Products

We offer a wide range of trading products.

Extended Settlement Contract Product FAQ

-

01. What is an Extended Settlement (ES) contract?

An Extended Settlement (ES) contract is a contract between two parties, to buy or sell a specific quantity of a specific underlying securities at a specific price for settlement at a specific future date when the contract matures or expires.

An Extended Settlement (ES) contract is a contract between two parties, to buy or sell a specific quantity of a specific underlying securities at a specific price for settlement at a specific future date when the contract matures or expires.ES contracts are listed and traded on the Singapore Exchange (SGX-ST). Buying and selling of ES contracts are contracted on the same basis as buying and selling of shares. However, SGX-ST has classified ES contracts as futures contracts and margins are required when you buy or sell ES contracts. Please refer to Appendix 1 for contract specifications.

-

02. How do I open an ES account?

You may contact your Trading Representative or call personally at our office at 16 Collyer Quay, #15-00, Income at Raffles, Singapore 049318.

You may contact your Trading Representative or call personally at our office at 16 Collyer Quay, #15-00, Income at Raffles, Singapore 049318. -

03. How long does it take to open an ES account?

It takes approximately 3 working days.

It takes approximately 3 working days. -

04. Can I pledge shares as collateral?

You may pledge share collateral (minimum S$10,000), subject to a minimum cash deposit of S$2,000.

You may pledge share collateral (minimum S$10,000), subject to a minimum cash deposit of S$2,000. Interest is chargeable on share collaterals (please see Question 22).

-

05. What are the shares that I can pledge?

Please refer to LTS's Acceptable Share Collaterals List For ES. (as at 1 March 2010)

Please refer to LTS's Acceptable Share Collaterals List For ES. (as at 1 March 2010)

-

06. What are the risks of trading ES contract?

Illustration: (in S$) Leveraged Nature of ES Contracts

Leveraged Nature of ES Contracts

You may trade several times the value of collaterals deposited with LTS. This means that the risks and returns are magnified accordingly. You may sustain large losses as well as gains in response to small price movements.

Cash Account ES Account Initial Outlay $5,000 $5,000 Price of underlying share $1.00 $1.00 Quantity Bought 5,000 50,000 (assuming leverage of 10x) Price of underlying share if price drops $0.20 $0.80 $0.80 Total loss $0.20 * 5,000 = $1,000; $0.20 * 50,000 = $10,000 Price of underlying share if price rises $0.10 $1.10 $1.10 Total gain $0.10 * 5,000 = $500 $0.10 * 50,000 = $5,000 Margin Call

You may be called upon at short notice to make additional margin deposits of substantial amounts when the market moves against the position that you hold. When you are unable to top up the required funds on time, LTS may close your outstanding positions and/or liquidate collateral shares without notice.

Illiquid counter

If the underlying is illiquid, the risk of loss may be increased as it is difficult or impossible for you to liquidate a position in the ES contract. In the event of suspension of trading in an ES contract or the underlying, you may be required to cash settle your trades.

Failed Delivery of Physical Shares

After the Last Trade Date (LTD), contracts will be settled in the same manner as the ready market contracts on LTD + 3.

If you hold a short ES position until expiration and do not have the required securities in your account on LTD + 3, CDP will conduct buying-in of the underlying securities the next market day.

If you hold a long ES position until expiration and do not make payment for the underlying securities of the ES contract by LTD + 3, LTS will commence force-selling of the underlying securities.

-

07. What are the margin requirements for ES contracts?

Initial Margin (IM) is required for opening of both long and short ES positions. Maintenance Margin (MM) must be maintained subsequent to the deposit of IM for outstanding positions in ES contracts.

Initial Margin (IM) is required for opening of both long and short ES positions. Maintenance Margin (MM) must be maintained subsequent to the deposit of IM for outstanding positions in ES contracts.IM : (SGX Margin Rate + 5%) x Value of Underlying Securities

MM : SGX Margin Rate x Value of Underlying Securities

-

08. How much leveraging can I get?

Depending on the ES contract that you trade, the leverage ranges from 4 to 10 times.SGX Margin Rate Initial Margin Rate Leverage 5% 10% 10x 10% 15% 6.6x 15% 20% 5x 20% 25% 4x 25% 30% 3.3x The ES trading limit will be set by LTS and this may be varied by LTS in its sole and absolute discretion.

-

09. What are the ES trading hours?

ES contract trading hours are the same as the trading hours of the underlying securities in the ready market.

ES contract trading hours are the same as the trading hours of the underlying securities in the ready market.

-

10. How are the ES contracts displayed on the trading screen?

The ES contracts are displayed below the underlying securities on the same trading screen.

The ES contracts are displayed below the underlying securities on the same trading screen. ES contracts follow specific naming convention that clearly identifies a counter as an ES contract and thereby differentiates it from its underlying security counter.

-

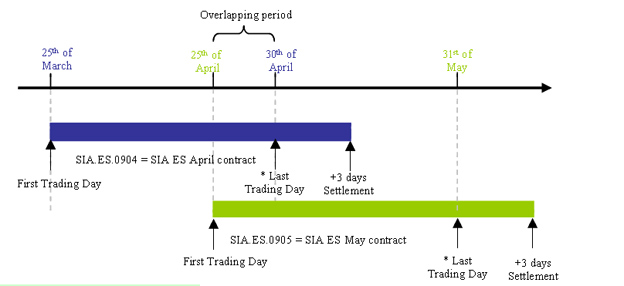

11. What is the ES contract tenure and when can I rollover my positions?

ES contract has a tenure of approximately 35 days.

ES contract has a tenure of approximately 35 days. ES has a defined First Trading Day (FTD) and Last Trading Day (LTD).

FTD is defined as 25th of the month that is immediately preceding the contract month eg. an April 09 ES contract will start trading on 25 March 2009.

LTD is defined as last market day of the contract month ("market day" is a day on which the SGX-ST is open for trading in securities).

You may 'roll over' your positions in ES contract by entering into an offsetting trade in the ES contract and initiating a new position in the ES contract during the period that the 2 contract months overlap

-

12. How are ES contracts settled?

Settlement of ES contracts is by delivery of the underlying securities on the third market day after the Last Trading Day (LTD + 3). On LTD + 3, ES contracts are settled in the same manner as ready market trades.

Settlement of ES contracts is by delivery of the underlying securities on the third market day after the Last Trading Day (LTD + 3). On LTD + 3, ES contracts are settled in the same manner as ready market trades. -

13. What happens when I do not have the underlying securities to deliver on Settlement Date (i.e. LTD +3)?

CDP will conduct buying-in of the underlying securities under CDP Clearing Rules.

CDP will conduct buying-in of the underlying securities under CDP Clearing Rules. -

14. What happens if I am unable to make payment for the underlying securities of the ES contract by Settlement Date (i.e. LTD +3)?

LTS will commence force-selling of the underlying securities.

LTS will commence force-selling of the underlying securities. -

15. How do corporate actions on the underlying securities affect my ES contracts??

Adjustments will be made to ES contracts in the event of the following corporate actions:.

Adjustments will be made to ES contracts in the event of the following corporate actions:.

- Dividends

- Bonus Share Issues

- Stock Splits

- Rights IssuesFor other corporate actions, there might be early expiration of contracts.

(Please refer to www.sgx.com/es for illustrations on corporate action adjustment to ES contracts.)

-

16. What happens to the ES contract when the underlying security is suspended from trading?

The corresponding ES contracts will also be suspended from trading. In the event of suspension of trading in an ES contract or the underlying, you may be required to cash settle your trades.

The corresponding ES contracts will also be suspended from trading. In the event of suspension of trading in an ES contract or the underlying, you may be required to cash settle your trades. -

17. When is a margin call made?

A margin call is made when the Net Customer Asset Value (Net CAV) falls below the Maintenance Margin (MM).

A margin call is made when the Net Customer Asset Value (Net CAV) falls below the Maintenance Margin (MM).Customer Asset Value (CAV) = Cash and market value of securities in a customer's account subject to such hair-cut as specified by LTS

Net CAV = CAV +/- (Realised + Unrealised*) Profit/Loss

Maintenance Margin (MM) = SGX Margin Rate X Last Done Price of Underlying Security X Quantity

*Unrealised profit/loss refers to mark to market gains and losses from the daily valuation of ES positions based on the valuation price of the ES contracts determined by SGX at the end of each day.

-

18. When do I need to top-up my ES account?

You will need to top-up your account to the Initial Margin (IM) level within one market day from the date of margin call. For example, if margin call is made on Monday, top-up is required by Tuesday.

You will need to top-up your account to the Initial Margin (IM) level within one market day from the date of margin call. For example, if margin call is made on Monday, top-up is required by Tuesday. Initial Margin (IM) = (SGX Margin rate + 5%) X Last Done Price of Underlying Security X Quantity

-

19. What happens if I am unable to top-up?

LTS shall have absolute discretion and without further notice to you, liquidate all or such part of your collaterals deposited or offset all or such part of your outstanding positions, to bring your margin to at least the IM level.

LTS shall have absolute discretion and without further notice to you, liquidate all or such part of your collaterals deposited or offset all or such part of your outstanding positions, to bring your margin to at least the IM level. -

20. When will force-selling take place?

Force selling shall take place when the Net CAV falls below 60% of the MM.

Force selling shall take place when the Net CAV falls below 60% of the MM. Force selling shall take place when the Net CAV falls below 60% of the MM.

-

21. Will my losses be only up to the collateral amount in the event that all my shares are force-sold?

No. Your losses may exceed the value of collaterals placed as margin, in which case you will be required to make good any outstanding losses after the force-sale.

No. Your losses may exceed the value of collaterals placed as margin, in which case you will be required to make good any outstanding losses after the force-sale. -

22. How is interest on share collateral computed?

Interest is chargeable at 6% per annum, calculated on daily rest, on the value of share collateral required as Net Maintenance Margin

(Net MM).

Interest is chargeable at 6% per annum, calculated on daily rest, on the value of share collateral required as Net Maintenance Margin

(Net MM).Net MM = MM +/- (Realised + Unrealised) Loss/Profit – Cash Balance

-

23. What are the transaction fees involved in trading ES?

Advisory Contract Value Brokerage Up to $50k 0.5% > $50k to $100k 0.4% > $100k 0.25% Minimum : $40/- Online Contract Value Brokerage Up to $100k 0.35% > $100k 0.25% Minimum : $25/- Additional charges:

SGX Trading Fees of 0.0075% on the value of the contract

CDP Clearing Fees of 0.0325% on the value of the contract, subject to a maximum of S$600; and Prevailing Goods and Services Tax (GST) on brokerage, trading and clearing fees. -

24. Can I withdraw cash or share collaterals from my ES account?

No. Your losses may exceed the value of collaterals placed as margin, in which case you will be required to make good any outstanding losses after the force-sale.

No. Your losses may exceed the value of collaterals placed as margin, in which case you will be required to make good any outstanding losses after the force-sale. CAV >= IM + (Realised losses + Unrealised losses)

-

25. When can I withdraw the gains after I closed off the positions?

You may withdraw the gains after the Last Trading Day (LTD) + 2, provided that after the withdrawal:

You may withdraw the gains after the Last Trading Day (LTD) + 2, provided that after the withdrawal: CAV >= IM + (Realised losses + Unrealised losses)

-

26. When can I withdraw the gains after I closed off the positions?

Yes, you may. The sales proceeds will be credited to your ES account.

Yes, you may. The sales proceeds will be credited to your ES account. -

27. Are there any other administrative charges?

Quarterly maintenance fees for your Depository Agent (DA) Sub-Account, fees for share transfer between your Global Securities Account (GSA) and DA Sub-Account are charged by CDP. These will be debited to your ES account on a monthly basis. (LTS may waive these fees depending on the volume transacted for that quarter). LTS charges handling fees for dividend appropriation on underlying and collateral shares.

Quarterly maintenance fees for your Depository Agent (DA) Sub-Account, fees for share transfer between your Global Securities Account (GSA) and DA Sub-Account are charged by CDP. These will be debited to your ES account on a monthly basis. (LTS may waive these fees depending on the volume transacted for that quarter). LTS charges handling fees for dividend appropriation on underlying and collateral shares. -

28. Who can I contact for assistance?

You may contact any of the following:

You may contact any of the following: 1.Your Trading Representative,

2. LTS call centre at +65 6799 8180 or

3. LTS Online Trading Helpdesk at +65 6799 8188

This advertisement has not been reviewed by the Monetary Authority of Singapore.