FAQ

- Brokerage Charges FAQ

- E-Statements and E-Contracts FAQ

- SGX Advanced Orders FAQ

- US Advanced Orders FAQ

- Contract For Difference Advanced Orders FAQ

- General FAQ

- SGX Circuit Breaker and Error Trade Policy FAQ

- 2FA FAQ

- Specified Investment Products FAQ

- Reclassification of OLIPs to EIPs FAQ

- Young Investors FAQ

- Cyber Security FAQ

US Intra-Day Active Trader Program/US ATP Short Account FAQ

Trading in US Stocks - What you should know?

-

01. WHAT IS INTRA-DAY ACTIVE TRADER PROGRAM (ATP)?

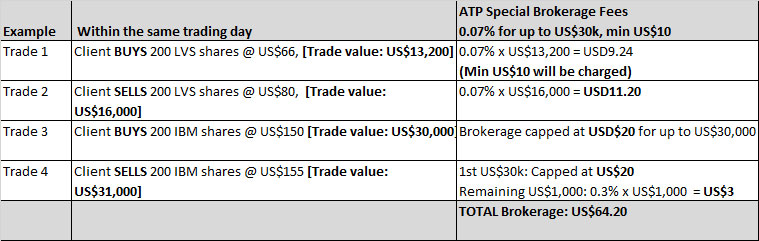

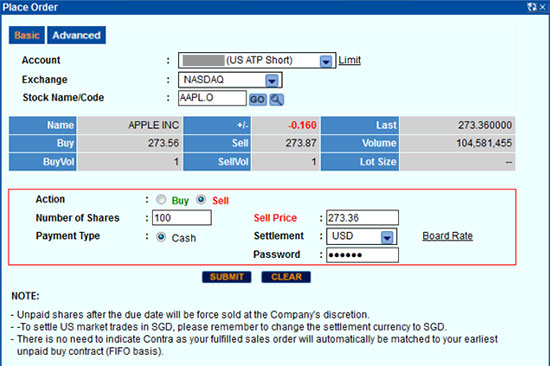

Intra-Day Active Traders Program allow client to trade at a special rate of 0.07% (up to trade value of US$30,000) with a minimum and maximum brokerage of USD$10 and USD$20 respectively.

Intra-Day Active Traders Program allow client to trade at a special rate of 0.07% (up to trade value of US$30,000) with a minimum and maximum brokerage of USD$10 and USD$20 respectively. -

02. HOW DO I QUALIFY FOR THE INTRA-DAY ACTIVE TRADER PROGRAM RATE?

To qualify, client has to transact a minimum of 1 U.S. Online intra-day contra trade by buying and selling the same counter within the same trading day. For example, if 100 shares of Counter A are bought on Day 1, and 60 shares are sold on Day 1, only these 60 shares qualify for ATP rate. These will be counted as 1 U.S. Online intra-day contra trade.

To qualify, client has to transact a minimum of 1 U.S. Online intra-day contra trade by buying and selling the same counter within the same trading day. For example, if 100 shares of Counter A are bought on Day 1, and 60 shares are sold on Day 1, only these 60 shares qualify for ATP rate. These will be counted as 1 U.S. Online intra-day contra trade.ATP special brokerage is applicable to trade value (price x quantity) of up to US$30,000. Prevailing GST and other U.S. trading charges will also apply.

-

03. HOW MUCH WILL I PAY IF MY INTRA-DAY ATP CONTRACT BROKERAGE IS BELOW USD$10?

If your brokerage under ATP rate is under USD$10, you will pay a minimum of USD$10 for the intra-day contract.

If your brokerage under ATP rate is under USD$10, you will pay a minimum of USD$10 for the intra-day contract. -

04. WHAT IS THE INTRA-DAY ATP US MARKETS BROKERAGE RATE?

Intra-Day Trade Value Intra-Day ATP Brokerage Price x Quantity Minimum US$10 US$30,000 Capped at US$20 US$30,001 > Default Commission Rate (Refer to the next FAQ [FAQ 5]) Other Charges US$ GST [Brokerage + US Trading Activity Fee (for SELL order only)] x prevailing GST rate US Trading Activity Fee (for SELL order only) US$0.000195 per share (Subject to minimum US$0.01 and maximum US$9.79 per contract) (w.e.f. 1 Jan 2026)

Additional charges:

10% gross proceeds withholding on sales of PTPs by non-US resident account holders, unless a qualified notice exception is provided by a Publicly Traded Partnerships (PTP).

Please click here to view the list of PTPs.

-

05. What are the standard non-intraday US markets brokerage rates?

Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.3% per trade 0.285% Minimum Commission US$20 US$19 Advisory Brokerage Rates Contract Size Rates* Commission 0.3% per trade Minimum Commission US$20 Other Charges US$ GST [Brokerage + US Trading Activity Fee (for SELL order only) + Financial Transaction Tax] x prevailing GST rate US Trading Activity Fee (for SELL order only) US$0.000195 per share (Subject to minimum US$0.01 and maximum US$9.79 per contract) (w.e.f. 1 Jan 2026) Financial Transaction Tax 0.3% (Buy orders only, applicable for French/Italian ADRs) *Subject to Changes

Additional charges:

10% gross proceeds withholding on sales of PTPs by non-US resident account holders, unless a qualified notice exception is provided by a Publicly Traded Partnerships (PTP).

Please click here to view the list of PTPs.

-

06. ARE US INTRA-DAY TRADES ELIGIBLE TO EARN REWARD POINTS?

All online trades placed by clients are eligible to earn Reward Points. Clients will be enrolled in a default limtan mileage rewards programme.

All online trades placed by clients are eligible to earn Reward Points. Clients will be enrolled in a default limtan mileage rewards programme.Loyalty reward points earned from US trading will be computed based on the final commission paid for each contract or intra-day contracts.

-

07. HOW MUCH IS THE SUBSCRIPTION TO US MARKETS LIVE PRICES AND HOW DO I SUBSCRIBE?

Online Trading clients will automatically1 be entitled free access to US live prices up to end of the following month upon account opening.

Online Trading clients will automatically1 be entitled free access to US live prices up to end of the following month upon account opening.Subsequent US Online contracts will entitle clients to additional 6 months of free access to US live prices based on the last Online contract date.

E.g. If a US Online contract is done on 1 Jan 2017, client's Online trading account will automatically gain access to US live prices until 1 Jul 2017. Subsequently, if another US Online contract is done on 2 Jan 2017, client's access to free US live prices will be extended to 2 Jul 2017.Subscription to Live quotes of NYSE, NASDAQ and NYSE American (formerly AMEX) is also available for a fee. Redemption for live prices are available via our loyalty rewards redemption catalogue using loyalty points or payment by cash.

1US Live Prices will be activated 2 days after the qualifying US trade.

Free Live U.S. Market Data will not be available for clients who are considered a Securities Professional.

According to U.S. markets' definition, you are considered a Securities Professional if you are:

1. Registered with any state, federal or international securities agency or self-regulatory body;

2. Engaged as an Investment Advisor;

"Investment advisor" means any person who, for compensation, engages in the business of advising others, either directly or through publications or writings, as to the value of securities or as to the advisability of investing in, purchasing, or selling securities, or who, for compensation and as part of a regular business, issues or promulgates analyses or reports concerning securities;

3. Employed by an organization that is exempt from U.S. securities laws that would otherwise require registration; or

4. A business or commercial entityA monthly charge of USD51, subject to prevailing GST rate, is payable should you choose to subscribe to real time U.S. market data. Alternatively, you may access delayed U.S. market data free of charge.

Kindly note that if you are a Securities Professional, you will not be entitled to any promotions related to free access to real time U.S. market data.

US Active Trader Intraday Short Account (US ATP Short Account)

-

01. What is a US ATP Intraday Short Account (US ATP Short Account)?

The US ATP Intraday Short account (US ATP Short) is an Online trading account that allows clients trading flexibility to Short US counters in a falling market at a competitive commission rate.

The US ATP Intraday Short account (US ATP Short) is an Online trading account that allows clients trading flexibility to Short US counters in a falling market at a competitive commission rate. -

02. What are the charges involved in trading US ATP Short?

Online Brokerage Rates ATP Commission 0.07%, Minimum US$10, Maximum US$20 Standard Commission 0.30%, Minimum US$20 Other Charges US$ GST [Brokerage + US Trading Activity Fee (for SELL order only)] x prevailing GST rate US Trading Activity Fee (for SELL order only) US$0.000195 per share (Subject to minimum US$0.01 and maximum US$9.79 per contract) (w.e.f. 1 Jan 2026)

-

03. How do I qualify for the US ATP rate?

To qualify, client has to transact a minimum of 1 U.S. Online intra-day contra trade by short selling and covering back the same counter within the same trading day.

To qualify, client has to transact a minimum of 1 U.S. Online intra-day contra trade by short selling and covering back the same counter within the same trading day.Example 1

100 shares of Counter A are sold, and 100 shares are subsequently covered, both buy and sell contracts will qualify for ATP rate and these will be counted as 1 U.S. Online intra-day contra trade.Example 2

100 shares of Counter A are sold, and 60 shares are covered. The balance 40 shares are subsequently covered. All 3 trades will qualify for ATP rates and these will be counted as 1 U.S. Online intra-day contra trade.Example 3

100 shares of Counter A are sold, and 60 shares are covered. The balance 40 shares are subsequently forced buy-in by Lim & Tan Securities Pte Ltd ["LTS"]. Only 60 shares that are shorted and covered will qualify for ATP rates. The 40 shares that are shorted and forced buy-in will be charged 0.3% standard commission. The 60 shares shorted and covered will be counted as 1 U.S. Online intra-day contra trade.ATP special brokerage is applicable to trade value (price x quantity) of up to US$30,000. Trade value above US$30,000 will be charged the default commission rate.

Please note that short positions that are not closed within the same trading day will be subject to forced buy-in with both legs subject to the standard US 0.3% commissions and fees.

-

04. How can I start trading US ATP Short?

Applicant must already have an existing US trading account with Lim & Tan Securities before opening an US ATP Intraday Short trading account to start trading.

Applicant must already have an existing US trading account with Lim & Tan Securities before opening an US ATP Intraday Short trading account to start trading.You may contact your Trading Representative or visit us at our office at 16 Collyer Quay, #15-00, Collyer Quay Centre, Singapore 049318.

-

05. What are the US Intra-day Short trading hours for client?

Please note that the trading hours for US ATP Short will end 10 minutes earlier than actual NYSE/NASDAQ/NYSE American (formerly AMEX) trading hours.

Please note that the trading hours for US ATP Short will end 10 minutes earlier than actual NYSE/NASDAQ/NYSE American (formerly AMEX) trading hours.US Stock Market: NYSE, NASDAQ and NYSE American (formerly AMEX) Summer Daylight Saving*

(Singapore Time)Winter**

(Singapore Time)Full-Day Trading NYSE/NASDAQ/NYSE American

(formerly AMEX) Trading Hours for US ATP Short9.30pm - 3.49am (Summer)

(3.50am being the Designated time, i.e. 10 minutes before market close at 4.00am)10.30pm - 4.49am (Winter)

(4.50am being the Designated time, i.e. 10 minutes before market close at 5.00am)NYSE/NASDAQ/NYSE American

(formerly AMEX) Trading Hours for US ATP Short3.50am - 4.00am (Summer)

(Non-order placing period)4.50am - 5.00am (Winter)

(Non-order placing period)Half-Day Trading NYSE/NASDAQ/NYSE American

(formerly AMEX) Trading Hours for US ATP Short9.30pm - 12.49am (Summer)

(12.50am being the Designated time, i.e. 10 minutes before market close at 1.00am)10.30pm - 1.49am (Winter)

(1.50am being the Designated time, i.e. 10 minutes before market close at 2.00am)NYSE/NASDAQ/NYSE American

(formerly AMEX) Trading Hours for US ATP Short12.50am - 1.00am (Summer)

(Non-order placing period)1.50am - 2.00am (Winter)

(Non-order placing period)* Daylight Savings effective from 2nd Sunday of March to 1st Sunday of November

** Effective from the 1st Sunday of November to the 2nd Sunday of MarchWe do not participate in the US pre-open and pre-close trading sessions.

Note:

When a holiday falls on a Saturday the NYSE, NASDAQ and NYSE American (formerly AMEX) will not operate on the preceding Friday.

When a holiday falls on a Sunday the NYSE, NASDAQ and NYSE American (formerly AMEX) will not operate on the succeeding Monday. -

06. What happens when I do not close off the short position by end of US Intra-day Short trading hours?

LTS will take over the covering of open Short positions from the designated time. If, for whatever reason/s the closure is not fulfilled on the same day, LTS reserves the right to continue the force-closure of these positions on T+1 or any other date at LTS's discretion.

LTS will take over the covering of open Short positions from the designated time. If, for whatever reason/s the closure is not fulfilled on the same day, LTS reserves the right to continue the force-closure of these positions on T+1 or any other date at LTS's discretion. -

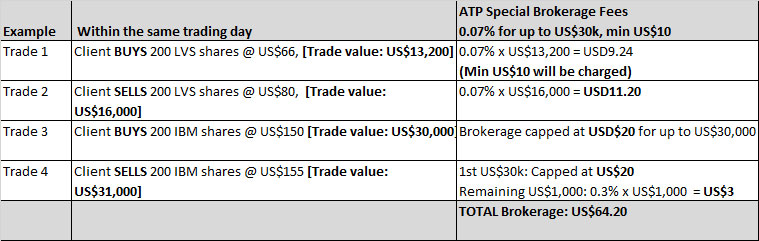

07. What are the counters available for trading under US ATP Short?

The Shorting of Stock is dependent on our US Broker's ability to locate stock. Certain stocks may face delays in order placing as they are manually processed. All orders placed may show "PQ" until the stock locate is confirmed and clients would not be able to amend or withdraw their orders until a confirmation is received from our US Broker. Should a stock locate be unsuccessful, the order will be updated subsequently in the Order Book as Rejected.

The Shorting of Stock is dependent on our US Broker's ability to locate stock. Certain stocks may face delays in order placing as they are manually processed. All orders placed may show "PQ" until the stock locate is confirmed and clients would not be able to amend or withdraw their orders until a confirmation is received from our US Broker. Should a stock locate be unsuccessful, the order will be updated subsequently in the Order Book as Rejected.E denotes counters for which the order submission and stock locate is expected to only face minimal delays under normal trading conditions. Counters without E will require additional time for our US counterpart to manually locate stock and manually update the order. Clients are advised to trade with caution.

Please refer to the "List of US Marginable Securities" for the eligible counters under US ATP Short.

-

08. Can I place a Buy order without having placed any short orders?

No. You can only place a Buy order to cover an existing short sold position up to the quantity filled.

No. You can only place a Buy order to cover an existing short sold position up to the quantity filled. -

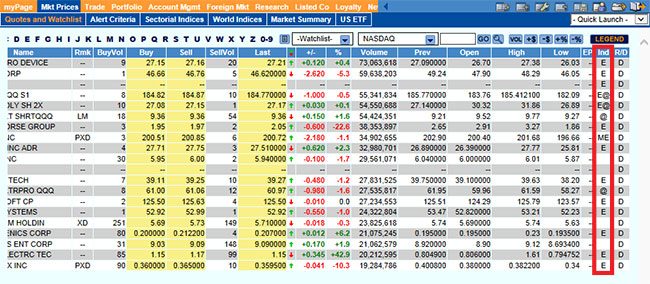

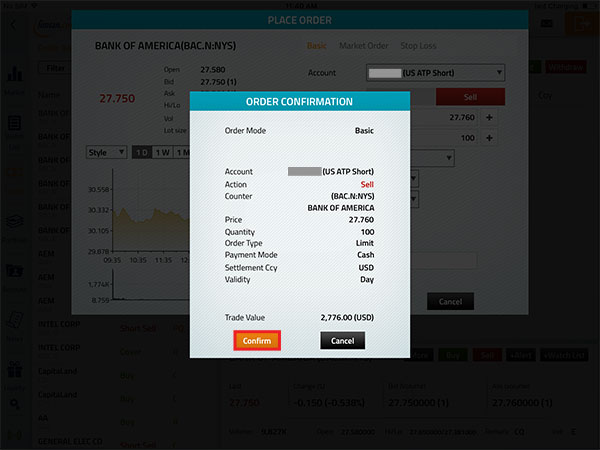

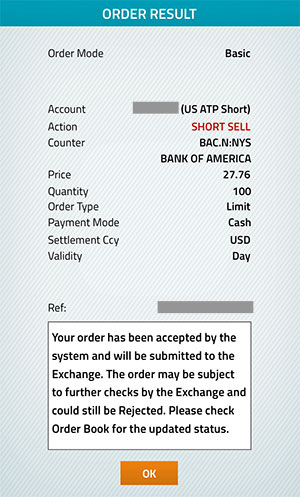

09. How do I place US ATP Short orders via limtan.com.sg?

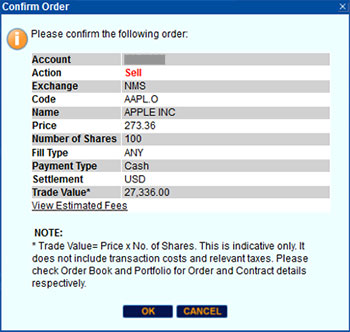

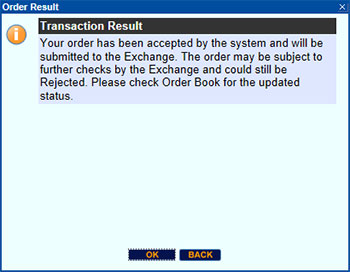

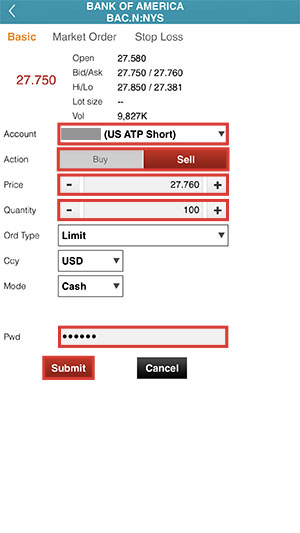

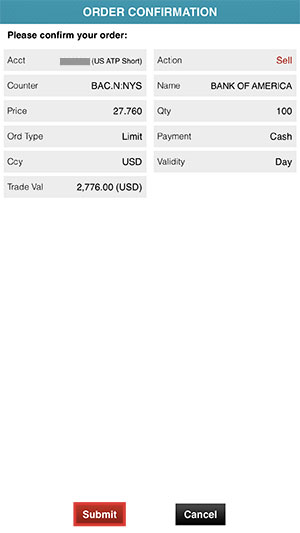

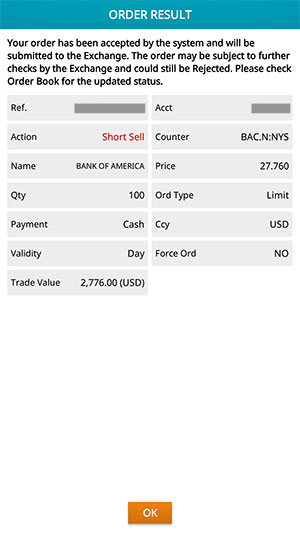

To place Sell order (Short Sell):

To place Sell order (Short Sell):

1. Select "US ATP Short" under Account

2. Select "Sell" under Action

3. Key in Number of shares, Price and Password

4. Select "Submit" to place the order

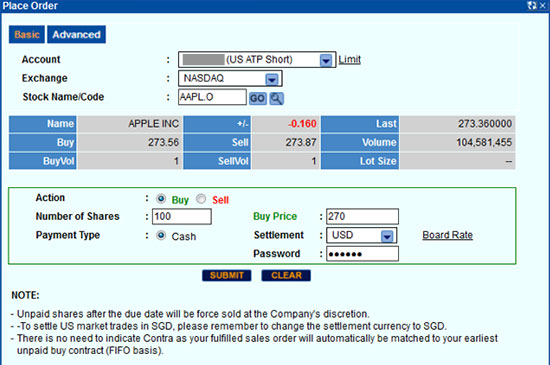

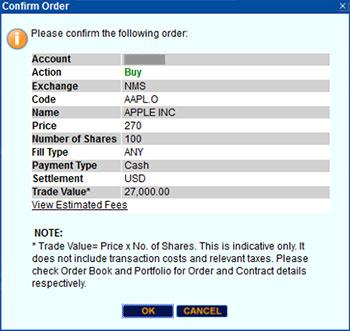

To place Buy order (Cover):

1. Select "US ATP Short" under Account

2. Select "Buy" under Action

3. Key in Number of shares, Price and Password

4. Select "Submit" to place the order

-

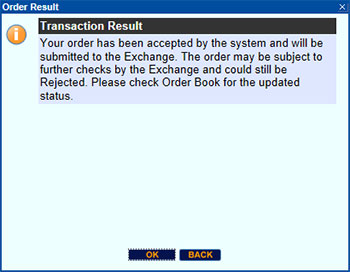

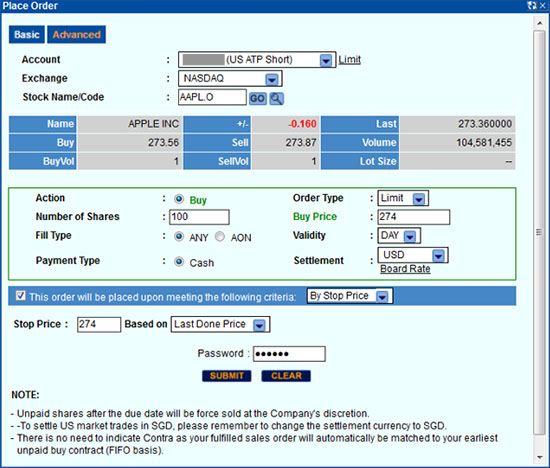

10. How do I place US ATP Short Advanced orders via limtan.com.sg?

To place Buy order (Cover):

To place Buy order (Cover):

1. Select "Advanced"

2. Select "US ATP Short" under Account

3. Select Order Type: "Limit" or "Market"

4. Key in Number of shares and Price

5. Select Fill Type: "ANY" or "AON" (All or None)

6. Select Settlement currency for counters traded in foreign currency

7. Check box to place order by Stop Price

8. Key in Stop Price (Your order above will be submitted upon meeting this price condition)

9. Insert your Online trading account password

10. Select "Submit" to place the order

Please note that Advanced order is available for Buy order (Cover) only. To place a Sell order (Short Sell), please refer to Qn 9 above.

-

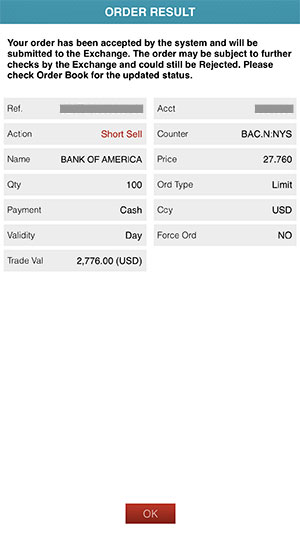

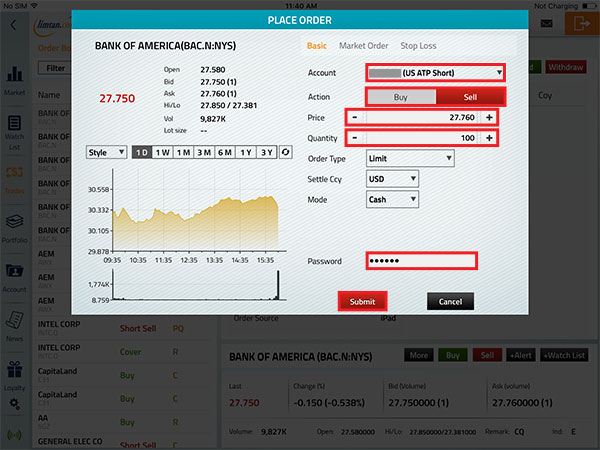

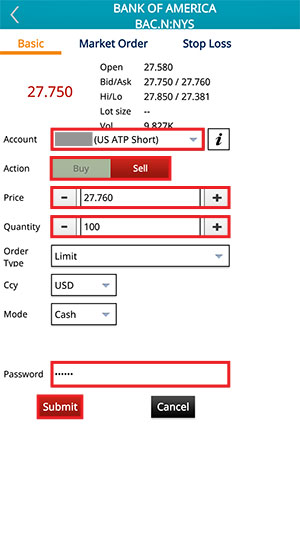

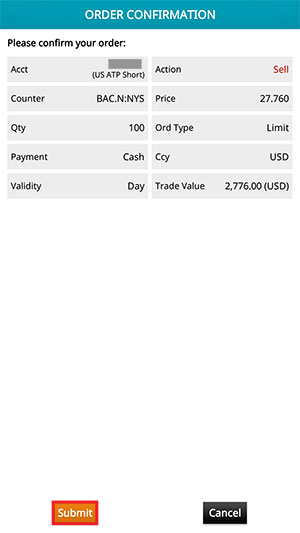

11. How do I place US ATP Short orders via limtan Mobile Channels?

To place US ATP Short orders:

To place US ATP Short orders:

1. Select "US ATP Short" under Account

2. Select "Sell" (Short Sell) or "Buy" (Cover) under Action

3. Key in Price, Quantity and Password

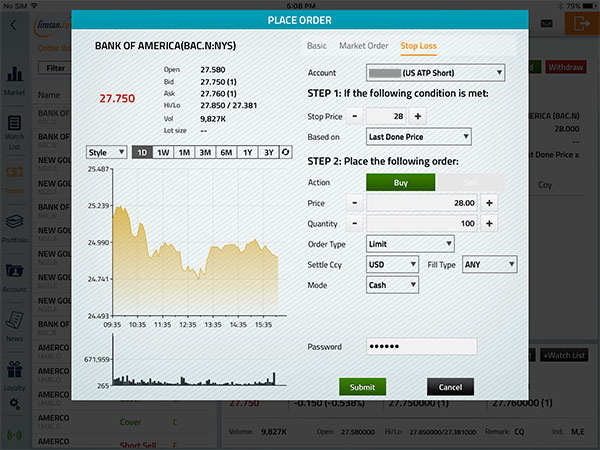

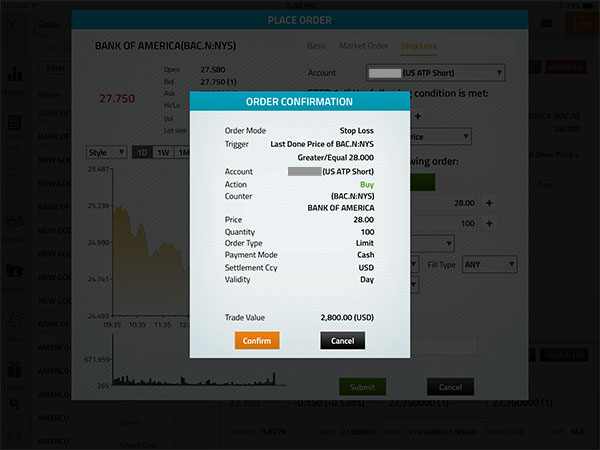

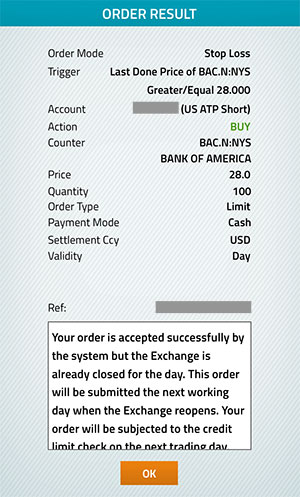

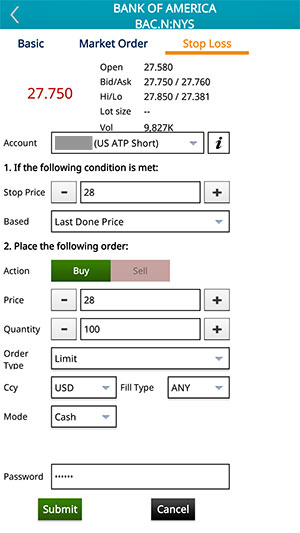

4. Select "Submit" to place the orderiPhone Mobile App

iPad Mobile App

Android Mobile App

-

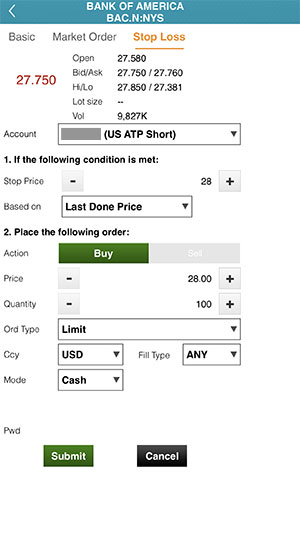

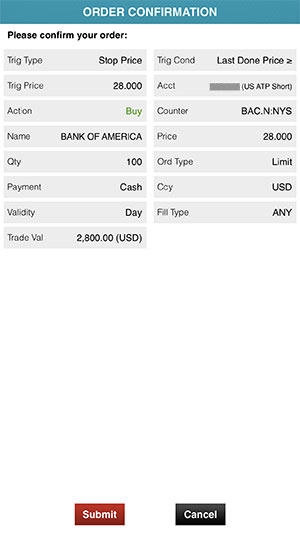

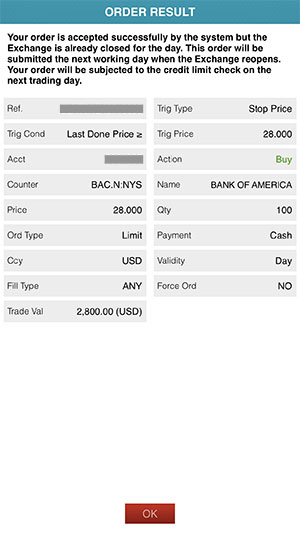

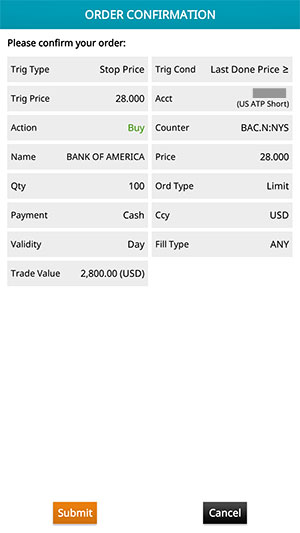

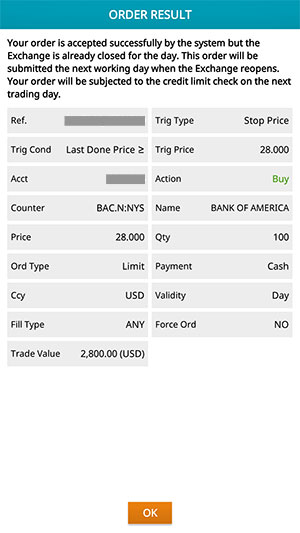

12. How do I place US ATP Short Advanced orders via limtan Mobile Channels?

To place Buy order (Cover):

To place Buy order (Cover):

1. Select "Stop Loss"

2. Select "US ATP Short" under Account

3. Key in Stop Price (Your order below will be submitted upon meeting this price condition)

4. Key in Price and Quantity

5. Select Order Type: "Limit" or "Market"

6. Select Settlement currency for counters traded in foreign currency

7. Select Fill Type: "ANY" or "AON" (All or None)

8. Insert your Online trading account password

9. Select "Submit" to place the orderiPhone Mobile App

iPad Mobile App

Android Mobile App

Please note that Advanced order is available for Buy order (Cover) only. To place a Sell order (Short Sell), please refer to Qn 11 above.

-

13. Can I sell my US shares bought through Online Trading account?

No, shares bought through Online Trading account cannot be sold through US ATP Intraday Short account.

No, shares bought through Online Trading account cannot be sold through US ATP Intraday Short account.

Trust Account

-

01. Will there be interest credited to credit balance in my Trust Account?

Interest (if any) will be computed and credited to trust account on a daily basis. Where applicable, we will pay interest at our published interest rate, calculated on daily balances. For avoidance of doubt, the published interest rate is determined by us, and subject to change from time to time at our sole and absolute discretion.CurrencyRate (W.E.F. 1 Mar 2026)SGD0.38% p.a.USD1.00% p.a.

Interest (if any) will be computed and credited to trust account on a daily basis. Where applicable, we will pay interest at our published interest rate, calculated on daily balances. For avoidance of doubt, the published interest rate is determined by us, and subject to change from time to time at our sole and absolute discretion.CurrencyRate (W.E.F. 1 Mar 2026)SGD0.38% p.a.USD1.00% p.a.

This advertisement has not been reviewed by the Monetary Authority of Singapore.