FAQ

- Brokerage Charges FAQ

- E-Statements and E-Contracts FAQ

- SGX Advanced Orders FAQ

- US Advanced Orders FAQ

- Contract For Difference Advanced Orders FAQ

- General FAQ

- SGX Circuit Breaker and Error Trade Policy FAQ

- 2FA FAQ

- Specified Investment Products FAQ

- Reclassification of OLIPs to EIPs FAQ

- Young Investors FAQ

- Cyber Security FAQ

CFD Advanced Orders FAQ

General Information on CFD Advanced Orders

-

01. WHAT ARE THE ADVANCED ORDER TYPES AVAILABLE?

- Limit Order

- Market Order

- Market-to-Limit Order

-

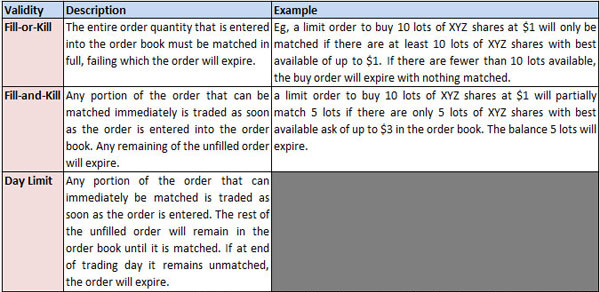

02. WHAT ARE THE ORDER VALIDITIES FOR THE ADVANCED ORDER TYPES?

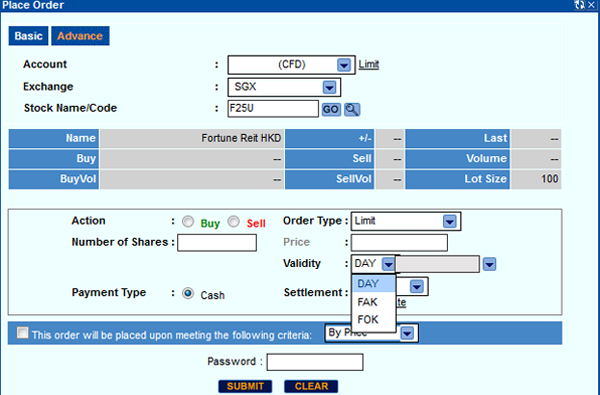

a) Day Order

a) Day Order

The order is only valid for the day that it is entered into the order book. If the order is not matched, it will expire at the end of trading day. As such, you will need to re-enter your order again on each trading day.

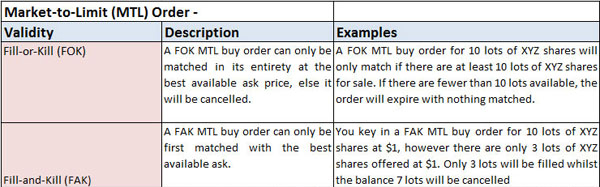

b) Fill and Kill (FAK)

The order will be matched with as much quantity as possible and any unmatched quantity will be cancelled.

c) Fill or Kill (FOK)

The order will be matched in its entire quantity or be completely cancelled. There is no partially filled order.

-

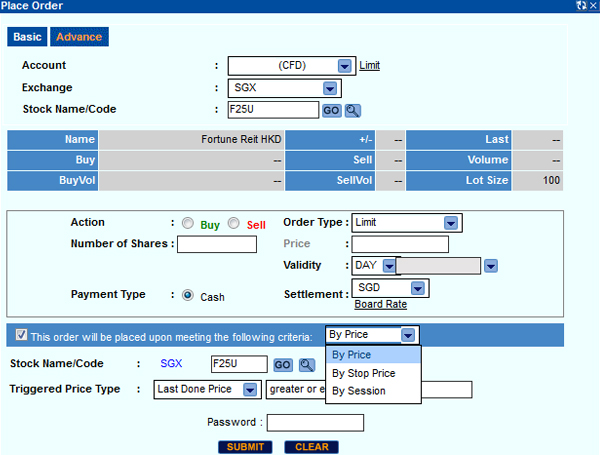

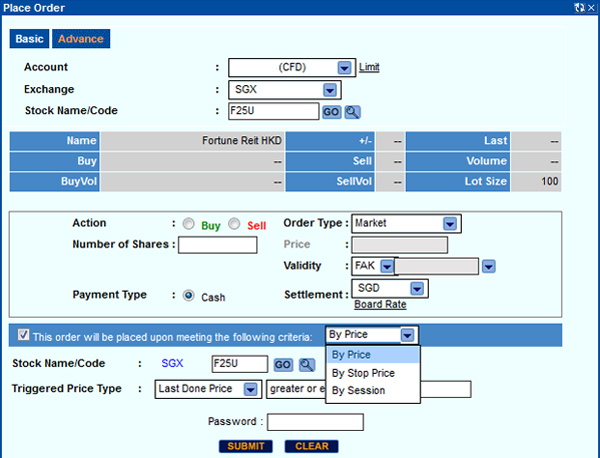

03. WHICH ORDER TRIGGERING CONDITIONS ARE AVAILABLE FOR US TO PLACE THE ADVANCED ORDERS?

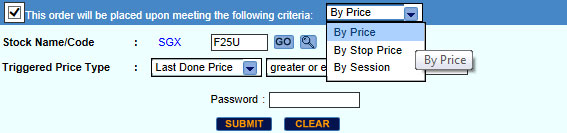

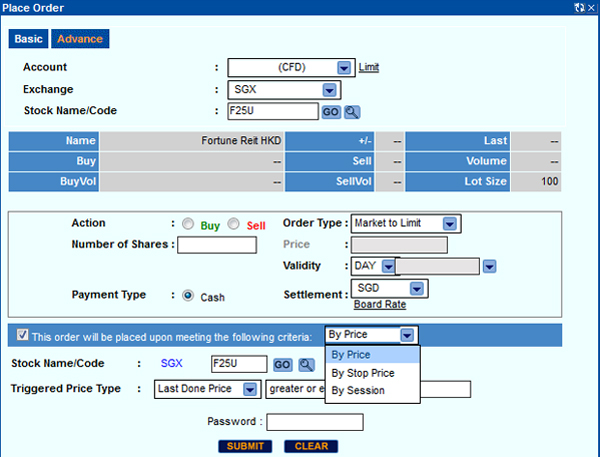

There are 3 order triggering conditions available: Price, Stop Price & Session.

There are 3 order triggering conditions available: Price, Stop Price & Session.a) Price

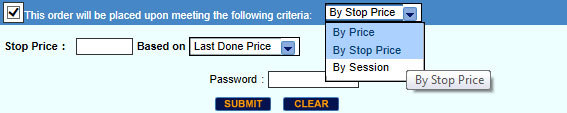

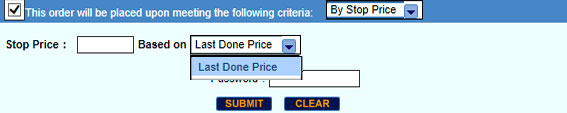

b) Stop Price

The price criteria is the condition that must be met for the order to be submitted.

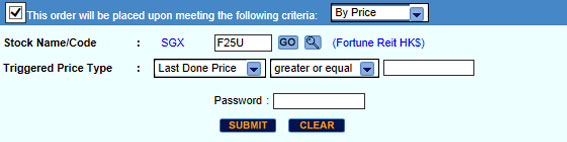

Step 1. Tick checkbox

Step 2. Select: By Price

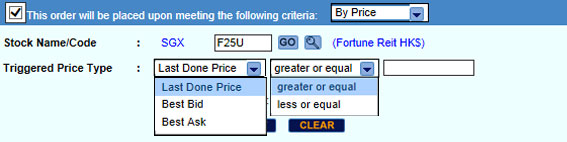

Step 3. Choose triggered price type

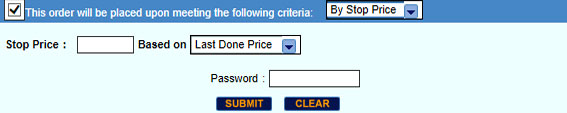

The order will be submitted upon reaching this stop price criteria.

Step 1. Tick checkbox

Step 2. Select: By Stop Price

Step 3. Enter Stop Price

The default is Last done price

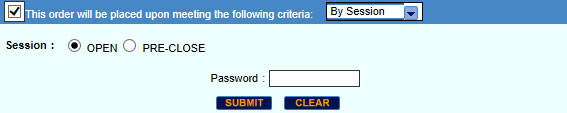

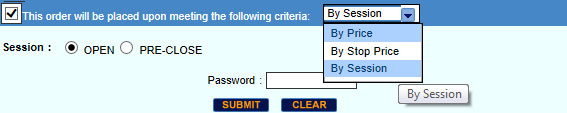

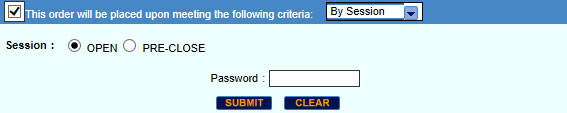

c) Session

A Session Order allows you to specify the session that you wish to submit your order. It will expire at the end of trading day if it is not triggered to SGX.

SESSION STATE ORDER SESSION THAT ORDER IS TRIGGERED TIME THAT ORDER WILL BE TRIGGERED TO SGX "Open" session when Open session starts at 9:00hrs "Pre-Close" session when Pre-Close session starts at 17:00hrs or 12:00hrs for half day trading

Step 1. Tick checkbox

Step 2. Select: By Session

Step 3. Select open or pre-close

-

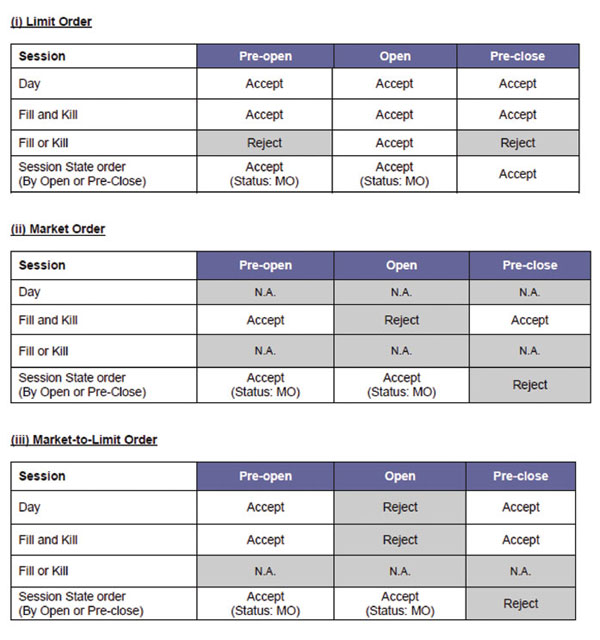

04. WHAT TYPE OF ORDER CAN I SUBMIT DURING PRE-OPEN, OPEN AND PRE-CLOSE SESSIONS?

Note:

Clients can only initiate a short position from 8.10am on the trading day itself.

Limit Orders

-

01. WHAT IS A LIMIT ORDER?

A limit order allows a buy or sell of a stock at a specified price or better.

A limit order allows a buy or sell of a stock at a specified price or better. -

02. HOW DOES A LIMIT ORDER WORK FOR THE DIFFERENT VALIDITY TYPES?

-

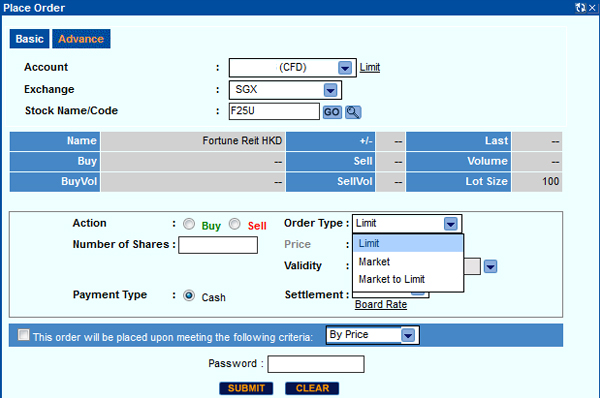

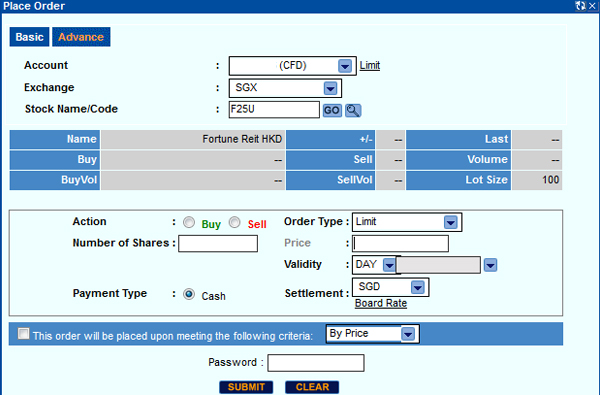

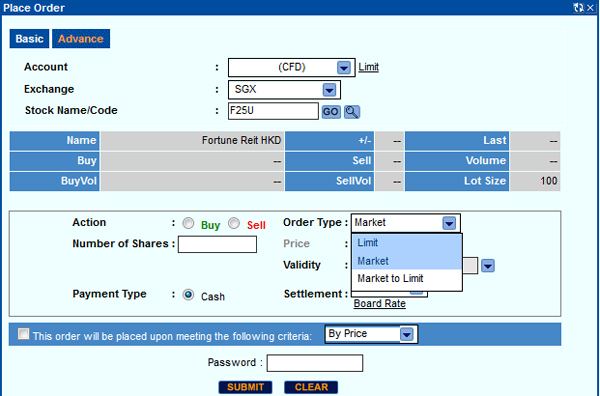

03. HOW DO I PLACE A LIMIT ORDER?

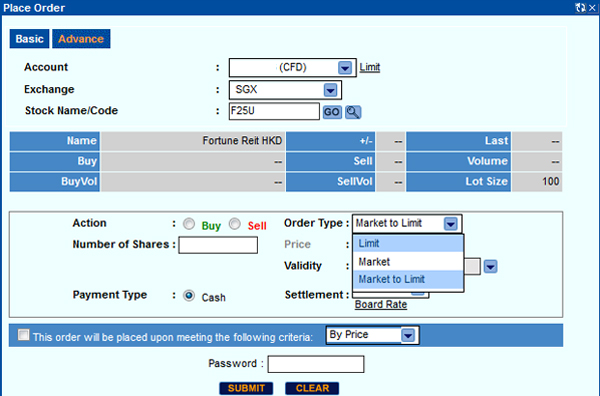

Step 1. Choose order type Limit

Step 2. Enter price

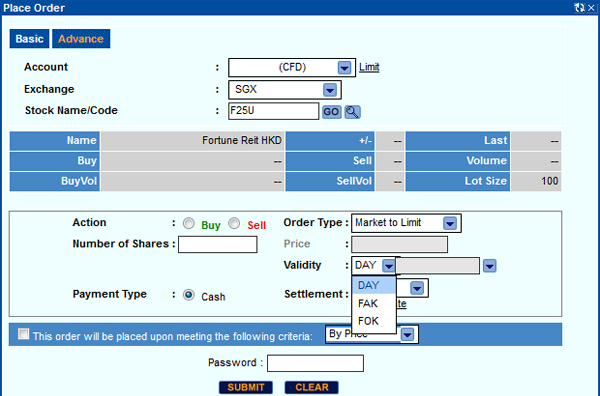

Step 3. Choose Validity

Step 4. (optional) If opting for Price Trigger Orders, please check box for Order Triggering Conditions

Market Orders

-

01. WHAT IS A MARKET ORDER?

A market order is entered with a quantity but without a price and it will be traded at the best price currently available in the market.

A market order is entered with a quantity but without a price and it will be traded at the best price currently available in the market. -

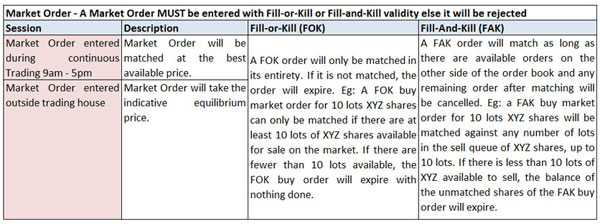

02. HOW DOES A MARKET ORDER WORK WITH THE DIFFERENT VALIDITY TYPES?

-

03. WHAT ARE THE RISKS IF I USE MARKET ORDERS?

a) There is no guarantee what price the order will be filled at. A buy order can be filled at a much higher price than intended or a sell order can be filled at a much lower price than intended.

a) There is no guarantee what price the order will be filled at. A buy order can be filled at a much higher price than intended or a sell order can be filled at a much lower price than intended.

b) Prices change quickly during a volatile market. As such the price executed may be different from the last done price before the order was entered. This is especially so for illiquid counters with a thin order book and/or wide bid-ask spread.

c) The order may be matched across multiple investors on the opposite side of the transaction and this may result in the order being done at different prices.

-

04. HOW DO I PLACE A MARKET ORDER?

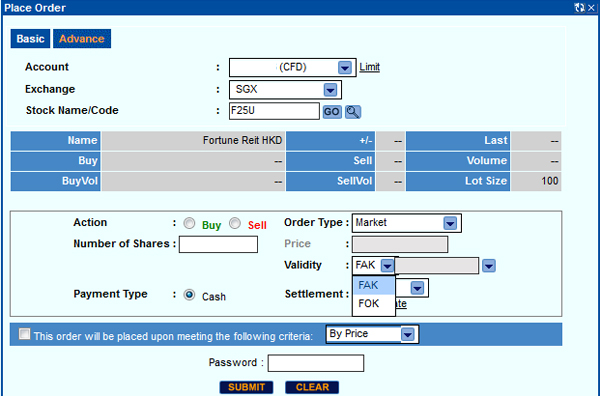

Step 1. Choose order type: Market

Step 2. Select either FAK or FOK.

Step 3. (optional) If opting for Price Trigger Orders, please check box for Order Triggering Conditions

Market-To-Limit (MTL) Orders

-

01. WHAT IS A MARKET-TO-LIMIT (MTL) ORDER?

A market-to-limit (MTL) order is entered with a quantity but without a price. It will only match at the current best bid or ask price. If the order is only partially filled after matching at the current best price, the remaining quantity will be converted to a Limit Order and the last done price will be the limit price.

A market-to-limit (MTL) order is entered with a quantity but without a price. It will only match at the current best bid or ask price. If the order is only partially filled after matching at the current best price, the remaining quantity will be converted to a Limit Order and the last done price will be the limit price.

A MTL order can only be entered during Pre-Open (8.30am – 8.58am), Open and Pre-Close (5pm – 5.04pm or 12pm – 12.04pm for half day trading) sessions.

A MTL Order can be entered with a Fill-or-Kill (FOK), Fill-and-Kill (FAK) or day validity. -

02. HOW DOES A MTL ORDER WORK WITH THE DIFFERENT VALIDITY TYPES?

-

03. HOW DO I PLACE A MARKET-TO-LIMIT ORDER?

Step 1. Choose order type: Market

Step 2. Select validity

Step 3. (optional) If opting for Price Trigger Orders, please check box for Order Triggering Conditions

This advertisement has not been reviewed by the Monetary Authority of Singapore.