FAQ

- Brokerage Charges FAQ

- E-Statements and E-Contracts FAQ

- SGX Advanced Orders FAQ

- US Advanced Orders FAQ

- Contract For Difference Advanced Orders FAQ

- General FAQ

- SGX Circuit Breaker and Error Trade Policy FAQ

- 2FA FAQ

- Specified Investment Products FAQ

- Reclassification of OLIPs to EIPs FAQ

- Young Investors FAQ

- Cyber Security FAQ

TRADING IN US STOCKS FAQ

Trading in US Stocks - What you should know?

-

01. Who is eligible for the US Stock Trading?

Anyone who is above 21 years old and with no record of delinquency can open a limtan.com.sg Online Trading account. This account will allow you to gain access to US Stock Trading, subject to Risk Warning Statement (RWS) acknowledgement and further permissions and / or documentation. Please click here for more information on RWS and Overseas List Investment Products (OLIPs).

Anyone who is above 21 years old and with no record of delinquency can open a limtan.com.sg Online Trading account. This account will allow you to gain access to US Stock Trading, subject to Risk Warning Statement (RWS) acknowledgement and further permissions and / or documentation. Please click here for more information on RWS and Overseas List Investment Products (OLIPs).You will also need to be SIP qualified to trade US ETFs. Please contact your Trading Representative or click here for more information on SIP qualifications.

US citizens or US residents are not allowed to trade in US securities.

-

02. How do I open a US Stock Trading account?

a) You need to have a limtan.com.sg Online Trading account before you can trade in the US Stock Market. If you do not have an Online Trading account, please visit Lim & Tan Securities or come by our various roadshow location islandwide. You may also call our Online Trading Helpdesk (Tel: +65 6799 8188) to obtain a set of forms. The forms can also be downloaded here.

a) You need to have a limtan.com.sg Online Trading account before you can trade in the US Stock Market. If you do not have an Online Trading account, please visit Lim & Tan Securities or come by our various roadshow location islandwide. You may also call our Online Trading Helpdesk (Tel: +65 6799 8188) to obtain a set of forms. The forms can also be downloaded here.b) Duly complete the U.S. Markets Account Opening Form, W-8BEN Form and Risk Disclosure Form and submit it to Lim & Tan Securities or our authorised Trading Representatives. The forms can be downloaded here.

c) Read the NYSE/NASDAQ/AMEX Market Data Agreement as required by NYSE/NASDAQ/NYSE American (formerly AMEX) and check to accept at the pop-up window on our Online Trading platform upon your first access to the U.S. market.

Please seek your own independent professional advice for filling out the W-8BEN form and the acceptance of the NYSE/NASDAQ/AMEX Market Data Agreement where necessary.

-

03. What is W-8BEN form?

Non-U.S. persons are subject to U.S. tax (max 30%) on certain types of income received from U.S. sources, such as interest and dividends.

Non-U.S. persons are subject to U.S. tax (max 30%) on certain types of income received from U.S. sources, such as interest and dividends. It is the requirement of the U.S. Internal Revenue Service ("IRS") that non-U.S. persons are required to complete and submit a duly completed W-8BEN Form for the following reasons:

to establish that you are not a U.S. person; and

to claim that you are the beneficiary of the US-sourced income for which the W-8BEN Form is provided; and

to claim, if applicable, a reduced rate of, or exemption from, withholding tax by being a resident of a foreign country with which the United States has an income tax treaty.

W-8BEN form

If you would like to know more about the instructions for Form W-8BEN and tax treaties, please visit the following IRS websites or consult your tax adviser:

Instructions for Form W-8BEN:

https://www.irs.gov/pub/irs-pdf/iw8ben.pdfTax Treaties Information:

https://www.irs.gov/businesses/international-businesses/united-states-income-tax-treaties-a-to-z -

04. How do I check the W-8BEN Form Expiry/resubmit the form?

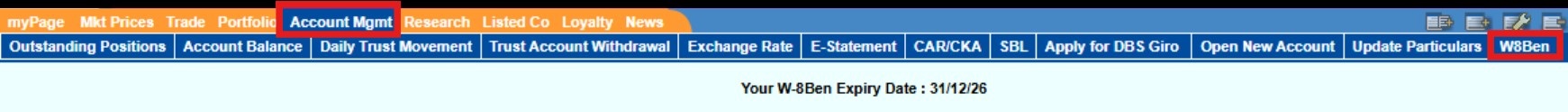

(1) Check W-8BEN Form Expiry

To check for the expiry date of your W-8BEN form, please login to limtan.com.sg and select as follow:1. Select "W8Ben" under Account Mgmt.

2. If W-8BEN has not expired, the expiry date will be indicated. If W-8BEN has expired, the W-8BEN acknowledgement box will pop-up.

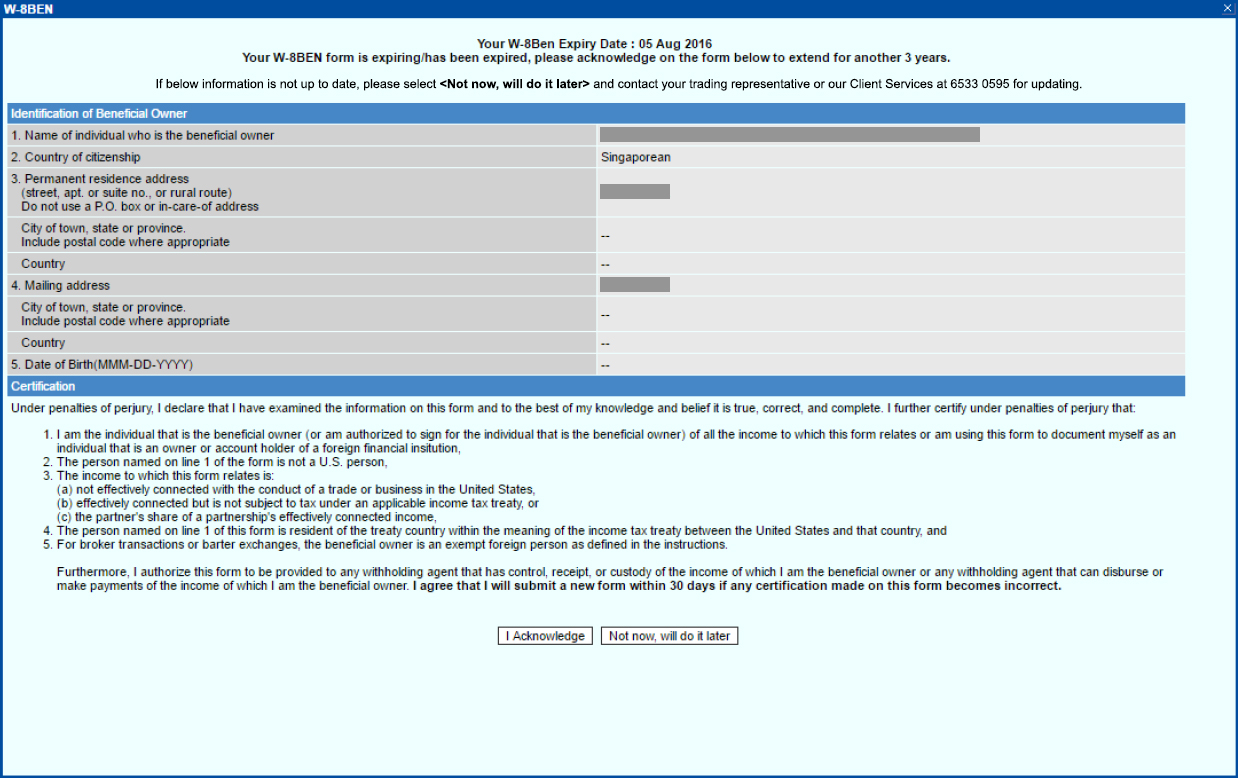

(2) Re-submission of W-8BEN

Please note that your rejected orders may be due to expired W-8BEN. To re-submit your W-8BEN to continue to trade in the US Markets, please check that the details on the electronic W-8BEN form are accurate before acknowledging it. Upon acknowledging the electronic W-8BEN form, you will be able to trade in the US Markets for an additional 3 years.

-

05. What is the NYSE/NASDAQ/AMEX Market Data Agreement?

Please contact the below mentioned address for more information:

Please contact the below mentioned address for more information:

The NYSE/NASDAQ/AMEX Market Data Agreement, also known as the 'Subscribers' Agreement' upon your first login, relates to provision of market data by the New York Stock Exchange (NYSE)/NASDAQ/NYSE American (formerly AMEX). As required by NYSE/NASDAQ/NYSE American (formerly AMEX), every Lim & Tan Securities client who wants to trade in the US Stock Market must read and check on this agreement to confirm that he/she is a "non-professional" market data subscriber before obtaining access to the NYSE/NASDAQ/AMEX market data.

-

06. What are the US Markets Brokerage Rates?

Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.3% per trade 0.285% Minimum Commission US$20 US$19 Advisory Brokerage Rates Contract Size Rates* Commission 0.3% per trade Minimum Commission US$20 Other Charges US$ GST [Brokerage + US Trading Activity Fee (for SELL order only) + Financial Transaction Tax] x prevailing GST rate US Trading Activity Fee (for SELL order only) US$0.000195 per share (Subject to minimum US$0.01 and maximum US$9.79 per contract) (w.e.f. 1 Jan 2026) Financial Transaction Tax 0.3% (Buy orders only, applicable for French/Italian ADRs) *Subject to Changes

Additional charges:

10% gross proceeds withholding on sales of PTPs by non-US resident account holders, unless a qualified notice exception is provided by a Publicly Traded Partnerships (PTP).

Please click here to view the list of PTPs.

-

07. WHAT IS INTRA-DAY ACTIVE TRADER PROGRAM (ATP)?

For more information on ATP, please refer to the FAQ.

For more information on ATP, please refer to the FAQ.

Account Related

-

01. Are there any processing fees required to open the account?

There is no processing fee for opening an Online Trading account.

There is no processing fee for opening an Online Trading account. -

02. Can I use my limtan Login ID and password to access and trade in the US Stock

Market? Yes. You can use the same login to your limtan.com.sg Online trading account if you are already approved to trade the US market. To find out how you can trade US market, please refer to question 02 in above section (Trading in US Stocks - What you should know?).

Yes. You can use the same login to your limtan.com.sg Online trading account if you are already approved to trade the US market. To find out how you can trade US market, please refer to question 02 in above section (Trading in US Stocks - What you should know?). -

03. Can I make changes to any of the Login ID and Password?

Yes. You are recommended to change the Login Password the first time you login.

Yes. You are recommended to change the Login Password the first time you login. -

04. What should I do if I have forgotten my Login ID and/or Password?

If you have forgotten your Login ID, please click here to reset.

If you have forgotten your Login ID, please click here to reset.If you have forgotten your Password, here are the ways to request for a new one:

1. For Individual Account with valid email and Mobile number on record with LTS

Electronic Password issuance: Please click here to request for a new one. A verification email and SMS will be sent to your email address and Mobile number in our records. Click on the link provided in the email for verification.

Upon successful verification, your new password will be sent to your Mobile number. Please refer to General FAQ - Electronic Password Qn 4 for step by step guide.

If you have an Individual Account and are not sure if you have a valid email and Mobile number on record with LTS, please check with your Trading Representative or the Online Trading Helpdesk.

2. For Joint/Corporate Account or Individual Account with no email address and/or Mobile number

Post: Please click here to request for a new one. Your old password will be permanently disabled and the new password will be mailed to your mailing address in our records within 2 - 3 working days.

Please note that the Electronic Password will not be eligible for clients who do not have a valid email address or Mobile number. All other types of account holders (e.g. Joint or Corporate account holders) will also not be eligible for the Electronic Password.

Trading Related

-

01. How do I place an order in the US Stock Market?

You may login to our Online Trading platform, click under 'Market' to access a drop down list to select the US Stock Market you would like to trade in. We can trade on NYSE (NYSE Equities market), NASDAQ and NYSE American (formerly AMEX).

You may login to our Online Trading platform, click under 'Market' to access a drop down list to select the US Stock Market you would like to trade in. We can trade on NYSE (NYSE Equities market), NASDAQ and NYSE American (formerly AMEX).

-

02. How do I place advanced orders in the US Stock Market?

Please click here for the User Guide on how to place advanced orders in the US Stock Market.

Please click here for the User Guide on how to place advanced orders in the US Stock Market. -

03. What are the Trading hours for the US Stock Market?

US Stock Market: NYSE, NASDAQ and NYSE American (formerly AMEX) Summer Daylight Saving*

(Singapore Time)Winter** (Singapore Time) Full-Day Trading NYSE/NASDAQ/NYSE American

(formerly AMEX) Trading Hours9.30pm - 4.00am (Summer) 10.30pm - 5.00am (Winter) Orders Accepted for next Trading Day 4.15am onwards (Summer) 5.15am onwards (Winter) Half-Day Trading NYSE/NASDAQ/NYSE American

(formerly AMEX) Trading Hours9.30pm - 1.00am (Summer) 10.30pm - 2.00am (Winter) Orders Accepted for next Trading Day 1.00am onwards (Summer) 2.00am onwards (Winter) Orders Routed for Trading From 9.00pm From 10.00pm * Daylight Savings effective from 2nd Sunday of March to 1st Sunday of November

** Effective from the 1st Sunday of November to the 2nd Sunday of March.We do not participate in the US pre-open and pre-close trading sessions.

Note:

When a holiday falls on a Saturday the NYSE, NASDAQ and NYSE American (formerly AMEX) will not operate on the preceding Friday.

When a holiday falls on a Sunday the NYSE, NASDAQ and NYSE American (formerly AMEX) will not operate on the succeeding Monday. -

04. What are the cutoff times for amending or withdrawing orders in the NASDAQ Opening and Closing Crosses?

Orders can be amended or withdrawn for the opening cross prior to 9.25am and for the closing cross prior to 3.50pm.

Orders can be amended or withdrawn for the opening cross prior to 9.25am and for the closing cross prior to 3.50pm. -

05. Is there a US Trading Night Desk and what are the operating hours?

US Trading Night Desk is available from 9pm-1am (Singapore Time). The telephone nos. are +65 6533 4192 / 9703.

US Trading Night Desk is available from 9pm-1am (Singapore Time). The telephone nos. are +65 6533 4192 / 9703. -

06. Is the price data live?

Prices are delayed by at least 15 minutes.

Prices are delayed by at least 15 minutes.All Online Trading clients will automatically1 be entitled to 6 months free access to US live prices upon the completion of the 1st US Online contract2. (2Online contract(s) refers to trade done using Cash and/or Cash Collateralised Trading (CCT) Accounts.)

Subsequent US Online contracts will entitle clients to additional free access to US live prices based on the last Online contract date. E.g. If a US Online contract is done on 1 Feb 2023, client's Online trading account will automatically gain access to US live prices until 1 Aug 2023. Subsequently, if another US Online contract is done on 2 Feb 2023, client's access to free US live prices will be extended to 2 Aug 2023.

You may also subscribe to Live quotes of NYSE, NASDAQ and NYSE American (formerly AMEX) for a fee. Redemption for live prices is available via our loyalty rewards redemption catalogue using loyalty points or payment by cash.

1US Live Prices will be activated 2 days after the qualifying US trade.

Free Live U.S. Market Data will not be available for clients who are considered a Securities Professional.

According to U.S. markets' definition, you are considered a Securities Professional if you are:

1. Registered with any state, federal or international securities agency or self-regulatory body;

2. Engaged as an Investment Advisor;

"Investment advisor" means any person who, for compensation, engages in the business of advising others, either directly or through publications or writings, as to the value of securities or as to the advisability of investing in, purchasing, or selling securities, or who, for compensation and as part of a regular business, issues or promulgates analyses or reports concerning securities;

3. Employed by an organization that is exempt from U.S. securities laws that would otherwise require registration; or

4. A business or commercial entityA monthly charge of USD51, subject to prevailing GST rate, is payable should you choose to subscribe to real time U.S. market data. Alternatively, you may access delayed U.S. market data free of charge.

Kindly note that if you are a Securities Professional, you will not be entitled to any promotions related to free access to real time U.S. market data.

-

07. Can I trade Odd Lot in the US Market?

Yes. Odd lot trading is allowed and the minimum quantity to be submitted is at least one share.

Yes. Odd lot trading is allowed and the minimum quantity to be submitted is at least one share. -

08. What is the Order Types available?

Currently, all orders are Limit Orders. It means that you are buying or selling the desired US stock(s) at a specific price or better than it within the trading day.

Currently, all orders are Limit Orders. It means that you are buying or selling the desired US stock(s) at a specific price or better than it within the trading day.

-

09. What is the maximum price I can submit for equities priced below $5 order?

Orders priced greater than 200% from the current bid or offer (as applicable) will be REJECTED.

Orders priced greater than 200% from the current bid or offer (as applicable) will be REJECTED.

- Current ask price for BUYs and current bid for SELLs will be used as the check price. If not available, the quote's last price will be used. -

10. What is the maximum price I can submit for equities priced at $5 or more order?

Orders priced greater than 30% from the last traded price will be REJECTED.

Orders priced greater than 30% from the last traded price will be REJECTED. -

11. What is the order price limit?

Buy orders: Can be placed up to maximum of 10% above the prevailing price.

Buy orders: Can be placed up to maximum of 10% above the prevailing price.

- Sell orders: Can be placed up to maximum of 10% below the prevailing price.

For example: If a security's prevailing market is $25.00 BID and $25.05 OFFER, all sell orders placed below $22.50 or buy orders placed above $27.55 will be rejected because they were placed greater than 10% away from the prevailing market. -

12. What is the fat finger rules?

Dollar amount Default: Maximum order value (Price x Quantity) is US$1.5 million

Dollar amount Default: Maximum order value (Price x Quantity) is US$1.5 million

- Shares amount Default for Others: For order value below US$1.5 million, maximum order quantity is 100,000 shares, except where order quantity compared to trading volume is acceptable by our US Broker. -

13. What is the validity period of my order(s)?

The validity of your order(s) is for one trading day. Order(s) will expire automatically at the end of each trading day.

The validity of your order(s) is for one trading day. Order(s) will expire automatically at the end of each trading day. -

14. How do I know my order has been filled?

All partially/fully filled orders will automatically be updated under the status of your 'Order Book'. At all times, please attempt to check the actual quantity filled under 'Order Book' - status.

All partially/fully filled orders will automatically be updated under the status of your 'Order Book'. At all times, please attempt to check the actual quantity filled under 'Order Book' - status. -

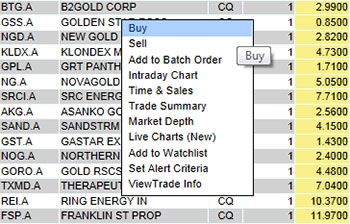

15. Will there be instances where the order will be rejected to prevent potential matching of my own orders?

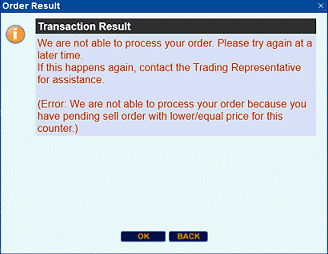

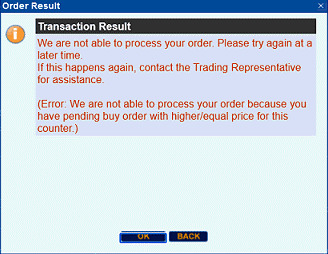

Yes. If you are placing a buy order and have a pending sell order with lower/equal price for this counter, the order will be rejected. If you are placing a sell order and have a pending buy order with higher/equal price for this counter, your order will be rejected.

Yes. If you are placing a buy order and have a pending sell order with lower/equal price for this counter, the order will be rejected. If you are placing a sell order and have a pending buy order with higher/equal price for this counter, your order will be rejected.

This applies to all limit, price-triggered and One Cancel the Other (OCO) Orders placed in all your accounts under the same login to the Online Trading system.

The system messages that will be shown is as follows:

Buy Order Matched Trade Error Message: Sell Order Matched Trade Error Message:

-

16. What is the minimum bid size for US Stock Market?

With effect from 3rd October 2016, U.S. Securities and Exchange Commission has implemented Tick Size Program where orders to be sent in five cent increments (0.05, 0.10, 0.15, etc).

With effect from 3rd October 2016, U.S. Securities and Exchange Commission has implemented Tick Size Program where orders to be sent in five cent increments (0.05, 0.10, 0.15, etc).The program is being phased in starting 3rd October 2016 and by 31st October 2016, all 1200 securities will be phased in. More details can be found at: https://www.finra.org/industry/tick-size-pilot-program.

-

17. Will I be able to amalgamate my US trades?

There is no amalgamation of orders for US trades. Each fulfilled order will be treated as an individual contract and brokerage will be charged accordingly for each of the contracts. For example, two buy orders of counter X fulfilled on the same day will be treated as two separate contracts for brokerage calculation. The same applies for sell orders as well.

There is no amalgamation of orders for US trades. Each fulfilled order will be treated as an individual contract and brokerage will be charged accordingly for each of the contracts. For example, two buy orders of counter X fulfilled on the same day will be treated as two separate contracts for brokerage calculation. The same applies for sell orders as well.

-

18. What are the US Stock Exchange Practices?

Standard trading and brokerage business practice within the U.S market.

Standard trading and brokerage business practice within the U.S market.

Auction Market: The New York Stock Exchange (NYSE) operates as an auction where trading takes place by verbal outcry of bids and offers by Exchange members acting as agents for institutions or individual investors. Buy and sell orders meet directly on the trading floor, and prices are determined by the interplay of supply and demand. This process is managed by Specialists, intermediaries that are mandated to match buyers and sellers and maintain a "fair and orderly market." Orders may also be placed through SuperDOT (Super Designated Order Turnaround System), a system that automatically transmits member firms' market and day limit orders, up to specified sizes in virtually all listed stocks, through the Common Message Switch (CMS) to the proper trading floor workstation. Specialists receiving orders through SuperDOT execute them in the trading crowd at their posts, as quickly as market interest and activity permit, and return reports to the originating firm's offices via the same electronic circuit that brought them to the floor.

Please be aware that NYSE Rule 123B for SuperDOT allows Specialists and brokers to change a price up to 12 noon (Eastern Standard Time) on Trade Date + 1. Price adjustments may occur when the Specialist discovers, upon reviewing the previous day's transactions, that clients were given a wrong price. This practice, where investors will be given and must accept the corrected price, may be different from other marketplaces.Dealer Market: In contrast, NASDAQ (National Association of Securities Dealers Automated Quotation) is an Over-The-Counter (OTC) market where the price is determined by a market maker, a dealer who buys and sells out of inventory. In the OTC market, the market maker may not support the entire position because they are not required to maintain a "fair and orderly market." NASDAQ is a global intranet providing brokers and dealers with price quotations on securities that are traded over-the-counter; orders are paired and executed on a computer network or "electronic trading floor".

-

19. Why is my cancelled trade(s) shown as filled in the Order Book?

Trades may not be cancelled successfully because the electronic order delivery system will execute trades immediately, taking priority over order cancellations. Please note that if your order has been executed but the electronic confirmation did not reach you immediately, the trade is still considered valid. Thus your cancellation request can be confirmed as Cancelled or Filled.

Trades may not be cancelled successfully because the electronic order delivery system will execute trades immediately, taking priority over order cancellations. Please note that if your order has been executed but the electronic confirmation did not reach you immediately, the trade is still considered valid. Thus your cancellation request can be confirmed as Cancelled or Filled. -

20. Why do I receive a different price from my confirmed execution after trade date?

NYSE Rule 123B for SuperDot system provides automated order routing and reporting services to facilitate the timely and efficient transmission, execution, and reporting of market and limit orders on the exchange. SuperDot allows Specialists and brokers to change a price up toTrade Date + 1. Price adjustments may occur when the Specialist discovers that a wrong price was given to the brokers after reviewing the previous day's transactions. Due to this practice investors will be given a corrected price and must accept the corrected price, which may be different from other marketplaces.

NYSE Rule 123B for SuperDot system provides automated order routing and reporting services to facilitate the timely and efficient transmission, execution, and reporting of market and limit orders on the exchange. SuperDot allows Specialists and brokers to change a price up toTrade Date + 1. Price adjustments may occur when the Specialist discovers that a wrong price was given to the brokers after reviewing the previous day's transactions. Due to this practice investors will be given a corrected price and must accept the corrected price, which may be different from other marketplaces.

-

21. What causes the price to be different?

Price differences may occur because of price adjustment made by the US counterpart after Trade Date and we are unable to adjust it manually at our Online Trading platform. It could also be due to a trade entry/Data entry error, which may have occurred at the US countpart where discrepancies can be detected up to T+1. Additionally, your order may be filled at various different prices and you may have only received or viewed the price of the last partially done trade via limtan.com.sg and hence your contract is generated with the average price.

Price differences may occur because of price adjustment made by the US counterpart after Trade Date and we are unable to adjust it manually at our Online Trading platform. It could also be due to a trade entry/Data entry error, which may have occurred at the US countpart where discrepancies can be detected up to T+1. Additionally, your order may be filled at various different prices and you may have only received or viewed the price of the last partially done trade via limtan.com.sg and hence your contract is generated with the average price. -

22. What are Market-Wide Circuit Breakers (MWCBs)?

MWCBs provide for cross-market trading halts during a severe market decline as measured by a single-day decrease in the S&P 500 Index.

MWCBs provide for cross-market trading halts during a severe market decline as measured by a single-day decrease in the S&P 500 Index.For more information, please click here.

-

23. Are there any stock trading volume criteria when placing an order?

Any single order for a stock that equals or exceeds 5% of its 30-day average daily volume will be stopped for manual review and may be subsequently allowed to proceed or rejected with a "ERR_EXCEEDING_30DAYVOLUME_THRESHOLD" error message.

Any single order for a stock that equals or exceeds 5% of its 30-day average daily volume will be stopped for manual review and may be subsequently allowed to proceed or rejected with a "ERR_EXCEEDING_30DAYVOLUME_THRESHOLD" error message.

Trading Settlement Related

-

01. What is the Settlement Date for the US Stock Market?

With effect from 28 May 2024, shares purchase will be due for delivery on Transaction date +1 market day (T+1). All purchases must be settled by due date.

With effect from 28 May 2024, shares purchase will be due for delivery on Transaction date +1 market day (T+1). All purchases must be settled by due date. "T" denotes the Transaction Date. For e.g. If you purchase US shares on Monday (T day), the due date for your contract is on Tuesday (T+1). However, if the due date coincides with a Singapore public holiday, the due date is the subsequent market day.

As a consequence of this settlement policy change, it is important to note that Trade Amendment requests will no longer be accommodated. Please check carefully on the counter, price, quantity and settlement currency for the orders placed before submitting it.

-

02. Is short selling allowed?

Short selling is not allowed. Short selling is only allowed under US ATP Short trading account. For more details, please click here.

Short selling is not allowed. Short selling is only allowed under US ATP Short trading account. For more details, please click here. -

03. How will I know how much is the settlement amount?

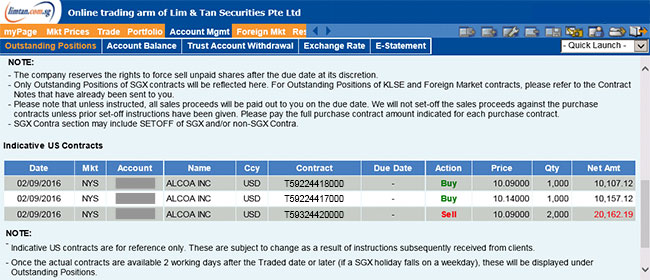

a. Indicative US Contracts

a. Indicative US Contracts

Apart from receiving a contract note, you can view indicative US contracts at "Account Management" under Outstanding Positions next day after the traded date.

Do note that Indicative US contracts are for reference only. These are subject to change as a result of instructions subsequently received from clients.

b. Actual US Contracts

Once the actual contracts are available 2 working days after the Traded date or later (if a SGX holiday falls on a weekday), these will be displayed under Outstanding Positions. The corresponding indicative US contracts will be automatically removed from "Indicative US Contracts" table.

-

04. What is the settlement currency for my purchases and sales?

The settlement currency in the Place Order screen will be defaulted to USD. If you wish to settle in SGD, please remember to change the settlement currency to SGD before you submit your order.

The settlement currency in the Place Order screen will be defaulted to USD. If you wish to settle in SGD, please remember to change the settlement currency to SGD before you submit your order. -

05. What if I want to change the settlement currency?

With effect from 28 May 2024, you will not be able to change the settlement currency due to US Settlement change to Transaction date + 1 market day (T+1).

With effect from 28 May 2024, you will not be able to change the settlement currency due to US Settlement change to Transaction date + 1 market day (T+1). Please check carefully on the counter, price, quantity and settlement currency for the orders placed before submitting it.

-

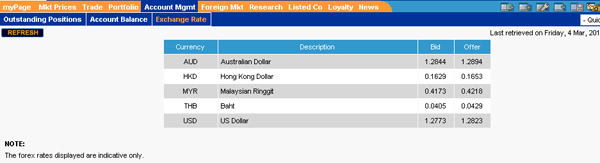

06. What will be the exchange rate used?

The exchange rate will be based on LTS's board rate on Transaction Date. You may check by clicking on "Board Rate" as shown on the screen below:

The exchange rate will be based on LTS's board rate on Transaction Date. You may check by clicking on "Board Rate" as shown on the screen below:

-

07. How do I make payment for my purchases?

With effect from 28 May 2024, Cash, Singapore dollars or US dollars cheque for payment must reach LTS before 5pm (Singapore Time) latest by T+1.

With effect from 28 May 2024, Cash, Singapore dollars or US dollars cheque for payment must reach LTS before 5pm (Singapore Time) latest by T+1.For S$ settlement: GIRO / EPS / Cheque / Cashier's Order.

Cash payment can only be made at our Cashier Counter

Opening hours: 8:30am to 5:45pm (Monday to Friday, excluding Public Holidays)For US$ settlement: Cashier's Order or Personal cheque drawn on any Singapore bank.

-

08. When I sell, how do I receive my sales proceed?

If your sales proceed is in S$, we will credit your bank account if you have opt for the GIRO/ EPS facility. Otherwise a cheque payment will be made in your name.

If your sales proceed is in S$, we will credit your bank account if you have opt for the GIRO/ EPS facility. Otherwise a cheque payment will be made in your name.

If your sales proceed is in US $, a cheque payment will be made in your name.

-

09. Can I use my CPF/SRS fund to settle the transaction?

No. CPF/SRS fund cannot be used to settle the foreign transaction.

No. CPF/SRS fund cannot be used to settle the foreign transaction. -

10. What will happen to my shares after I have made payment for it?

The shares will be kept in our foreign custody by next working day after payment.

The shares will be kept in our foreign custody by next working day after payment.

-

11. Are there any charges for keeping my shares in the safe custody of LTS?

Yes. Monthly foreign custody fee is S$2 per counter, subject to a maximum of S$150 per quarter + GST or 0.0025% pa of market value of shares whichever is applicable.

Yes. Monthly foreign custody fee is S$2 per counter, subject to a maximum of S$150 per quarter + GST or 0.0025% pa of market value of shares whichever is applicable.For clients who conduct at least 6 trades in a quarter in any markets, the monthly fee of S$2 per counter will be waived in any month of that quarter. If there are less than 6 trades per quarter, clients who conduct at least 2 trades in a month, the monthly fee of S$2 per counter will be waived in that month.

-

12. How will I be billed for custody charges if I hold foreign shares in two separate accounts?

The custody charges will be levied on a per account basis. If you hold foreign shares in two separate accounts, you will be billed according to the shareholdings in each account.

The custody charges will be levied on a per account basis. If you hold foreign shares in two separate accounts, you will be billed according to the shareholdings in each account. -

13. Can I consolidate all my foreign shares into one account?

Yes. Account holders may submit written instruction to our Operations department - Custody/Corporate Actions.

Yes. Account holders may submit written instruction to our Operations department - Custody/Corporate Actions. -

14. How do I make payment for the custody charges?

You may pay by any of the following payment methods:

You may pay by any of the following payment methods: - Cash

- Cheque

- Electronic Payment of Shares (EPS)

Cash payment can only be made at our Cashier Counter.

Opening hours: 8:30 a.m. to 5:45 p.m. (Monday to Friday, excluding Public Holidays)Outstanding custody fees will also be auto-netted against any payments due to you. Where there are no outgoing payments, the deductions of outstanding custody fees will be from any available funds in the Trust account.

-

15. Can I transfer the US shares in from other Broker(s) to my Online Trading account at Lim & Tan?

Will there be any charges for shares transferred into LTS? Yes, transfer request is allowed. For transfer details, you may contact our Operations department - Settlement at 6437 0145/148.

Yes, transfer request is allowed. For transfer details, you may contact our Operations department - Settlement at 6437 0145/148.There are no charges for shares transferred into LTS. However, there are transfer fees imposed by the delivering securities firm.

-

16. Will there be any charges for shares transferred out from LTS?

Yes, there will be charges depending on the type of transfers i.e. ACAT/DTC/DWAC. Each of these transfers has different fees charged ranging from US$5 to US$100 per counter (excluding LTS handling charges, GST and courier fees). For more details, you may contact Operations department - Settlement at 6437 0145/148.

Yes, there will be charges depending on the type of transfers i.e. ACAT/DTC/DWAC. Each of these transfers has different fees charged ranging from US$5 to US$100 per counter (excluding LTS handling charges, GST and courier fees). For more details, you may contact Operations department - Settlement at 6437 0145/148. -

17. Can I contra my purchases?

Yes, contra is allowed for the US Stock Market. However, do note that the shares not bought through our Online Trading system must be custodised with Lim & Tan's depository agent before you can sell.

Yes, contra is allowed for the US Stock Market. However, do note that the shares not bought through our Online Trading system must be custodised with Lim & Tan's depository agent before you can sell. -

18. What will happen if I do not pay on time?

Unpaid shares after the due date will be force sold at the Company's discretion.

Unpaid shares after the due date will be force sold at the Company's discretion. -

19. Are there any Dividend Handling Fee for dividend received?

Yes. Dividend Handling Fee will be charged Dividend Amount Dividend Charges + Foreign broker fees and taxes (if applicable) Below S$10 S$3.00+GST S$10 to S$500 S$5.00+GST Above S$500 1% subject to max. of S$100+GST Note: Dividends are subjected to a withholding tax of 30%.

All fees and charges are subject to revision without prior notice. -

20. How much is the Corporate Action charges?

Service charge on cash offer/ expiry of warrants/ rights application is S$10 per counter + GST.

Service charge on cash offer/ expiry of warrants/ rights application is S$10 per counter + GST. -

21. What is ADR and is there any charges for ADR?

An American Depositary Receipt (ADR) is a stock that trades in the United States and it represents a specified number of shares in a foreign corporation. ADRs were introduced as a result of the complexities involved in buying shares in foreign countries and the difficulties associated with trading at different prices and currency values. For this reason, ADR agents (banks and investment banks) purchase stocks on foreign exchanges and reissues them on either the NYSE, NASDAQ or the NYSE American (formerly AMEX).

An American Depositary Receipt (ADR) is a stock that trades in the United States and it represents a specified number of shares in a foreign corporation. ADRs were introduced as a result of the complexities involved in buying shares in foreign countries and the difficulties associated with trading at different prices and currency values. For this reason, ADR agents (banks and investment banks) purchase stocks on foreign exchanges and reissues them on either the NYSE, NASDAQ or the NYSE American (formerly AMEX).ADR agents charge ADR fees to compensate for holding and managing the foreign stocks. ADR fees vary for each counter and you will be billed according to the shareholdings for each ADR shares.

Trust Account

-

01. Will there be interest credited to credit balance in my Trust Account?

Interest (if any) will be computed and credited to trust account on a daily basis. Where applicable, we will pay interest at our published interest rate, calculated on daily balances. For avoidance of doubt, the published interest rate is determined by us, and subject to change from time to time at our sole and absolute discretion.CurrencyRate (W.E.F. 1 Nov 2025)SGD0.60% p.a.USD1.00% p.a.

Interest (if any) will be computed and credited to trust account on a daily basis. Where applicable, we will pay interest at our published interest rate, calculated on daily balances. For avoidance of doubt, the published interest rate is determined by us, and subject to change from time to time at our sole and absolute discretion.CurrencyRate (W.E.F. 1 Nov 2025)SGD0.60% p.a.USD1.00% p.a.

This advertisement has not been reviewed by the Monetary Authority of Singapore.