FAQ

- Brokerage Charges FAQ

- E-Statements and E-Contracts FAQ

- SGX Advanced Orders FAQ

- US Advanced Orders FAQ

- Contract For Difference Advanced Orders FAQ

- General FAQ

- SGX Circuit Breaker and Error Trade Policy FAQ

- 2FA FAQ

- Specified Investment Products FAQ

- Reclassification of OLIPs to EIPs FAQ

- Young Investors FAQ

- Cyber Security FAQ

Share COLLATERALISED TRADING FAQ

-

01. What are the markets available for Share Collateralised Trading (SCT) Account?

You can trade equities listed on the Singapore Exchange (SGX) only.

You can trade equities listed on the Singapore Exchange (SGX) only.For share collateral, we accept most SGX counters, except structured warrants and suspended counters. For the SCT term sheet, please click here.

-

02. What are the brokerage rates for Share Collateralised Trading (SCT) Account?

Online Trading Rates for Singapore Exchange (SGX) Contract Size Rates* Effective Rates* (Less 5% Mileage) Minimum $25 $23.75 Up to $50,000 0.28% 0.266% > $50,000 - $100,000 0.22% 0.209% > $100,000 0.18% 0.171% Other Charges S$ SGX Trading Fee Contract Value x 0.0075% CDP Clearing Fee Contract Value x 0.0325% SGX Settlement Fee S$0.35 or equivalent in foreign currency per contract GST (Brokerage + SGX Trading Fee + Clearing Fee + SGX Settlement Fee) x prevailing GST rate *Subject to Changes

You are also eligible to earn Reward Points for brokerage paid to LTS for online trades made under SCT account. Click here for more information on our Rewards Programme.

-

03. Will there be interest credited to credit balance in my Trust Account?

Interest (if any) will be computed and credited to trust account on a daily basis. Where applicable, we will pay interest at our published interest rate, calculated on daily balances. For avoidance of doubt, the published interest rate is determined by us, and subject to change from time to time at our sole and absolute discretion.CurrencyRate (W.E.F. 1 Mar 2026)SGD0.38% p.a.MYR1.00% p.aHKD0.25% p.a.USD1.00% p.a.

Interest (if any) will be computed and credited to trust account on a daily basis. Where applicable, we will pay interest at our published interest rate, calculated on daily balances. For avoidance of doubt, the published interest rate is determined by us, and subject to change from time to time at our sole and absolute discretion.CurrencyRate (W.E.F. 1 Mar 2026)SGD0.38% p.a.MYR1.00% p.aHKD0.25% p.a.USD1.00% p.a.

-

04. I have a Cash account with LTS. Can I open a SCT account?

Yes, you may open a SCT account in addition to your existing Cash account if you are 18 years old and above. Please note that shares purchased through the SCT account will be custodised in LTS Sub-account and/or LTS Foreign custody account while shares purchased through the Cash account are custodised in your individual global securities account with CDP.

Yes, you may open a SCT account in addition to your existing Cash account if you are 18 years old and above. Please note that shares purchased through the SCT account will be custodised in LTS Sub-account and/or LTS Foreign custody account while shares purchased through the Cash account are custodised in your individual global securities account with CDP. -

05. What is CCT/SCT Live?

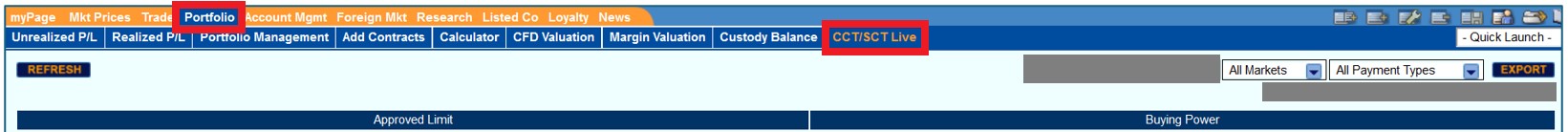

CCT/SCT Live is a live version of the unrealised portfolio of the CCT/SCT account. It also displays the current buying power as well as the approved limit of the CCT/SCT account.

CCT/SCT Live is a live version of the unrealised portfolio of the CCT/SCT account. It also displays the current buying power as well as the approved limit of the CCT/SCT account.

-

06. What is the buying power and how does it determine my trading limits?

The buying power automatically calculates the amount of trading that can be done for a SCT account.

The buying power automatically calculates the amount of trading that can be done for a SCT account.Based on the share collateral or/and cash deposit placed, a credit limit will be recommended. You may trade up to the credit limit, which may be adjusted from time to time, taking into consideration the quality and value of the total collateral. The buying power deducts for any buy order that has been placed and reinstates for any sell order that has been fulfilled.

-

07. Can I open a SCT account without opening a Cash account with LTS?

Yes. However, you are encouraged to open a Cash account in addition to the SCT account. Please note that shares purchased through SCT account are custodised in LTS Sub-account while shares purchased through the Cash account are custodised in your individual global securities account with CDP.

Yes. However, you are encouraged to open a Cash account in addition to the SCT account. Please note that shares purchased through SCT account are custodised in LTS Sub-account while shares purchased through the Cash account are custodised in your individual global securities account with CDP.A SCT account can also be opened by Joint Account holders.

-

08. How do I make payment for my purchases and how will the sales proceeds be paid to me?

Payment for your purchases will be deducted from the funds in your trust account on Due Date +1 (D+1). Similarly, sales proceeds will be credited to your trust account on D+1.

Payment for your purchases will be deducted from the funds in your trust account on Due Date +1 (D+1). Similarly, sales proceeds will be credited to your trust account on D+1. -

09. Is contra allowed?

Contra is allowed for SGX trades only.

Contra is allowed for SGX trades only. -

10. Can I use CPF/SRS funds to trade in a SCT account?

No. If you would like to trade using your CPF/SRS funds, you need to open a Cash account with LTS. Different brokerage rates will apply.

No. If you would like to trade using your CPF/SRS funds, you need to open a Cash account with LTS. Different brokerage rates will apply. -

11. Will my purchases be custodised with LTS?

Shares purchased shall be custodised in LTS' Sub-account. Only custodised shares may be sold in the account. There is no charge for maintaining the Sub-account.

Shares purchased shall be custodised in LTS' Sub-account. Only custodised shares may be sold in the account. There is no charge for maintaining the Sub-account. -

12. Where can I view the shares custodised in my SCT account?

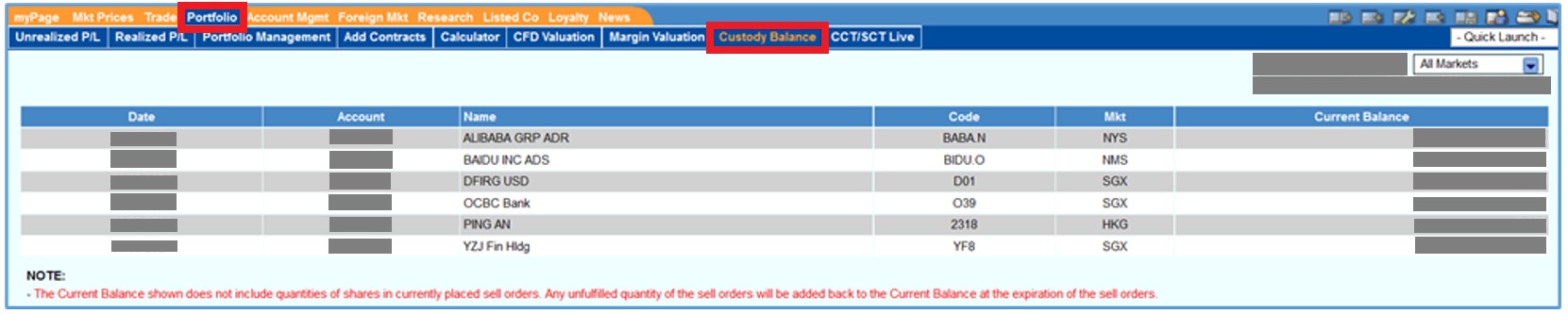

To view the shares custodised in your SCT account, select your SCT account and click on "Portfolio" on the navigation menu followed by "Custody Balance".

To view the shares custodised in your SCT account, select your SCT account and click on "Portfolio" on the navigation menu followed by "Custody Balance".

-

13. Am I still entitled to dividends, rights and bonus on my SCT account shareholdings?

Yes, you will be informed of the details of the corporate actions by mail and any rights shares or scrip dividends will be credited to LTS's Sub-account.

Yes, you will be informed of the details of the corporate actions by mail and any rights shares or scrip dividends will be credited to LTS's Sub-account.Cash dividends will be credited to your trust account.

-

14. My shares are held in my global securities account (GSA) with CDP. Can I sell these shares through the SCT account?

You will need to transfer the shares from your GSA with CDP to LTS' Sub-account before selling.

You will need to transfer the shares from your GSA with CDP to LTS' Sub-account before selling. -

15. How do I withdraw funds from my SCT account?

To withdraw funds from your SCT account, click on "Account Mgmt" on the navigation menu and click on "SCT Withdrawal".

To withdraw funds from your SCT account, click on "Account Mgmt" on the navigation menu and click on "SCT Withdrawal".Please click here for a step by step SCT withdrawal guide.

-

16. What are the SGX Advanced Orders?

You may click here to learn more about the SGX Advanced Orders.

You may click here to learn more about the SGX Advanced Orders.

This advertisement has not been reviewed by the Monetary Authority of Singapore.