FAQ

- Brokerage Charges FAQ

- E-Statements and E-Contracts FAQ

- SGX Advanced Orders FAQ

- US Advanced Orders FAQ

- Contract For Difference Advanced Orders FAQ

- General FAQ

- SGX Circuit Breaker and Error Trade Policy FAQ

- 2FA FAQ

- Specified Investment Products FAQ

- Reclassification of OLIPs to EIPs FAQ

- Young Investors FAQ

- Cyber Security FAQ

SHARE MARGIN FINANCING FAQ

-

01. What is Share Margin Financing?

Share Margin Financing is a facility that allows you to increase your financial power and boost your investments in stocks and shares. All you need to do is to place either cash and/or marginable securities as collateral for the credit facility applied for.

Share Margin Financing is a facility that allows you to increase your financial power and boost your investments in stocks and shares. All you need to do is to place either cash and/or marginable securities as collateral for the credit facility applied for. -

02. How much collateral must I place?

You only need to place a minimum initial cash deposit of S$5,000 or S$10,000 worth of marginable securities.

You only need to place a minimum initial cash deposit of S$5,000 or S$10,000 worth of marginable securities. -

03. How much can I buy?

You may buy up to 3.5 times the amount of cash deposit or 2.5 times the amount of marginable securities.

You may buy up to 3.5 times the amount of cash deposit or 2.5 times the amount of marginable securities. -

04. What shares can I buy or pledge as collaterals in the Share Margin Financing account?

You may buy or pledge most of the securities and warrants (with more than a year to expiry) listed on the Singapore Exchange and marginable securities listed on Bursa Malaysia, Hong Kong Exchange and the US markets.

You may buy or pledge most of the securities and warrants (with more than a year to expiry) listed on the Singapore Exchange and marginable securities listed on Bursa Malaysia, Hong Kong Exchange and the US markets. -

05. Can I buy foreign currency denominated shares and settle in that foreign currency?

You may only buy foreign currency denominated shares listed on the Singapore Exchange, Bursa Malaysia, Hong Kong Exchange and the US markets, subject to LTS's marginable securities list. You may settle in S$, M$, HK$ and US$. In the event that you maintain a debit balance in one currency and a credit balance in a different currency, there is no automatic conversion of currencies to offset a credit balance against any debit balance. You are required to give instructions to your Trading Representative for such currency conversions.

You may only buy foreign currency denominated shares listed on the Singapore Exchange, Bursa Malaysia, Hong Kong Exchange and the US markets, subject to LTS's marginable securities list. You may settle in S$, M$, HK$ and US$. In the event that you maintain a debit balance in one currency and a credit balance in a different currency, there is no automatic conversion of currencies to offset a credit balance against any debit balance. You are required to give instructions to your Trading Representative for such currency conversions. -

06. How is the valuation of the marginable securities computed?

SGX marginable securities are valued at 100% based on the last done price of the previous market day. Marginable securities quoted on other markets are valued at 80% - 100% or such other percentages at the discretion of management. The valuation of the margin portfolio will be converted to S$.

SGX marginable securities are valued at 100% based on the last done price of the previous market day. Marginable securities quoted on other markets are valued at 80% - 100% or such other percentages at the discretion of management. The valuation of the margin portfolio will be converted to S$.For dual currency counters, valuation is based on the primary currency. If the primary currency is a foreign currency, it will be converted to the S$ equivalent at the LTS prevailing board rates.

The above is subject to change at the discretion of the management without prior notice.

-

07. Are there any maximum cap on the valuation of the marginable securities?

There is a maximum cap set for each counter on the list of marginable securities. The caps include $50k, $100k, $250k, $300k, $500k, $1m and $3m. Please click the respective list of marginable securities quoted on Singapore Exchange, Bursa Malaysia, Hong Kong Exchange and the US markets to view the maximum cap.

There is a maximum cap set for each counter on the list of marginable securities. The caps include $50k, $100k, $250k, $300k, $500k, $1m and $3m. Please click the respective list of marginable securities quoted on Singapore Exchange, Bursa Malaysia, Hong Kong Exchange and the US markets to view the maximum cap.For SGX-listed securities, the valuation will be at 100%. To illustrate, if client's portfolio has a counter listed under the "$100k cap" category, notwithstanding that the securities carry a market value of $130k, valuation for the purpose of margin financing will be valued at $100k. Warrants of marginable securities with more than 1 year to expiry date will be capped at $50,000.

For foreign listed securities, the valuation will be at 80% - 100%. To illustrate, if client's portfolio has a US counter listed under the "S$300k cap" category, notwithstanding that the securities carry a market value of S$350k, valuation for the purpose of margin financing will be valued at S$280k. All types of warrants are not marginable.

-

08. Will I be able to view the Daily changes in my Margin Account?

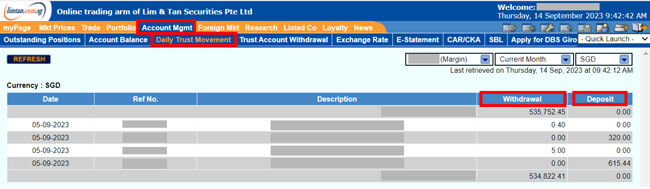

You can refer to the Daily Trust Movement tab and select the Margin Account.

You can refer to the Daily Trust Movement tab and select the Margin Account. Balance under 'Withdrawal' refers to a debit balance (drawdown/ borrowing). This is represented by a positive amount under Total Financed/ Cash Balance in the Daily Margin Valuation report.

Balance under 'Deposit' refers to a credit balance. This is represented by a negative amount under Total Financed/ Cash Balance in the Daily Margin Valuation report.

Alternately, you can refer to the Monthly Margin Statement as well.

-

09. Where can I view my daily margin valuation report?

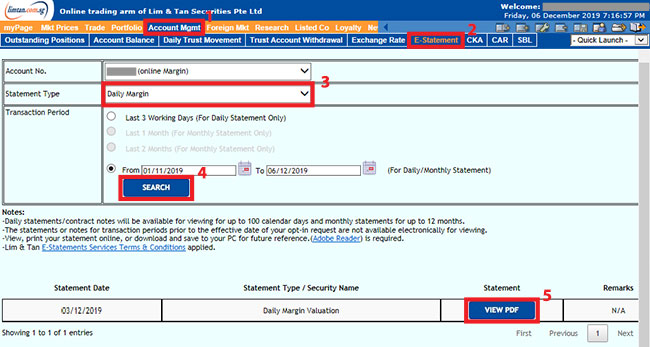

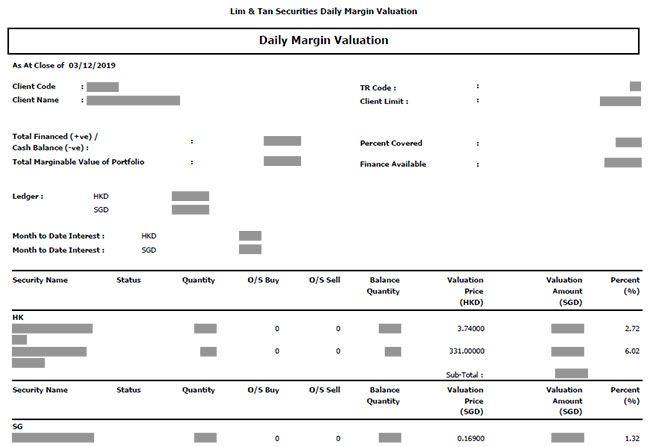

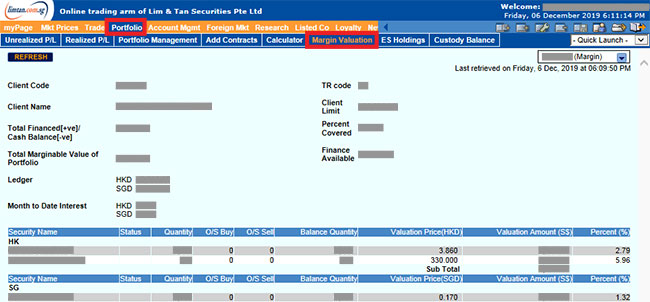

You can view your daily margin valuation report from the following:

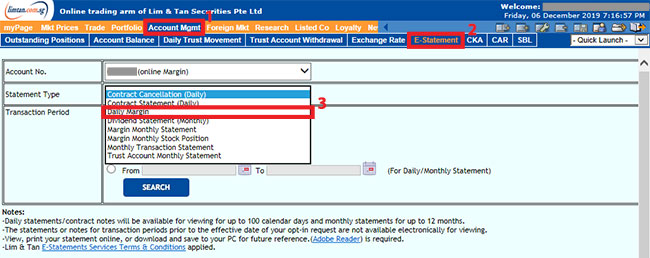

You can view your daily margin valuation report from the following:1) Under Account Management -> E-Statement -> Daily Margin

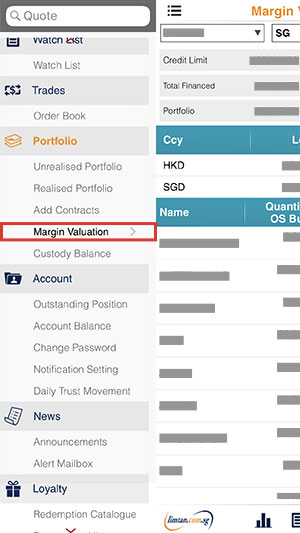

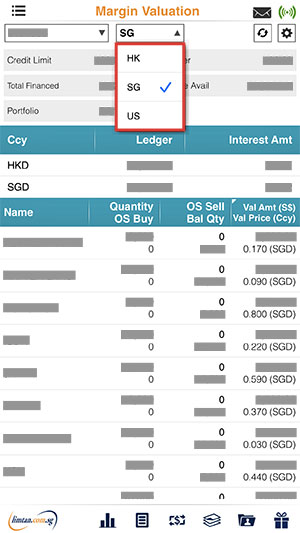

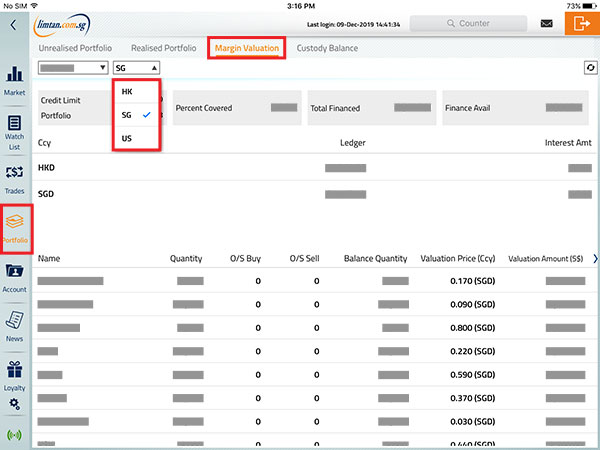

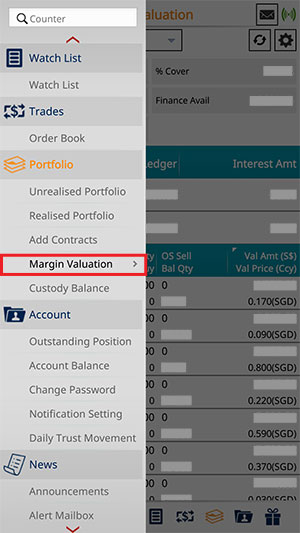

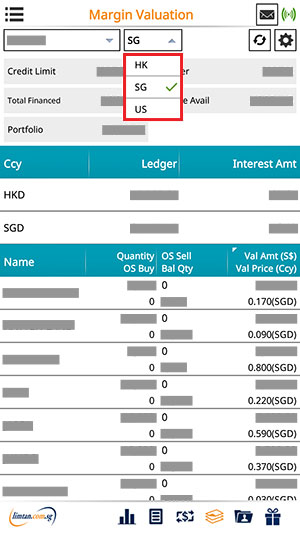

2) Under Portfolio -> Margin Valuation (Display traded shares done on SGX, US and Hong Kong market)

limtan.com.sg

iPhone Mobile App

iPad Mobile App

Android Mobile App

Please note that the above screenshots may differ for different phone models.

-

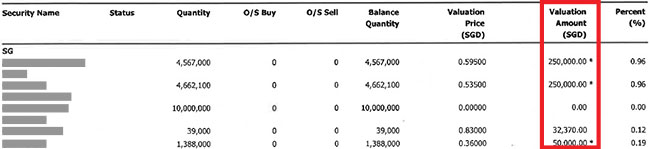

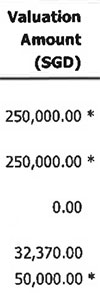

10. How do I see a counter has been capped by the Maximum Cap Limit in the Daily Margin Valuation Report?

When a counter has been capped, an asterisk (*) will be indicated next to the respective valuation amount. Please see below for illustration.

When a counter has been capped, an asterisk (*) will be indicated next to the respective valuation amount. Please see below for illustration.

Valuation Amount Column

-

11. How is the trading limit computed?

Trading limit (i.e. financing available) is calculated based on all marginable collaterals in all markets and reflected as a consolidated figure in S$ equivalent. There is no separate foreign market limit.

Trading limit (i.e. financing available) is calculated based on all marginable collaterals in all markets and reflected as a consolidated figure in S$ equivalent. There is no separate foreign market limit.For non-SGX trades, the required limit is 1.5 times of the gross contract value (price x quantity). For example, given a trading limit of S$150,000, you may buy up to S$150,000 on SGX-listed marginable securities or up to S$100,000 on US-listed marginable securities.

All Margin sell trades via the Online Trading system will reinstate the Margin buy limit by the sell trade value. This applies to closing of open buy positions as well as selling existing holdings. With this implementation, we hope to enhance clients' overall trading experience without the need for clients to request for manual limit reinstatement.

-

12. What are the interest rates and brokerage charges?

Interest is chargeable on debit balance at 6% per annum calculated on daily rest. It is subjected to changes at any time without prior notice.

Interest is chargeable on debit balance at 6% per annum calculated on daily rest. It is subjected to changes at any time without prior notice.We also provide two brokerage options to cater to your trading style.

Option 1: Lower Brokerage

SGX Market: Attractive Online Brokerage Rates Contract Size ($) Online Rates* Effective Rates* Less Mileage Up to 50K 0.28% 0.266% > 50K to 100K 0.22% 0.209% > 100K 0.18% 0.171% Minimum $25 $23.75 US Markets: Attractive Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.3% per trade 0.285% Minimum Commission US$20 US$19 HK Market: Attractive Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.25% per trade 0.2375% Minimum Commission HK$100 HK$95 Bursa Market: Attractive Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.25% per trade 0.2375% Minimum Commission MYR 40 MYR 38 *Subject to Changes

- Brokerage for margin trades under this option is entitled to the 5% cash rebates under limtan Reward Programme.

- No interest free period. i.e. Interest for Share Margin Financing will commence from due date of share purchase.

Option 2: Longer Settlement Period

- For SGX market only.

- Longer settlement period of up to 14 interest-free days from purchase date.

- Competitive interest-free days from purchase date.

- Brokerage rates charged are as follows:

Contract Size ($) Online Rates for Margin Account Up to 50K 0.4% or $25 whichever is higher > 50K to 100K 0.32% > 100K 0.20%

- Minimum brokerage $25.

- Brokerage for margin trades under this option are not entitled to the 5% cash rebates under our limtan Reward Programme.

-

13. Can I drawdown in my Share Margin Financing account to pick up shares purchased

in my cash trading account? Yes, you must inform us latest by the due date of the purchase contract. Margin percentage must be at least 140% after taking in the value of the purchases and interest is payable immediately.

Yes, you must inform us latest by the due date of the purchase contract. Margin percentage must be at least 140% after taking in the value of the purchases and interest is payable immediately. -

14. How long does it take to open a Share Margin Financing account?

Share Margin Financing account will be opened within 2 working days from the date you sign the margin documents. You may commence to trade upon deposit of cash and/or transfer of marginable securities into your margin account.

Share Margin Financing account will be opened within 2 working days from the date you sign the margin documents. You may commence to trade upon deposit of cash and/or transfer of marginable securities into your margin account. -

15. What is the margin percentage to be maintained?

You must maintain a margin percentage of at least 140%. No new purchases are permitted unless additional collateral is furnished to bring the margin percentage to not less than 140%.

You must maintain a margin percentage of at least 140%. No new purchases are permitted unless additional collateral is furnished to bring the margin percentage to not less than 140%. The margin percentage is computed as follows:

Definition:

Equity refers to the market value of share collateral + market value of shares financed by & custodised with LTS + (market value of outstanding purchase contracts - market value of outstanding sales contracts)

Total Amount Financed is the amount of financing utilised + outstanding purchase contracts + interest accrued + all other related expenses - cash collateral - outstanding sales contracts.

-

16. Can I withdraw cash from my Share Margin Financing account?

You may withdraw cash when you sell your shares or when there is a credit balance in your account. Margin percentage must be at least 140% after cash withdrawal.

You may withdraw cash when you sell your shares or when there is a credit balance in your account. Margin percentage must be at least 140% after cash withdrawal. -

17. When is margin call made?

A margin call is made when the margin percentage falls below 140%

A margin call is made when the margin percentage falls below 140% -

18. When do I need to top-up my Share Margin Financing account?

You need to top-up your margin within two market days from the date of notice e.g. if the margin call is made on a Monday, you will need to top-up by Wednesday.

You need to top-up your margin within two market days from the date of notice e.g. if the margin call is made on a Monday, you will need to top-up by Wednesday. -

19. How do I top-up my Share Margin Financing account?

You will need to provide additional margin of cash and/or marginable securities to bring the margin percentage to not less than 140%

You will need to provide additional margin of cash and/or marginable securities to bring the margin percentage to not less than 140% -

20. What happens if I am unable to top-up?

LTS shall have absolute discretion and without further notice to you, liquidate the margin account including the shares deposited as collateral to bring the margin percentage to not less than 140% if the margin requirement is not met within two market days of margin call.

LTS shall have absolute discretion and without further notice to you, liquidate the margin account including the shares deposited as collateral to bring the margin percentage to not less than 140% if the margin requirement is not met within two market days of margin call. -

21. When will force-selling take place?

Force-selling shall take place when the margin percentage falls below 130%. LTS has the right to liquidate the margin account to bring the margin percentage to not less than 140%. In a volatile market, you are required to monitor your position closely and if you do not wish to be sold-out, you are required to top-up with cash by 12 pm on the force-selling day.

Force-selling shall take place when the margin percentage falls below 130%. LTS has the right to liquidate the margin account to bring the margin percentage to not less than 140%. In a volatile market, you are required to monitor your position closely and if you do not wish to be sold-out, you are required to top-up with cash by 12 pm on the force-selling day. -

22. Are there any administrative charges?

There is no processing fee to open a Margin account. Charges are maintenance fees for your Depository Agent (DA) Sub-Account on a quarterly basis and fees for share transfer between your Global Securities Account (GSA) and DA Sub-Account. The maintenance fees may be waived depending on the amount traded or average drawdown for that quarter. Charges by LTS include handling fees for dividend distribution.

There is no processing fee to open a Margin account. Charges are maintenance fees for your Depository Agent (DA) Sub-Account on a quarterly basis and fees for share transfer between your Global Securities Account (GSA) and DA Sub-Account. The maintenance fees may be waived depending on the amount traded or average drawdown for that quarter. Charges by LTS include handling fees for dividend distribution. Please click here to download a copy of the Schedule of Charges.

-

23. Am I still entitled to dividends, rights and bonus on my shareholding?

Yes, these will be credited to your margin account. For rights issue, you will be informed of the details by mail.

Yes, these will be credited to your margin account. For rights issue, you will be informed of the details by mail. -

24. How will I be notified of my trades?

Contract notes will be sent to you by CDP. LTS will send you a monthly statement, reflecting all share transactions and movements in your account, shareholdings at the close of that month and debit/credit entries for interest/fees charged and dividends received respectively.

Contract notes will be sent to you by CDP. LTS will send you a monthly statement, reflecting all share transactions and movements in your account, shareholdings at the close of that month and debit/credit entries for interest/fees charged and dividends received respectively. -

25. Do I earn interest if the net balance in my Share Margin Financing Account is in credit?

Yes, the interest rate will be based on an overnight deposit rate given by the bank and will be subject to change daily.

Yes, the interest rate will be based on an overnight deposit rate given by the bank and will be subject to change daily. -

26. What is Margin Refinancing?

Margin Refinancing is the facility that allows you to pay off your existing margin account balance with another financial institution and transfer the balance and marginable securities to LTS. (Standard Share Margin Financing Account Terms & Conditions apply.)

Margin Refinancing is the facility that allows you to pay off your existing margin account balance with another financial institution and transfer the balance and marginable securities to LTS. (Standard Share Margin Financing Account Terms & Conditions apply.) -

27. How do I apply for Margin Refinancing?

All you have to do is to open a Margin Financing Account with LTS and instruct us on the refinancing. The whole process will take no longer than 3 working days. At the time of Margin Refinancing, the margin percentage must be at least 140%. (The above Q&A are also applicable for Margin Refinancing.)

All you have to do is to open a Margin Financing Account with LTS and instruct us on the refinancing. The whole process will take no longer than 3 working days. At the time of Margin Refinancing, the margin percentage must be at least 140%. (The above Q&A are also applicable for Margin Refinancing.) -

28. What are advanced orders and the different order types available for Margin Financing account?

SGX Market

SGX Market

Available Order Types include: Limit Order, Market Order and Market-to-Limit Order. For more information on Advanced Orders and each Order Type, please refer to SGX Advanced Orders FAQ.Note: Long Dated Order - Good Till Day and Good Till Maximum Order are not available.

US Markets

Available Order Types include: Limit Order, Market Order, Trailing Stop Order and One Cancels The Other Order. For more information on Advanced Orders and each Order Type, please refer to US Advanced Orders FAQ.Note: Long Dated Order - Good Till Cancel Order is not available.

-

29. Who can I contact for assistance?

You can contact your Trading Representative, our Helpdesk on +65 6799 8188/180 or Margin Department on +65 64370120/147/165.

You can contact your Trading Representative, our Helpdesk on +65 6799 8188/180 or Margin Department on +65 64370120/147/165.

Marginable List

- List of SGX Marginable Securities (as at 29 January 2026)

- List of Bursa Malaysia Marginable Securities (as at 21 April 2025)

- List of US Marginable Securities (as at 23 January 2026)

- List of HK Marginable Securities (as at 14 January 2026)

This advertisement has not been reviewed by the Monetary Authority of Singapore.