FAQ

- Brokerage Charges FAQ

- E-Statements and E-Contracts FAQ

- SGX Advanced Orders FAQ

- US Advanced Orders FAQ

- Contract For Difference Advanced Orders FAQ

- General FAQ

- SGX Circuit Breaker and Error Trade Policy FAQ

- 2FA FAQ

- Specified Investment Products FAQ

- Reclassification of OLIPs to EIPs FAQ

- Young Investors FAQ

- Cyber Security FAQ

US ADVANCED ORDERS FAQ

General Information on US Advanced Orders

-

01. WHAT ADVANCED ORDER TYPES ARE AVAILABLE?

The Advanced Order types available are:

The Advanced Order types available are:- Limit Order

A limit order allows a buy or sell of a stock at a specified price or better. - Market Order

A market order is entered with a quantity but without a price and it will be traded at the best price currently available in the market. Please use extreme caution when using a market order as a lack of liquidity may result in an extremely adverse filled price. - Trailing Stop Order

A sell trailing stop order is placed when you have a long position on a stock. The Trailing Stop Price is placed either as a dollar amount or as a percentage of the market price below the current market price of the stock.

As the market price increases, the stop price rises by the trail amount or percentage. However, the stop price will remain the same when the market price decreases. If the market price reaches a new high, the stop price will resume rising by the trail amount or percentage. However, if the market price falls to or below the stop price, the Sell Trailing Order is triggered and a market order is submitted. - One Cancels The Other (OCO) Order

An OCO order consists of 2 sub-orders - the first a Limit sub-order, the other a Stop Loss sub-order. If the Limit price or the Stop Loss condition price is reached, the relevant sub-order is submitted and the other automatically cancelled.

- Limit Order

-

02. WHAT ARE THE ORDER VALIDITIES FOR THE ADVANCED ORDER TYPES?

a) Day Order

a) Day Order

The order is only valid for the day that it is entered into the order book. If the order is not matched, it will expire at the end of trading day. As such, you will need to re-enter your order again on each trading day.b) Good Till Cancel (GTC) Order

GTC is a long dated order that allow clients to place an order that will remain valid until the order is fully filled, specifically cancelled or the instrument has corporate actions, is de-listed or expired, whichever is earlier. -

03. WHAT ARE THE FILL TYPES FOR THE ADVANCED ORDER TYPES?

Fill Types: ANY and AON

Fill Types: ANY and AON

a) ANY

The order will be matched with as much quantity as possible and any unmatched quantity will be cancelled.

b) AON (All-or-None)

An All-Or-None (AON) order is an order to buy or sell a stock that must be executed in its entirety, or not executed at all. AON orders that cannot be executed immediately remain active until they are executed or cancelled. -

04. WHICH ORDER TRIGGERING CONDITIONS ARE AVAILABLE FOR US TO PLACE THE ADVANCED ORDERS?

Only Stop Price trigger condition is available.

Only Stop Price trigger condition is available.Stop Price

A Stop Price order is an order which will be traded at the specified price or better after a given stop price has been reached.

-

05. WHICH ACCOUNT TYPE ARE ADVANCED ORDERS AVAILABLE FOR ONLINE TRADING?

Currently this is available for Cash, CCT, US ATP Short and Margin accounts only.

Currently this is available for Cash, CCT, US ATP Short and Margin accounts only. -

06. WHICH MARKETS CAN I PLACE ADVANCED ORDERS?

This is currently available for US and SGX Stock Market.

This is currently available for US and SGX Stock Market.

For SGX Advanced order FAQ, please click here -

07. CAN I AMEND ADVANCED ORDERS?

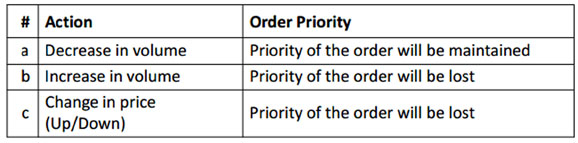

Yes, you can amend the price and quantity. However please note the conditions on the possible change of the priority of orders.

Yes, you can amend the price and quantity. However please note the conditions on the possible change of the priority of orders.

-

08. HOW DO I PLACE ADVANCED ORDERS IN US STOCK MARKET?

Please click here for the User Guide.

Please click here for the User Guide. -

09. Can I place Market orders on IPO stocks before the counter starts trading?

No, it is allowed only with limit order.

No, it is allowed only with limit order.Please note that you are not allowed to place market orders on IPO stocks before the counter starts trading. Such orders will be rejected by the market centers in US and will automatically be updated as Rejected Order under the status of your 'Order Book'.

Good Till Cancel (GTC) Order

-

01. CAN I PLACE STOP PRICE TRIGGER CONDITION FOR GTC ORDER?

Yes, Stop Price triggered order condition can be entered with GTC order type.

Yes, Stop Price triggered order condition can be entered with GTC order type. -

02. CAN I PLACE MARKET ORDERS WITH GTC FACILITY?

No, it is allowed only with limit order.

No, it is allowed only with limit order. -

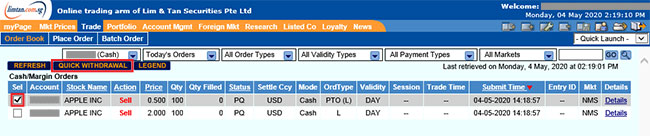

03. CAN I WITHDRAW GTC ORDERS?

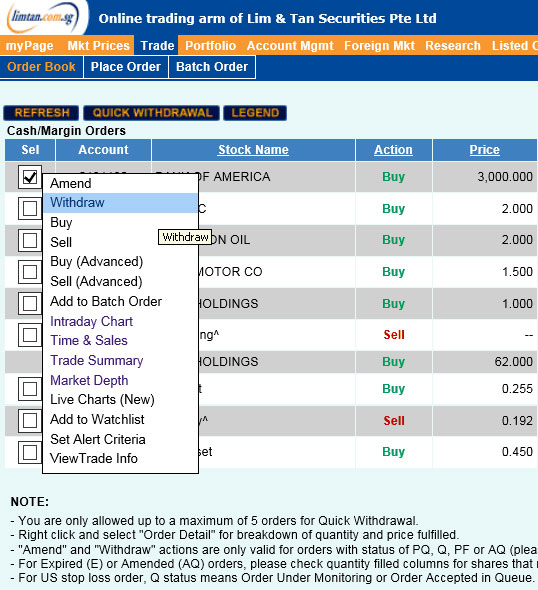

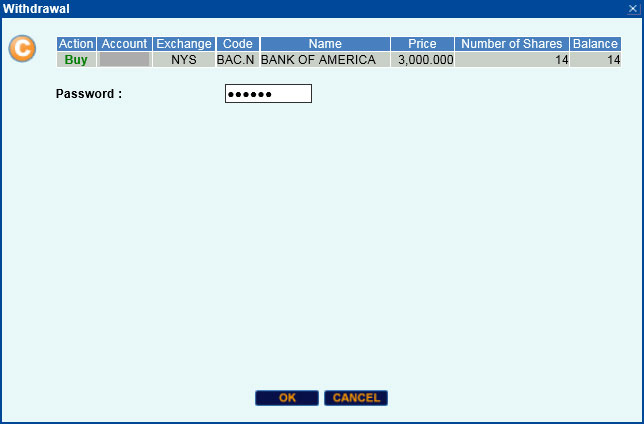

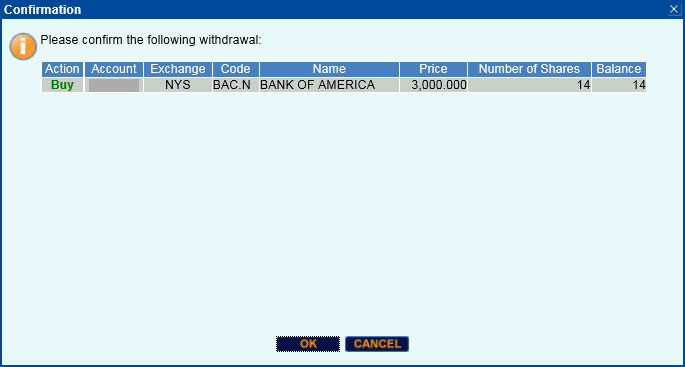

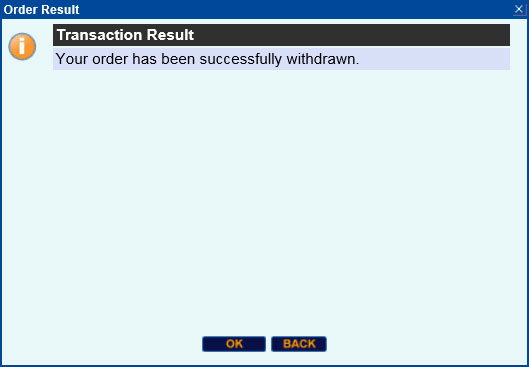

Yes, you may withdraw your GTC orders reflected under 'Order Book' in the Online Trading platform.

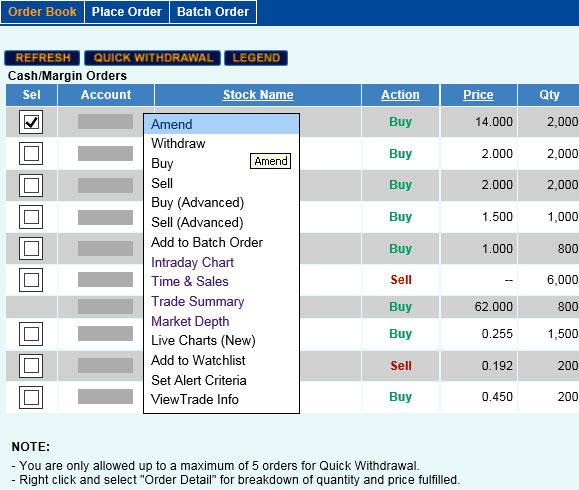

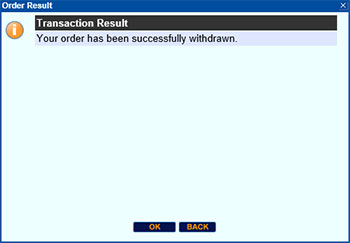

Yes, you may withdraw your GTC orders reflected under 'Order Book' in the Online Trading platform.Step 1: Select Counter to withdraw

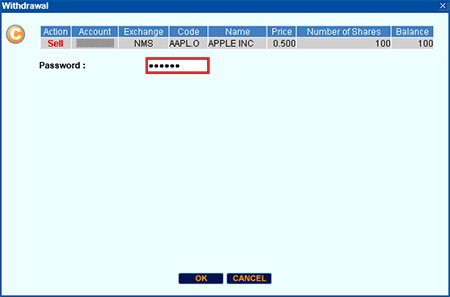

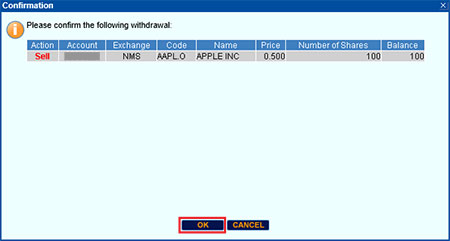

Step 2: Enter password

Step 3: Confirm on your withdrawal

-

04. CAN I AMEND GTC ORDERS?

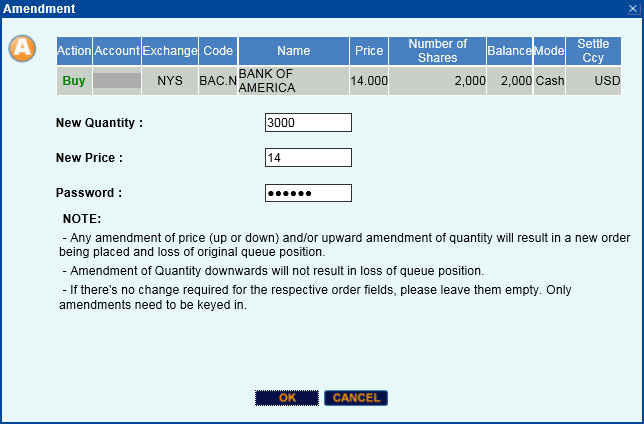

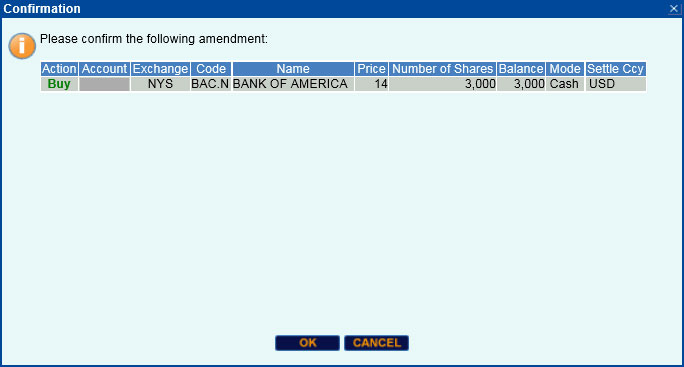

Yes, you can amend price and quantity for GTC order. However, successful amendment of order may result in possible change of the priority in queue position.

Yes, you can amend price and quantity for GTC order. However, successful amendment of order may result in possible change of the priority in queue position.Step 1: Select Counter to amend

Step 2: Enter new quantity and price followed by password

Step 3: Confirm on your amendments

Sell Trailing Stop Order

-

01. What is a sell trailing stop order?

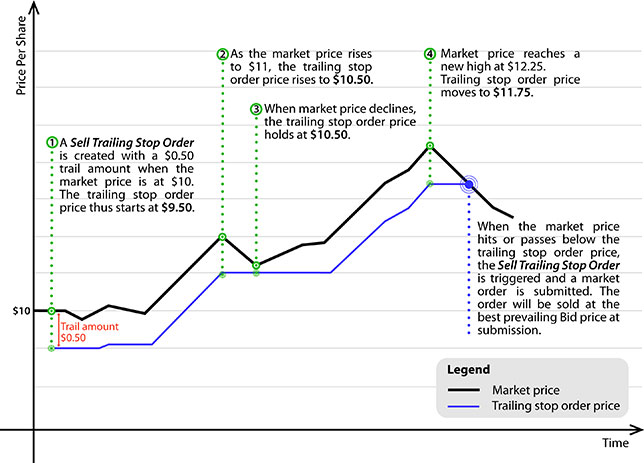

A sell trailing stop order is placed when you have a long position on a stock. The Trailing Stop Price is placed either as a dollar amount or as a percentage of the market price below the current market price of the stock.

A sell trailing stop order is placed when you have a long position on a stock. The Trailing Stop Price is placed either as a dollar amount or as a percentage of the market price below the current market price of the stock.As the market price increases, the stop price rises by the trail amount or percentage. However, the stop price will remain the same when the market price decreases. If the market price reaches a new high, the stop price will resume rising by the trail amount or percentage. However, if the market price falls to or below the stop price, the Sell Trailing Order is triggered and a market order is submitted.

Do note that Market Orders will be executed at the best prevailing bid price. You are advised to exercise caution, in particular, for illiquid counters as your order may be filled at an unfavourable price.

The below graph is for illustration purpose only:

-

02. What is the difference between setting a Trail amount in percentage or dollar value?

When setting a trail amount as a percentage, the trail amount in dollar value will get bigger as the market price increases. On the other hand, when setting trail amount as a dollar value, the trail amount in dollar value remains fixed.

When setting a trail amount as a percentage, the trail amount in dollar value will get bigger as the market price increases. On the other hand, when setting trail amount as a dollar value, the trail amount in dollar value remains fixed. -

03. Can I specify the validity of the Sell Trailing Stop order?

Yes. Validity of the Sell Trailing Stop order can be placed as either a Day or Good-Till-Cancel (GTC).

Yes. Validity of the Sell Trailing Stop order can be placed as either a Day or Good-Till-Cancel (GTC).A day order is only valid for the day that it is entered into the order book. If the order is not triggered, it will expire at the end of the trading day. As such, you will need to re-enter your order again on each trading day.

GTC is a long dated order that allow clients to place an order that will remain valid until the order is fully filled, specifically cancelled or the instrument has corporate actions, is de-listed or expired, whichever is earlier.

-

04. Can I amend a Sell Trailing Stop order?

A Sell Trailing Stop Order cannot be amended. You would need to withdraw the order and resubmit a new order.

A Sell Trailing Stop Order cannot be amended. You would need to withdraw the order and resubmit a new order.

One Cancels The Other (OCO) Order

-

01. What is an One Cancels The Other (OCO) order?

An OCO order consists of 2 sub-orders - the first a Limit sub-order, the other a Stop Loss sub-order. If the Limit price or the Stop Loss condition price is reached, the relevant sub-order is submitted and the other automatically cancelled.

An OCO order consists of 2 sub-orders - the first a Limit sub-order, the other a Stop Loss sub-order. If the Limit price or the Stop Loss condition price is reached, the relevant sub-order is submitted and the other automatically cancelled. -

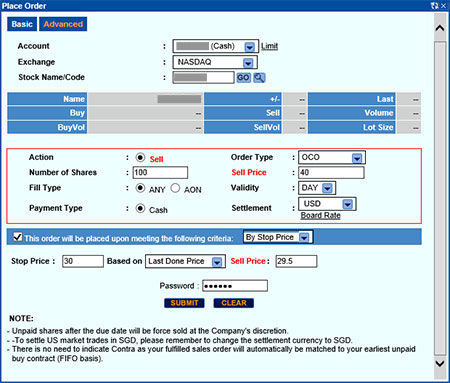

02. How does an OCO order work?

Example: A client holds shares of company ABC, currently trading at $35. He would like to sell at $40, but also wants to stop loss if the price drops below $30. He thus places an OCO order with the Limit order price at $40 and the Stop Loss condition price at $30. He places the Stop Loss order price at $29.50 which is slightly below the condition price to ensure that his stop loss order will be filled, subject to liquidity.

Example: A client holds shares of company ABC, currently trading at $35. He would like to sell at $40, but also wants to stop loss if the price drops below $30. He thus places an OCO order with the Limit order price at $40 and the Stop Loss condition price at $30. He places the Stop Loss order price at $29.50 which is slightly below the condition price to ensure that his stop loss order will be filled, subject to liquidity.

-

03. Can I withdraw an OCO order?

Yes. You may withdraw your OCO order from the Order Book by withdrawing either the Limit or the Stop Loss sub-orders. Withdrawing either sub-order will automatically withdraw the other sub-order as well.

Yes. You may withdraw your OCO order from the Order Book by withdrawing either the Limit or the Stop Loss sub-orders. Withdrawing either sub-order will automatically withdraw the other sub-order as well.Step 1: Select Counter to withdraw

Step 2: Enter password

Step 3: Confirm on your withdrawal

-

04. Can I amend an OCO order?

An OCO order cannot be amended. You would need to withdraw the order and resubmit a new order.

An OCO order cannot be amended. You would need to withdraw the order and resubmit a new order.

This advertisement has not been reviewed by the Monetary Authority of Singapore.