the maintenance fees based on volume transacted per quarter (currently S$100,000).

HANDLING FEES FOR DIVIDENDS ATTRIBUTABLE TO SHARE COLLATERAL

S$3 per counter up to S$10.00

S$5 per counter up to S$500.00

1% per counter above S$500.00, maximum S$100/-

* All fees are subject to prevailing GST

Terms enumerated herein are subject to change without further notice

Novation

The Client acknowledges that in the event of any default on the part of LTS, CDP is not obliged to effect any novation to take over the position of LTS.

This advertisement has not been reviewed by the Monetary Authority of Singapore.