FAQ

- Brokerage Charges FAQ

- E-Statements and E-Contracts FAQ

- SGX Advanced Orders FAQ

- US Advanced Orders FAQ

- Contract For Difference Advanced Orders FAQ

- General FAQ

- SGX Circuit Breaker and Error Trade Policy FAQ

- 2FA FAQ

- Specified Investment Products FAQ

- Reclassification of OLIPs to EIPs FAQ

- Young Investors FAQ

- Cyber Security FAQ

Brokerage Charges FAQ

-

01. SGX Market Brokerage Rates

Online Trading Rates

Online Trading RatesContract Size Rates* Effective Rates* (Less 5% Mileage) Minimum $25 $23.75 Up to $50,000 0.28% 0.266% > $50,000 - $100,000 0.22% 0.209% > $100,000 0.18% 0.171% *Subject to Changes

Advisory Trading Rates

Contract Size Rates* Minimum S$40 Up to $50,000 0.50% > $50,000 - $100,000 0.40% > $100,000 0.25% *Subject to Changes

Shares traded on SGX under Clob International

Contract Size Rates* Settlement in AUD Settlement in HKD Settlement in USD Up to AUD50k Up to HKD200k Up to USD25k 0.28% >AUD50K to AUD100K >HKD200K to HKD400K >USD25K to USD50K 0.22% >AUD100K >HKD400K >USD50K 0.18%; Minimum Brokerage AUD25 HKD100 USD12.50 *Subject to Changes

Additional charges:

SGX Trading Fee1 (Contract Value x 0.0075%)

1except for Structured Warrants which will be at 0.001% of trade value.

CDP Clearing Fee2 (Contract Value x 0.0325%)

SGX Settlement Fee (S$0.35 or equivalent in foreign currency per contract)

GST ((Brokerage + SGX Trading Fee + Clearing Fee + SGX Settlement Fee) x prevailing GST rate)

2except for Structured Warrants which will be at 0.004% of the contract value with no cap.SGX will waive Clearing Fees for all Exchange Traded Funds (ETFs) traded on SGX from 1 June - 31 December 2015

Please click here to download a copy of the Schedule of Charges.

-

02. Cash Collateralised Trading Account Brokerage Rates

SGX Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.12% 0.114% Minimum Commission S$15 S$14.25 Other Charges S$ SGX Trading Fee Contract Value x 0.0075% CDP Clearing Fee Contract Value x 0.0325% SGX Settlement Fee S$0.35 or equivalent in foreign currency per contract GST (Brokerage + SGX Trading Fee + Clearing Fee + SGX Settlement Fee) x prevailing GST rate *Subject to Changes

Standard Non-Intraday US Markets Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.3% per trade 0.285% Minimum Commission US$20 US$19 Other Charges US$ GST [Brokerage + US Trading Activity Fee (for SELL order only) + Financial Transaction Tax] x prevailing GST rate US Trading Activity Fee (for SELL order only) US$0.000195 per share (Subject to minimum US$0.01 and maximum US$9.79 per contract) (w.e.f. 1 Jan 2026) Financial Transaction Tax 0.3% (Buy orders only, applicable for French/Italian ADRs) *Subject to Changes

Additional charges:

10% gross proceeds withholding on sales of PTPs by non-US resident account holders, unless a qualified notice exception is provided by a Publicly Traded Partnerships (PTP).

Please click here to view the list of PTPs.

Standard Non-Intraday HK Market Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.25% 0.2375% Minimum Commission HK$100 HK$95 Other Charges HK$ GST [Brokerage + Stamp Duty + SFC & FRC Transaction Levy + Trading Fee + CCASS Fee + Financial Transaction Tax*] x prevailing GST rate Stamp Duty HK$1.00 per HK$1,000 SFC & FRC Transaction Levy 0.00285% Trading Fee 0.00565% (w.e.f. 1 Jan 2023) CCASS Fee 0.0042% (w.e.f. 30 June 2025) Financial Transaction Tax*

(applicable for Italian counters)(Buy Trades) Additional 0.10% on gross proceeds *Subject to Changes

Bursa Market Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.25% per trade 0.2375% Minimum Commission MYR 40 MYR 38 Other Charges MYR GST [Brokerage + Stamp Duty + Clearing Fee] x prevailing GST rate Stamp Duty MYR 1.00 per MYR 1,000 Clearing Fee 0.03% of Trade Value (Subject to a maximum of MYR 1000 per contract) Malaysia Sales and Service Tax (SST) effective 1 Oct 2025 Brokerage and clearing fees on REITS, ETFs, WARRANTS and STRUCTURED WARRANTS are subject to SST of 8% *Subject to Changes

SH-HK Stock Connect Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.25% 0.2375% Minimum Commission CNY 88 CNY 83.60 Other Charges CNY GST [Brokerage + Trading Fee + Clearing Fee + Stamp Duty + Handling Fee + Securities Management Fee + Transfer Fee] x prevailing GST rate Stamp Duty 0.05% of the consideration of a transaction on the seller (SAT) Handling Fee 0.00341% of the consideration of a transaction per side (SSE) Securities Management Fee 0.002% of the consideration of the transaction per side (CSRC) Transfer Fee (i) 0.001% of the consideration of the transaction per side (ChinaClear)

(ii) 0.002% of the consideration of the transaction per side (HKSCC)*Subject to Changes

You are also eligible to earn Reward Points for brokerage paid to LTS for online trades made under CCT account. Click here for more information on our Rewards Programme.

-

03. Share Margin Financing Account Brokerage Rates

Lower Brokerage

Lower Brokerage

SGX Market: Attractive Online Brokerage Rates Contract Size ($) Online Rates* Effective Rates* Less Mileage Up to 50K 0.28% 0.266% > 50K to 100K 0.22% 0.209% > 100K 0.18% 0.171% Minimum $25 $23.75 US Markets: Attractive Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.3% per trade 0.285% Minimum Commission US$20 US$19 HK Market: Attractive Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.25% per trade 0.2375% Minimum Commission HK$100 HK$95 Bursa Market: Attractive Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.25% per trade 0.2375% Minimum Commission MYR 40 MYR 38 *Subject to Changes

-

04. Contract For Difference Account Brokerage Rates

Brokerage tier for Online CFD Trades:

Brokerage tier for Online CFD Trades:

Contract Size Brokerage Rates* Effective Rates Less Mileage Min. Brokerage S$18 S$17.10 Up to S$20,000 0.22% 0.209% > S$20,000 to S$50,000 0.18% 0.171% > S$50,000 0.15% 0.1425%

Brokerage tier for CFD Trades placed through your Trading Representative:

Brokerage tier for CFD Trades placed through your Trading Representative:

Contract Size Brokerage Rates* Min. Brokerage S$30 Up to S$20,000 0.35% > S$20,000 to S$50,000 0.30% > S$50,000 0.25% - For opening a long position, the finance charge of 6.5% per annum will be levied. (The interest-free period will be up to T+2 market days.)

- For opening a short position, the finance charge of 4% per annum will be levied. (The interest-free period will be up to T+2 market days.)

- For all closing positions, the brokerage charge will apply.

*Charges are subject to change from time to time.

-

05. Standard Non-IntraDay US Markets Brokerage Rates

Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.3% per trade 0.285% Minimum Commission US$20 US$19 Advisory Brokerage Rates Contract Size Rates* Commission 0.3% per trade Minimum Commission US$20 Other Charges US$ GST [Brokerage + US Trading Activity Fee (for SELL order only) + Financial Transaction Tax] x prevailing GST rate US Trading Activity Fee (for SELL order only) US$0.000195 per share (Subject to minimum US$0.01 and maximum US$9.79 per contract) (w.e.f. 1 Jan 2026) Financial Transaction Tax 0.3% (Buy orders only, applicable for French/Italian ADRs) *Subject to Changes

Additional charges:

10% gross proceeds withholding on sales of PTPs by non-US resident account holders, unless a qualified notice exception is provided by a Publicly Traded Partnerships (PTP).

Please click here to view the list of PTPs.

-

06. Intra-Day Active Trader Program (ATP) US Markets Brokerage Rates

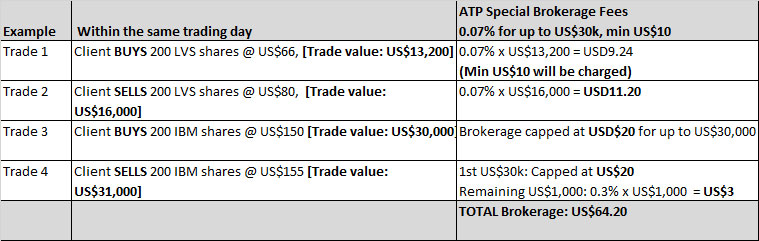

Intra-Day Trade Value Intra-Day ATP Brokerage Price x Quantity Minimum US$10 US$30,000 Capped at US$20 US$30,001 > Default Commission Rate (Refer to the above FAQ 5) Other Charges US$ GST [Brokerage + US Trading Activity Fee (for SELL order only)] x prevailing GST rate US Trading Activity Fee (for SELL order only) US$0.000195 per share (Subject to minimum US$0.01 and maximum US$9.79 per contract) (w.e.f. 1 Jan 2026)

ATP special brokerage is applicable to trade value (price x quantity) of up to US$30,000. Trade value above US$30,000 will be charged the default commission rate.

To qualify, client has to transact a minimum of 2 Online trades by buying and selling the same counter within the same trading day, these will be counted as 1 trade for the purpose of determining the minimum 2 qualifying Online trades.

Additional charges:

10% gross proceeds withholding on sales of PTPs by non-US resident account holders, unless a qualified notice exception is provided by a Publicly Traded Partnerships (PTP).

Please click here to view the list of PTPs.

-

07. Standard Non-IntraDay HK Market Brokerage Rates

Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.25% 0.2375% Minimum Commission HK$100 HK$95 Advisory Brokerage Rates Contract Size Rates* Commission 0.35% Minimum Commission HK$100 Other Charges HK$ GST [Brokerage + Stamp Duty + SFC & FRC Transaction Levy + Trading Fee + CCASS Fee + Financial Transaction Tax*] x prevailing GST rate Stamp Duty HK$1.00 per HK$1,000 SFC & FRC Transaction Levy 0.00285% Trading Fee 0.00565% (w.e.f. 1 Jan 2023) CCASS Fee 0.0042% (w.e.f. 30 June 2025) Financial Transaction Tax*

(applicable for Italian counters)(Buy Trades) Additional 0.10% on gross proceeds *Subject to Changes

-

08. Intra-Day Active Trader Program (ATP) HK Market Brokerage Rates

Intra-day Trade Value Intra-day HK ATP Brokerage Effective Rates* (Less 5% Mileage) Price x Quantity Minimum HK$80 Minimum HK$76 HK$200,000 0.12% 0.114% HK$200,001 > 0.25% 0.2375% Other Charges HK$ GST [Brokerage + Stamp Duty + SFC & FRC Transaction Levy + Trading Fee + CCASS Fee + Financial Transaction Tax*] x prevailing GST rate Stamp Duty HK$1.00 per HK$1,000 SFC & FRC Transaction Levy 0.00285% Trading Fee 0.00565% (w.e.f. 1 Jan 2023) CCASS Fee 0.0042% (w.e.f. 30 June 2025) Financial Transaction Tax*

(applicable for Italian counters)(Buy Trades) Additional 0.10% on gross proceeds *Subject to Changes

-

09. SH-HK Stock Connect Online Brokerage Rates

SH-HK Stock Connect Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.25% 0.2375% Minimum Commission CNY 88 CNY 83.60 Other Charges CNY GST [Brokerage + Trading Fee + Clearing Fee + Stamp Duty + Handling Fee + Securities Management Fee + Transfer Fee] x prevailing GST rate Stamp Duty 0.05% of the consideration of a transaction on the seller (SAT) Handling Fee 0.00341% of the consideration of a transaction per side (SSE) Securities Management Fee 0.002% of the consideration of the transaction per side (CSRC) Transfer Fee (i) 0.001% of the consideration of the transaction per side (ChinaClear)

(ii) 0.002% of the consideration of the transaction per side (HKSCC)*Subject to Changes

-

10. Bursa Market brokerage rates

Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.25% per trade 0.2375% Minimum Commission MYR 40 MYR 38 Advisory Brokerage Rates Contract Size Rates* Commission 0.3% per trade Minimum Commission MYR 50 Other Charges MYR GST [Brokerage + Stamp Duty + Clearing Fee] x prevailing GST rate Stamp Duty MYR 1.00 per MYR 1,000 Clearing Fee 0.03% of Trade Value (Subject to a maximum of MYR 1000 per contract) Malaysia Sales and Service Tax (SST) effective 1 Oct 2025 Brokerage and clearing fees on REITS, ETFs, WARRANTS and STRUCTURED WARRANTS are subject to SST of 8% *Subject to Changes

-

11. Foreign Markets Brokerage Rates

01. Australia Commission 0.8% Minimum Commission S$80 Remittance Charge AUD$25 02. Indonesia Market Commission 0.75% Minimum Commission S$80 VAT 12% on commission (wef 1 Jan 2025) Transaction Levy Rate 0.0433% Remittance Charge Rp 200,000 Stamp Duty

(for contract value >Rp 10 million)Rp 10,000 Note:

Additional Tax of 0.1% imposed on sale proceeds03. Japan Commission 0.65% Minimum Commission S$70 Remittance Charge Yen 1,500 04. Korea Commission 1% Minimum Commission S$90 Remittance Charge WON 30,000 Note:

Sales: Additional Sales Tax of 0.3% imposed on sales proceeds (for board lot) and 0.5% imposed on sales proceeds (for odd lot)05. Philippines Commission 1.0% Minimum Commission S$90 VAT 12% x Commission SCCP Fees Gross Amt x 0.01% Remittance Charge PHP 1,000/trade Note:

Registration fee of PHP 1,000/trade

Sales: Additional Sales Tax of 0.6% imposed on sales proceeds.

Depository Fee: Portfolio value x 0.00000833 (based on month end portfolio value)

06. Taiwan Commission 0.8% Minimum Commission S$100 Remittance Charge NTD 800 Transaction Fee NTD 1,500 Note:

Sales: Additional Tax of 0.3% imposed on sales proceeds

Custody Fee: Portfolio Value of 0.2%/12 subject to a minimum of S$2 per month (Based on month end portfolio value)

07. Thailand Commission 0.7% Minimum Commission S$90 VAT 7% of commissions Remittance Charge THB 1,000

This advertisement has not been reviewed by the Monetary Authority of Singapore.