FAQ

- Brokerage Charges FAQ

- E-Statements and E-Contracts FAQ

- SGX Advanced Orders FAQ

- US Advanced Orders FAQ

- Contract For Difference Advanced Orders FAQ

- General FAQ

- SGX Circuit Breaker and Error Trade Policy FAQ

- 2FA FAQ

- Specified Investment Products FAQ

- Reclassification of OLIPs to EIPs FAQ

- Young Investors FAQ

- Cyber Security FAQ

SGX Markets

Opening An Account With limtan.com.sg

-

01. What is limtan.com.sg?

It is an online share trading system specially designed to give investors total control over their investment decisions. Investors can place their orders and make account enquiries at their own convenience, at any time and from any location. Investors can access the same limtan.com.sg Online Trading account using the Internet.

It is an online share trading system specially designed to give investors total control over their investment decisions. Investors can place their orders and make account enquiries at their own convenience, at any time and from any location. Investors can access the same limtan.com.sg Online Trading account using the Internet. -

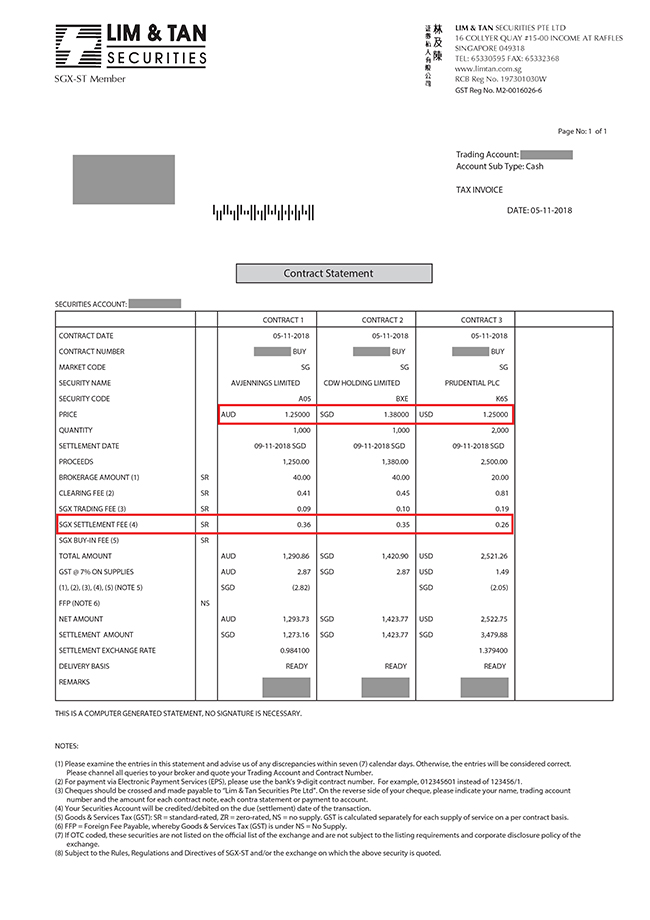

02. What are the brokerage charges?

Online Trading Rates

Online Trading Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Minimum $25 $23.75 Up to $50,000 0.28% 0.266% > $50,000 - $100,000 0.22% 0.209% > $100,000 0.18% 0.171% * Subject to Changes

Advisory Trading Rates

Contract Size Rates* Minimum S$40 Up to $50,000 0.50% > $50,000 - $100,000 0.40% > $100,000 0.25% * Subject to Changes

Shares traded on SGX under Clob International

Contract Size Rates* Settlement in AUD Settlement in HKD Settlement in USD Up to AUD50k Up to HKD200k Up to USD25k 0.28% >AUD50K to AUD100K >HKD200K to HKD400K >USD25K to USD50K 0.22% >AUD100K >HKD400K >USD50K 0.18%; Minimum Brokerage AUD25 HKD100 USD12.50 * Subject to Changes

Additional charges:

SGX Trading Fee1 (Contract Value x 0.0075%)

1except for Structured Warrants which will be at 0.001% of trade value.

CDP Clearing Fee2 (Contract Value x 0.0325%)

SGX Settlement Fee (S$0.35 or equivalent in foreign currency per contract)

GST ((Brokerage + SGX Trading Fee + Clearing Fee + SGX Settlement Fee) x prevailing GST rate)

2except for Structured Warrants which will be at 0.004% of the contract value with no cap.SGX will waive Clearing Fees for all Exchange Traded Funds (ETFs) traded on SGX from 1 June - 31 December 2015

Please click here to download a copy of the Schedule of Charges.

-

03. What is the securities clearing fee?

Securities Clearing Fee

Securities Clearing Fee The Securities Clearing Fee* is at 0.0325% of the contract value subject to a maximum of S$600. Fee structure is applicable to all trades (except futures, options and structured warrants) done on / after 12 February 2010.

For non-S$ contracts, the equivalent maximum clearing fee cap shall be as follows:

Settlement Currency Clearing Fee^ @ 0.0325%, subject to a maximum of Australia Dollar (AUD) AUD 470.00 British Pound (GBP) GBP 265.00 Canadian Dollar (CAD) CAD 455.00 Euro (EUR) EUR 294.00 Hong Kong Dollar (HKD) HKD 3,342.00 United States Dollar (USD) USD 431.00 Japanese Yen (YEN) YEN 38,363.00 ^ Subject to Changes

*except for Structured Warrants which will be at 0.004% of the contract value with no cap.

-

04. What is the SGX Settlement Fee?

With effect from 1 December 2018, SGX will be imposing a settlement fee of S$0.35 or equivalent in foreign currency per contract.

With effect from 1 December 2018, SGX will be imposing a settlement fee of S$0.35 or equivalent in foreign currency per contract.

-

05. Who can I call if I need help?

Our Online Helpdesk (Tel: +65 6799 8188) is open from 8.30 am to 5.45 pm, Monday to Friday, to answer any questions you may have. Alternatively, you can fax us at +65 6538 7730 or email us here.

Our Online Helpdesk (Tel: +65 6799 8188) is open from 8.30 am to 5.45 pm, Monday to Friday, to answer any questions you may have. Alternatively, you can fax us at +65 6538 7730 or email us here. -

06. Who can open a limtan.com.sg online trading account?

Anyone who is above 21 years old and with no record of delinquency can open a limtan.com.sg online trading account.

Anyone who is above 21 years old and with no record of delinquency can open a limtan.com.sg online trading account. -

07. How will I get my Login ID and Password?

For Individual accounts: All new accounts will receive the Login ID via email upon successful account creation.

All new accounts will receive the Login ID via email upon successful account creation.

- Where a valid email address and Mobile number have been provided in the Account Opening form, you can request for a new password via the Electronic Password issuance process on our website. Please refer to General FAQ - Electronic Password for more details.

- If a valid email address and/or Mobile number has not been provided, you will receive your password in a physical Pin Mailer sent by post.

For Joint and Corporate accounts:

- You will receive your password in a physical Pin Mailer sent by post.

-

08. What would I have to pay to open a limtan.com.sg online trading account?

Opening an online trading account with limtan.com.sg is FREE.

Opening an online trading account with limtan.com.sg is FREE. -

09. What is the Initial Deposit required?

Waiver of deposit is subject to Management's approval.

Waiver of deposit is subject to Management's approval.Foreigners will need to place a 50% collateral. For instance, a collateral of $1,000 will allow the foreign investor a trading limit of $2,000. Notwithstanding the deposit, the trading limit is still subject to Management's approval.

-

10. What are the payment modes available?

We accept payment via: Cheque Please make cheque payable to 'Lim & Tan Securities Pte Ltd' EPS For payments to Lim & Tan Securities, you can use Electronic Payment for Shares service (EPS) available at ATMs or through the banks' Internet Banking website. Payment due to you will be credited directly into your bank account. Available at: DBS/POSB, OCBC, UOB, Citibank, Maybank

Download Application FormGIRO Outgoing payments and incoming funds are automatically directed to your bank account. Please ensure you have enough funds on the Due Date of the contract.

Available banks: DBS/POSB, OCBC, UOB

Please refer to General FAQ – GIRO for more details.Bill Payments Bills Payment service is only for payments and available on the Internet Banking services with selected banks. Available banks: DBS/POSB, Maybank, OCBC, Standard Chartered, UOB. PayNow PayNow service is only for payments in SGD and available on the Internet Banking services with selected banks. Available banks: Bank of China, Citibank Singapore Limited, DBS Bank/POSB, HSBC, Industrial and Commercial Bank of China Limited, Maybank, OCBC Bank, Standard Chartered Bank and UOB.

Please click here for PayNow FAQ.

Trading Matters

-

01. What is the Settlement date for the SGX Market?

T+2 settlement cycle changes will be effected for trades done from 10 December 2018 onwards. Shares purchase will be due for delivery on Transaction date +2 market days (T+2).

T+2 settlement cycle changes will be effected for trades done from 10 December 2018 onwards. Shares purchase will be due for delivery on Transaction date +2 market days (T+2)."T" denotes the Transaction date. For example, if you purchase SGX shares on Monday (T day), the due date for your contract is on Wednesday (T+2). However, if the due date coincides with a public holiday, the due date is the subsequent market day.

-

02. What are the bid sizes?

Scales of minimum bids for SGX Shares except preference shares, structured warrants, exchange traded funds, exchange traded notes, bonds, debentures, loan stocks, along with HK$ and JPY dominated stocks.

Scales of minimum bids for SGX Shares except preference shares, structured warrants, exchange traded funds, exchange traded notes, bonds, debentures, loan stocks, along with HK$ and JPY dominated stocks.Products Price Range ($) Minimum Bid Size ($) Forced Orders (Bids) Stocks (excluding preference shares), Real Estate Investment Trusts (REITS), business trusts, company warrants and any other class of securities or Futures Contracts not specified in the rows below

(Effective from 31 May 2021)Below 0.20

0.20 - 0.995

1.00 - 99.99

100.00 - 199.90

200.00 - 499.80

500.00 - 999.500.001

0.005

0.010

0.100

0.200

0.500+/- 30

+/- 300Structured warrants Below 0.20

0.20 - 1.995

2.00 and above0.001

0.005

0.01+/- 30 Daily Leverage Certificates (DLC)

(Effective from 2 September 2024)0.001 - 0.005

0.006 - 0.199

0.200 - 1.995

2.000 - 999.990.001

0.001

0.005

0.010+/- 300%

+/- 50%Exchange traded funds and exchange traded notes

(Effective from 17 January 2022)All 0.01 or 0.001 as determined by SGX-ST +/- 10% Debentures, bonds, loan stocks and preference shares quoted in the $1 price convention All 0.001 +/- 30 Debentures, bonds, loan stocks and preference shares quoted in the $100 price convention All 0.001 +/- 1,000

Hong Kong Dollar/Chinese Yuan Minimum Bids Schedule Products Price Range (HKD/CNY) Bid Size (HKD/CNY) Forced Orders (Bids) Securities denominated in Hong Kong Dollar/Chinese Yuan 0.01 - 0.25 0.001 +/- 30 > 0.25 - 0.50 0.005 > 0.50 - 10.00 0.005 > 10.00 - 20.00 0.01 > 20.00 - 50.00 0.02 > 50.00 - 100.00 0.05 > 100.00 - 200.00 0.10 > 200.00 - 500.00 0.20 > 500.00 - 999.50 0.50

Japanese Yen Minimum Bids Schedule Products Price Range (JPY) Bid Size (JPY) Forced Orders (Bids) Securities denominated in Japanese Yen Below 2,000 1 +/- 30 2,000 - 2,995 5 3,000 - 29,990 10 30,000 - 49,950 50 50,000 - 99,900 100 100,000 and above 1,000 -

03. Is there a maximum bid size which even with force key, will be rejected by the system?

Yes, our system sets a maximum bid size for stocks as follows:Price RangeMax Bid Size

Yes, our system sets a maximum bid size for stocks as follows:Price RangeMax Bid SizeUp to $9.99 +/-$0.90 $10 to $99.99 +/-$2 $100 and higher +-600 bids

-

04. Can I sell shares that I have previously bought elsewhere through limtan.com.sg?

Yes, you may so long as the shares are recorded in the free balance of your Securities Account with CDP.

Yes, you may so long as the shares are recorded in the free balance of your Securities Account with CDP. -

05. What are Pre-Open, Pre-Close, Non-Cancel and Trade at Close market phases?

Pre-Open during Opening Routine

The Opening Routine is a 30-minute session before regular trading starts at 09:00 hours which comprises a Pre-Open Phase and a Non-Cancel Phase.

During the Pre-Open Phase which starts at 08:30 hours and ends randomly at any time from 08:58-08:59 hours, buy and sell orders can be entered, amended or withdrawn. They will not be matched and executed during this period.Pre-Open during Mid-Day Break

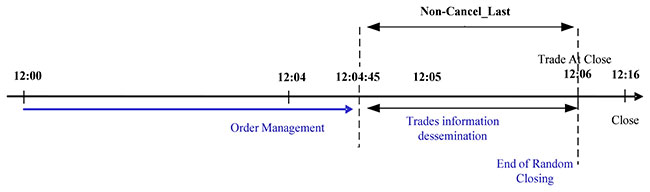

Mid-Day Break is a 60-minute session between 12:00 hours to 13:00 hours which comprises a Pre-Open Phase and a Non-Cancel Phase.

During the Pre-Open Phase which starts at 12:00 hours and ends randomly at any time from 12:58-12:59 hours, buy and sell orders can be entered, amended or withdrawn. They will not be matched and executed during this period.Pre-Close during Closing Routine

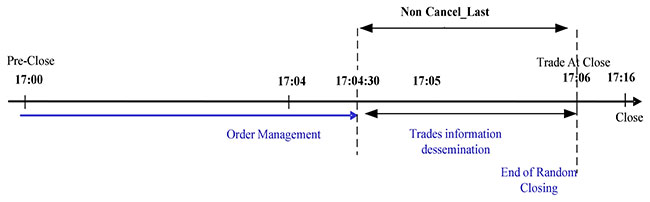

The Closing Routine is a 6-minute session after trading stops at 17:00 hours for normal day trading, or 12:00 hours for half-day trading which comprises a Pre-Close Phase and a Non-Cancel Phase. All unmatched orders are carried forward to the Closing Routine at 17:00 hours (for normal day trading) or 12:00 hours (for half-day trading).

During the Pre-Close Phase which starts at 17:00 hours to 17:04-17:05 hours/12:00 hours to 12:04-12:05 hours, buy and sell orders can be entered, amended or withdrawn. They will not be matched during this period.Non-Cancel

The Non-Cancel Period will begin simultaneously with the end of the Pre-Open and Pre-Close Phase. (Please refer to Qn 5 for the time that the Pre-Open and Pre-Close Phase ends)

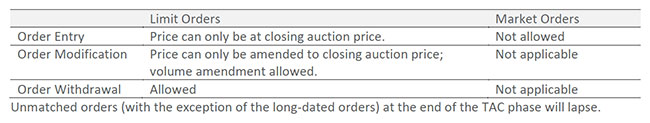

During the Non-Cancel Phase, input, amendment and withdrawal of orders are not permitted. Orders that are matched are executed at a single computed price, which will be the same as or better than the price at which the orders are entered. This computed price shall be the opening price for the day. Unmatched orders will be carried forward to the next phase unless they expire.Trade at Close (TAC) (w.e.f. 3 Jun 2019)

TAC is a 10-minutes trading phase commencing immediately after the closing auction (i.e. 17:06 hours to 17:16 hours for normal day trading and 12:06 hours to 12:16 hours for half-day trading).

TAC is available for a security on a trading day if there is a closing price established during the closing auction on that same day. Correspondingly, TAC will not be applicable for a security if there is no closing auction price on that day (including ETFs which may have an alternative closing price).

Single Price Matching: Trades during TAC can occur only at the fixed equilibrium price established from preceding closing auction.

Continuous Matching: TAC is a continuous trading session whereby incoming orders are matched immediately against resting orders in the order book based on time priority.

Order Management: Unmatched limit orders from the closing routine will be carried forward to TAC. The following order management activities can be done during TAC:

-

06. What are Random endings to the Pre-Open and Pre-Close phases of the Opening Routine, Mid-Day Break and Closing Routine?

SGX has implemented Random Opening and Random Closing to improve market transparency and to safeguard trading.

SGX has implemented Random Opening and Random Closing to improve market transparency and to safeguard trading.The timing of the end of Pre-Open and Pre-Close Phases of trading are random. Random endings means that the end of the Pre-Open and Pre-Close Phases will take place at any time within a one-minute period of the time frame currently allotted for the phase. This is to prevent opening and closing prices from being manipulated from the sudden entry or withdrawal of large orders.

The Pre-Open Phase would end at any time from 8:58am to 8:59am and any time from 12:58pm to 12:59pm during the mid-day break. The Pre-Close Phase would end any time from 5:04pm to 5:05pm for full-day trading or 12:04pm to 12:05pm for half-day trading.

An example taken from SGX on the time view of the random end of the Pre-Close Routine in SGX REACH 2.0. This example is for a full trading day where matching happens 30 seconds into the random period of time. Non-Cancel_Last session then starts at 17:04:30.

The following is a time view of the random end to the Closing Routine in SGX REACH 2.0 for a half trading day when matching happens till 12:04:45.

The varying time period protects the integrity of the closing price against the impact of sudden large entry and withdrawal orders.

-

07. What is Indicative Equilibrium Price (IEP)?

The indicative equilibrium price (IEP) is the price at which orders would be executed if auction matching were to occur at that point.

The indicative equilibrium price (IEP) is the price at which orders would be executed if auction matching were to occur at that point. IEP acts as an indication of the eventual Opening or Closing price, which help investors assess the market demand and supply conditions and allow adjustments of orders accordingly.

-

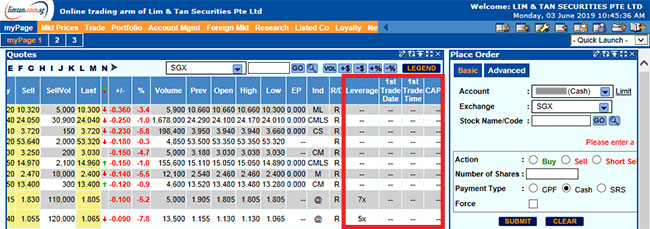

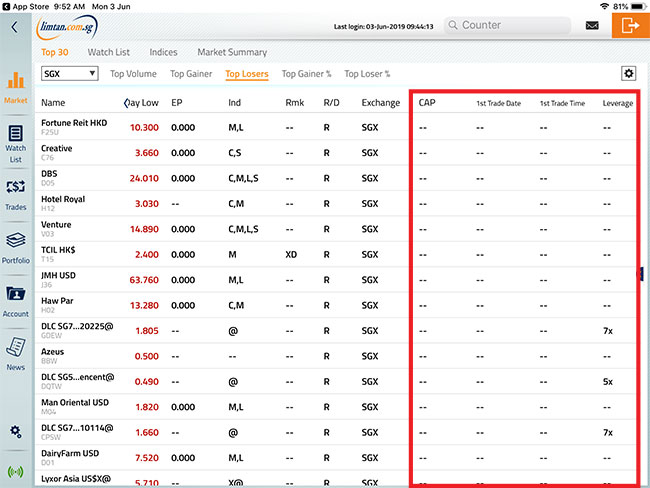

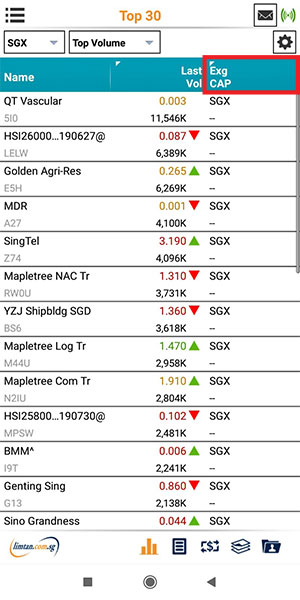

08. Where can I view the additional columns relating to Trade-At-Close, IPOs and DLC?

You can view the following in various channels:

You can view the following in various channels:Column Names Definition CAP Closed Auction Price.

This will be the price the counter will be trading during the Trade At Close (TAC) session.1st Trade Date Only applicable for newly listed counters (IPO).

The date the counter starts trading.1st Trade Time Only applicable for newly listed counters (IPO).

The time the counter starts trading.Leverage Only applicable for DLCs.

The amount of leverage the DLC provides.

Online Trading System limtan.com.sg

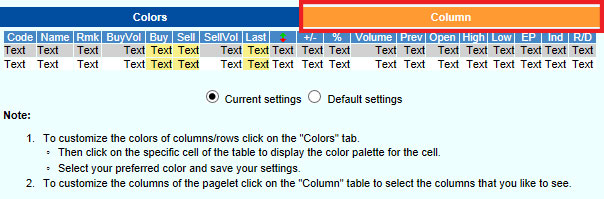

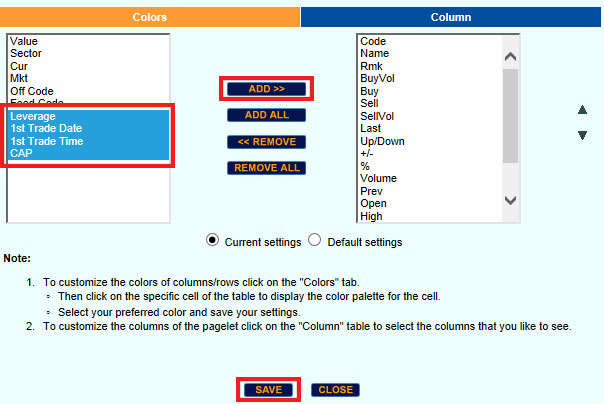

Please note that the column names are only available under 'myPage'.Step 1: Click on 'myPage', then 'Edit Pagelet Settings' icon.

Step 2: Select 'Column'.

Step 3: Click on the column name, then select 'ADD', followed by 'SAVE'.

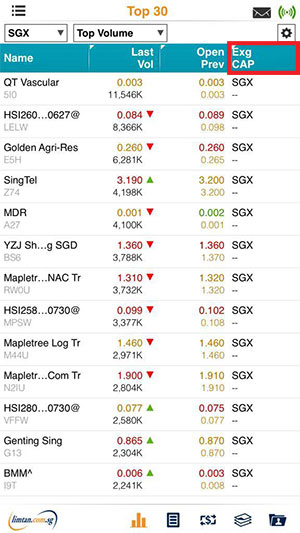

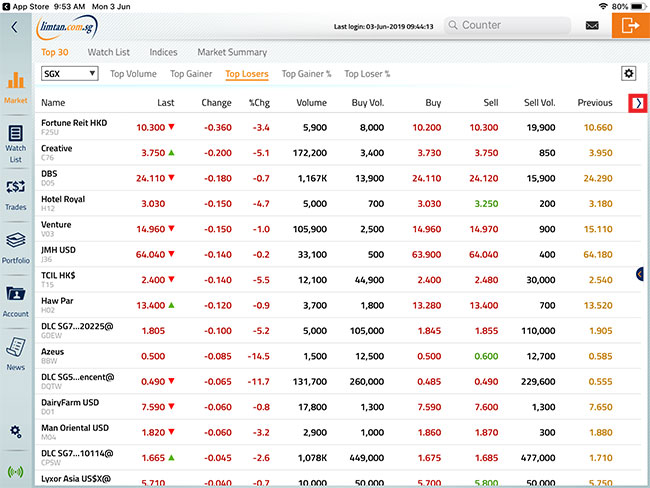

iPhone

Tap on the 4th column to view the column names.

iPad

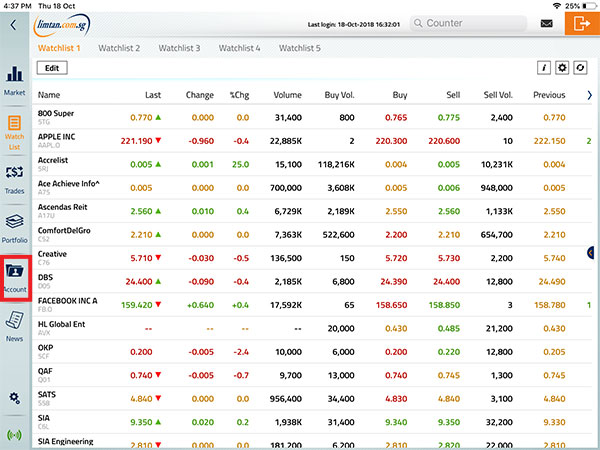

Tap on the arrow icon to view the column names.

Android

Tap on the 3rd column to view the column names.

Please note that the above screenshots may differ for different phone models.

-

09. Will SGX trading system check and match my order placement?

The SGX trading system will not check for:

The SGX trading system will not check for:

a) Buy order price being higher than Seller's price

b) Sell order price being lower than Buyer's price

Orders fulfilling these criteria will now be sent to the Order Book for matching.As an example:

Assume the current Bid/ Ask for Singtel is: $3.51/ $3.52.

If a client keys to buy 50K Singtel shares at $3.55, depending on available volume, the order will be filled from $3.52 up to a limit price of $3.55 without further warning or message. If there is sufficient sell volume queuing at $3.52, the buy order will be completely matched at $3.52. If there is insufficient queue volume to complete this buy order even at $3.55, the balance quantity will be left on queue at $3.55.Similarly, if a client attempts to sell Singtel at $3.48. The order will be filled from $3.51 down to a limit price of $3.48 depending on the available volume until the sell order quantity is completely filled.

-

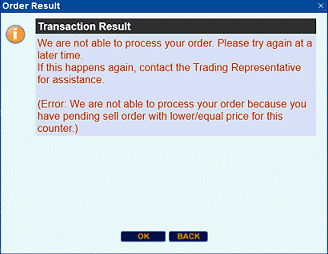

10. Will there be instances where the order will be rejected to prevent potential matching of my own orders?

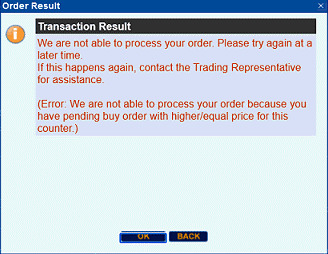

Yes. If you are placing a buy order and have a pending sell order with lower/equal price for this counter, the order will be rejected. If you are placing a sell order and have a pending buy order with higher/equal price for this counter, your order will be rejected.

Yes. If you are placing a buy order and have a pending sell order with lower/equal price for this counter, the order will be rejected. If you are placing a sell order and have a pending buy order with higher/equal price for this counter, your order will be rejected.

This applies to all limit and price-triggered orders placed in all your accounts under the same login to the Online Trading system.

The system messages that will be shown is as follows:

Buy Order Matched Trade Error Message: Sell Order Matched Trade Error Message:

-

11. Are there any trade restrictions?

Singtel A, Singtel 2 and any related bonus shares cannot be traded through the online trading system. In addition, the odd-lot and the buy-in markets are also not available.

Singtel A, Singtel 2 and any related bonus shares cannot be traded through the online trading system. In addition, the odd-lot and the buy-in markets are also not available. -

12. What is 'Amalgamate'?

With the auto-amalgamate feature, orders are combined based on your average traded price. This will allow you to save on your brokerages. Conditions for auto-amalgamate

With the auto-amalgamate feature, orders are combined based on your average traded price. This will allow you to save on your brokerages. Conditions for auto-amalgamateTrades must be done on the same trading day

Trades must be of the same stock

Trades must be of the same action (A buy action can be amalgamated with another buy action regardless of the trading mode)

The trade must be done through the same account

Payment mode must be the same (whether cash, CPF or contra)

Settlement currency must be the same

13. What is a Unit Share Market?

The Unit Share Market, also known as the Odd Lot Market, allows clients to trade counters in quantities less than the standard Board Lot for the counter. The minimum trade amount is 1 share. Currently, Unit Share Market is only available for SGX listed counters.

The Unit Share Market, also known as the Odd Lot Market, allows clients to trade counters in quantities less than the standard Board Lot for the counter. The minimum trade amount is 1 share. Currently, Unit Share Market is only available for SGX listed counters. 14. What are circuit breakers?

SGX will be introducing circuit breakers as an additional market safeguard on 24 February 2014.

SGX will be introducing circuit breakers as an additional market safeguard on 24 February 2014. With circuit breakers, investors will have time to assimilate incoming information and make informed choices during periods of high market volatility. The intention is to provide investors with time to make considered decisions when price movements are sharp.

Click here to view the FAQ.

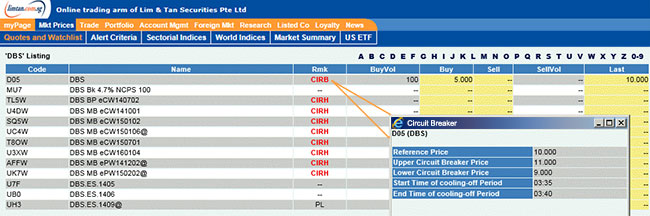

15. How will I know if a circuit breaker is triggered for a particular counter?

If a circuit breaker is triggered for a particular counter, CIRB/CIRH will be displayed under column Rmk. You may click on CIRB/CIRH for information on the Reference Price, Upper and Lower Circuit Breaker Price as well as the Start and End time of cooling-off Period.

If a circuit breaker is triggered for a particular counter, CIRB/CIRH will be displayed under column Rmk. You may click on CIRB/CIRH for information on the Reference Price, Upper and Lower Circuit Breaker Price as well as the Start and End time of cooling-off Period.

16. How is the closing price of ETFs computed?

SGX launched a new closing price methodology for ETFs on 24 February 2014.

SGX launched a new closing price methodology for ETFs on 24 February 2014.A daily closing price will be computed by SGX for all SGX-listed ETFs based on a pre-defined methodology and published at the end of each market day. The closing price for ETFs will reflect prevailing market conditions closely. With this enhancement, investors of ETFs will have an up-to-date closing price for making investment decision and portfolio valuation. Accordingly, the closing price for ETFs will be used as a reference price in market safeguards such as Dynamic Circuit Breaker and Error Trade Policy, and for margining of ETF transactions and in determining forced order range.

Please refer to Circuit Breakers FAQ and Error Trade Policy FAQ for more information.

17. What are Advanced Orders?

Please click here for more information on Advanced Orders.

Please click here for more information on Advanced Orders.18. How do I search for counters by certain categories - REITs, DLCs, ETFs and Warrants?

Select "Quotes and Watchlist" followed by "SGX". You will be able to select the category under "All Types" dropdown box.

Select "Quotes and Watchlist" followed by "SGX". You will be able to select the category under "All Types" dropdown box.

Dual Currency Trading

-

01. What is Dual Currency Trading?

Starting 2 April 2012, SGX introduces dual currency trading for selected securities counters. This will provide investors an option to trade in two different currencies for any of the selected securities counters.

Starting 2 April 2012, SGX introduces dual currency trading for selected securities counters. This will provide investors an option to trade in two different currencies for any of the selected securities counters. With this new functionality, the listed security can now be traded in two different currency denominations (eg: USD and SGD). This means that investors can now trade securities in SGD for securities that are listed in a foreign currency. They can also trade the listed security in both currencies without the need to have separate unit holdings as the shares / units holdings will be consoliated and custodised at CDP.

For more information on dual currency trading, please click here.

-

02. What are the settlement currencies available?

The default settlement currency is the traded currency. For a US$ or RMB listed security, you can choose to pay in their respective currency or S$. If you opt for settlement in a different currency from the listed security counter, the conversion will be done at the Company's prevailing exchange rate. This could result in a price difference if you had purchased the security counter listed in the other currency.

The default settlement currency is the traded currency. For a US$ or RMB listed security, you can choose to pay in their respective currency or S$. If you opt for settlement in a different currency from the listed security counter, the conversion will be done at the Company's prevailing exchange rate. This could result in a price difference if you had purchased the security counter listed in the other currency. For S$ of the same counter, you can only pay in S$.

Example: If you buy HPH US$ and opt for S$ settlement, the settlement will be converted at the Company's prevailing exchange rate. This settlement amount may be different if you had purchased the same number of shares of HPH S$.

-

03. What are the things I have to take note for RMB Settlement?

- Open an RMB a/c with any Singapore registered banks if you do not already have one

- Payment is by telegraphic transfer (TT) to LTS' Standard Chartered Bank Account. Please check with your Trading Representative for details. Do remember to factor in the TT charges that will need to be paid by you.

- RMB cheques or cash will not be accepted by LTS

- For sales proceeds and contra gains, these will be TT to your stipulated bank account in Singapore. The relevant TT charge will also be borne by you.

- FX rates will be updated on a daily basis

- An RMB trust account will be set up for RMB settlement or for conversion to S$. No interest will be given for placement of RMB in the trust account

Only applicable for RMB Offshore banking customers

-

04. Can I contra my purchase?

Contra can only be done if the settlement currency for both buy and sell contracts are the same.

Contra can only be done if the settlement currency for both buy and sell contracts are the same. -

05. How will contracts of Dual currency tradeable counters be reflected on my Portfolio page in my Online Trading Account?

Portfolio entries will be based on the primary currency (Eg: HPH Trust is US$). As such contracts in S$ will be converted to the primary currency using an exchange rate determined by the Company. Do note that this may affect your weighted average cost.

Portfolio entries will be based on the primary currency (Eg: HPH Trust is US$). As such contracts in S$ will be converted to the primary currency using an exchange rate determined by the Company. Do note that this may affect your weighted average cost.

CPF/ SRS Trading

-

01. Can I use my CPF funds to trade online?

Yes, you can. However, please note the following important conditions when using CPF funds to invest: -

Yes, you can. However, please note the following important conditions when using CPF funds to invest: - Sufficient Funds/ Shares

Ensure that you have sufficient funds in your CPF Investment Account before you trade. If you are not sure of the balance you have for investing in stocks and shares, please check with your CPF custodian bank. Purchases will be revoked if there are insufficient funds in your CPF Investment Account. Your purchases may be "force-sold" and you will be liable for any losses that may arise.

When selling shares from your CPF Investment Account, please ensure there are sufficient shares in free balance in the account. If there are insufficient shares in your CPF Investment Account, the shortfall in quantity will be revoked and subject to buying-in by the SGX.Authorization to settle CPF transaction

From 1 March 2000, investors who transact shares using CPF funds need only give a one-time authorization to their agent banks and the CPF Board for the settlement of transactions. Please remember to provide the CPF Investment Account to your Trading Representative or our Online Trading Helpdesk at +65 6799 8188 prior to your first CPF trade through the Online Trading account.

If you have forgotten to do so, the latest time for submitting your CPF Investment Account is by 5.15pm on Trade date. Otherwise, your CPF trade will be revoked and converted to a Cash trade.Use of CPF funds for Investment

Investors should use the funds in their CPF Investment Account for investment only. No contra trading is allowed for transactions using CPF funds.Changes in CPF Investment Account

Please update us of any changes in your CPF Investment Account. You may inform your Trading Representative or our Online Trading Helpdesk at +65 6799 8188. -

02. Can I use my SRS funds to trade online?

Yes, you can. However, please note the following important conditions when using SRS funds to invest: -

Yes, you can. However, please note the following important conditions when using SRS funds to invest: - Sufficient Funds / Shares

Ensure that you have sufficient funds in your SRS Account before you trade. If you are not sure of the balance you have for investing in stocks and shares, please check with your SRS Operator bank. Purchases will be revoked if there are insufficient funds in your SRS Account. Your purchases may be "force-sold" and you will be liable for any loses which may arise.

When selling shares from your SRS Account, please ensure there are sufficient shares in free balance in the account. If there are insufficient shares in your SRS Account, the shortfall in quantity will be revoked and subject to buying-in by the SGX.Update of SRS Account prior to first SRS trade through Online Trading Account

Please remember to provide the SRS Account and Operator bank to your Trading Representative or our Online Trading Helpdesk at +65 6799 8188 prior to your first SRS trade through the Online Trading account.

If you have forgotten to do so, the latest time for submitting your SRS Account is by 5.15pm on Trade date. Otherwise, your SRS trade will be converted to a Cash trade.Use of SRS funds for Payment of Share purchase

Investors should use the funds in their SRS account for investment only. No contra trading is allowed for transactions using SRS funds.Changes in SRS Account/ Operator

Please update us of any changes in your SRS Account/ Operator bank. You may inform your Trading Representative or our Online Trading Helpdesk at +65 6799 8188. -

03. Can I amend my CPF / SRS trades after they are fulfilled?

Yes you can. However, please note that all amendments for CPF / SRS trades can only be done Trade Date itself. Amendment requests on T+1 market day (before 10am) will be subjected to the CPF / SRS agent bank's approval and their processing fees.

Yes you can. However, please note that all amendments for CPF / SRS trades can only be done Trade Date itself. Amendment requests on T+1 market day (before 10am) will be subjected to the CPF / SRS agent bank's approval and their processing fees. -

04. What are the new restrictions on the CPF Investment Scheme (CPFIS) from 1 April 2008?

With effect from 1 April 2008, you will not be able to invest the first $20,000 in your Ordinary Account and first $20,000 in your Special Account. Please click here to read more.

With effect from 1 April 2008, you will not be able to invest the first $20,000 in your Ordinary Account and first $20,000 in your Special Account. Please click here to read more. -

05. What happens when my CPF / SRS trades are revoked by my agent bank?

Possible reasons for revocation of CPF / SRS trades to Cash tradesexceed the 35% stock limit for CPF

have insufficient funds in CPFIS and/or SRS accounts

counter is not approved under CPFIS

do not have the stockholding in the CPFIS and/or SRS accounts (for sell trades)

Payment for shares which are revokedPlease pay us as per a CASH contract by T+2, to avoid any selling out of your shares.

Otherwise, please sell the shares as a CASH trade within the contra period.

For GIRO clients, payment due will be automatically deducted from your bank account. Please note that this is applicable for part or full revocation.

Sale of your shares which have been revoked

Please sell your revoked shares as a CASH tradePortfolio Management

Trades that have been revoked from CPF to Cash will not be reflected in your portfolio automatically. Please refer to the following instructions to amend your online portfolio manually.(For full revocation of CPF trade to Cash trade)

1) Please delete the CPF trade from your portfolio management.

2) Select "Add Contracts" and fill in the relevant information, selecting "cash" for payment type.(For partial revocation of CPF trade to Cash trade)

1) Please delete the CPF trade from your portfolio management.

2) Select "Add Contracts" and add in the 2 contracts of CPF trade and Cash trade separately -

06. Can I use my CPF funds to buy securities placed under SGX watchlist?

With effect from 1 Mar 2016, CPF savings will not be allowed for buying of securities placed under SGX Watchlist.

With effect from 1 Mar 2016, CPF savings will not be allowed for buying of securities placed under SGX Watchlist.If you wish to sell your holdings of such counters currently in your CPFIS account:

1. The sell order should be placed with payment type CASH.

2. You must then inform your Trading Representative on the same day (Trade day) so that the contract can be manually amended to CPF.

3. Amendment not done on Trade day will result in short selling.Please click here for the list of stocks under CPF Investment Scheme.

-

07. Can I use my CPF/SRS to trade SDR?

No, you are unable to trade SDR with CPF/SRS.

No, you are unable to trade SDR with CPF/SRS.

Short-Sell & Buying-in by SGX

-

01. Definition of Short Selling

Short-selling of securities is:

Short-selling of securities is:a. The sale of securities that a seller does not own at the time of the sale.

b. May either be ‘Covered’ or ‘Uncovered/Naked’ Short Selling ‘Covered’ Short Sell ‘Uncovered/Naked’ Short.

We would like to stress that short-selling is not encouraged.

Please click here for the Securities and Futures Act - Guidelines on Short Selling Disclosure.

-

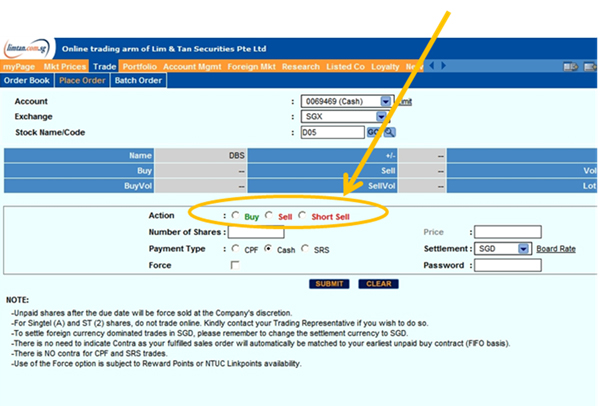

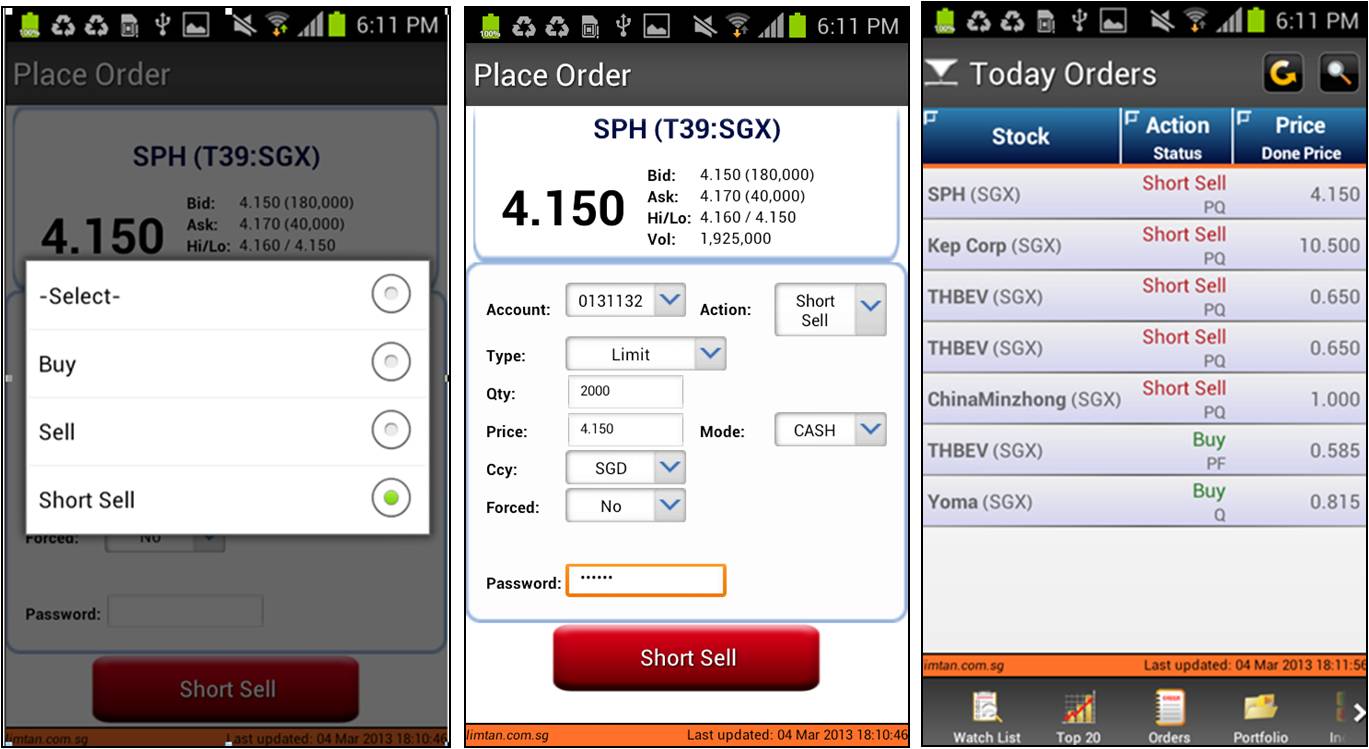

02. How do I mark a short sell on my sell order?

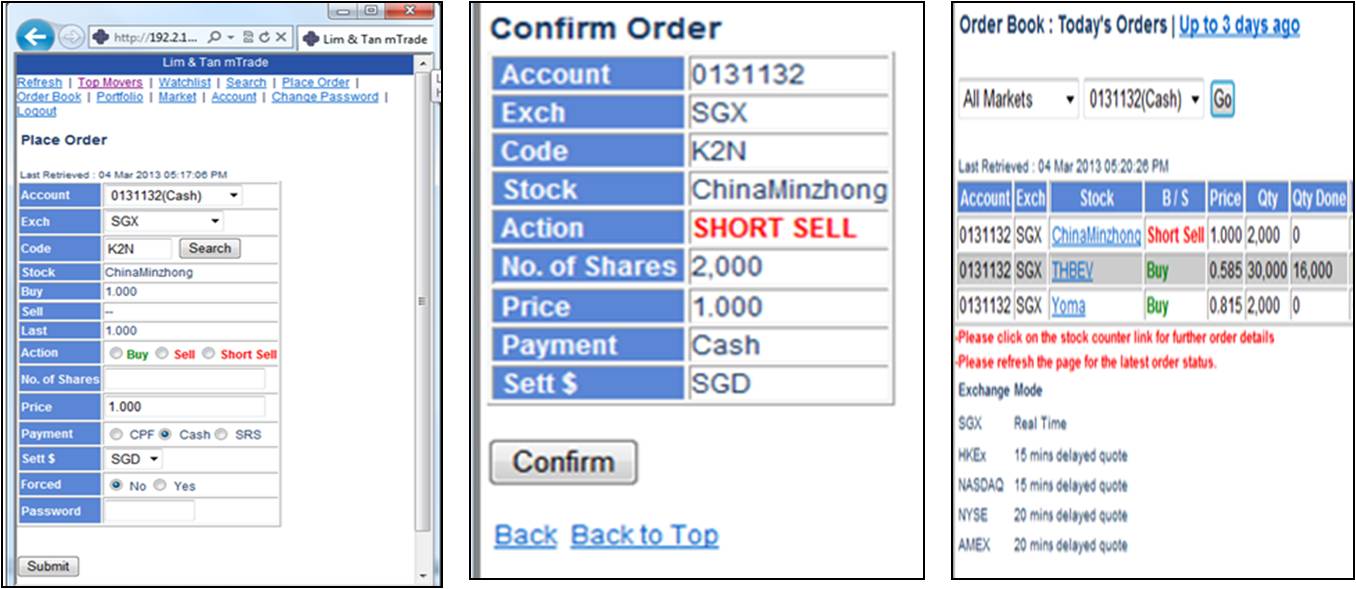

For cash trading on SGX, there are 3 indications for the type of order you are placing: Buy, Sell & Short Sell. You are required to mark if it is a Sell or Short Sell order based on what you know about your position. This is not applicable for CPF, SRS and Margin trades as you are not allowed to short these products.

For cash trading on SGX, there are 3 indications for the type of order you are placing: Buy, Sell & Short Sell. You are required to mark if it is a Sell or Short Sell order based on what you know about your position. This is not applicable for CPF, SRS and Margin trades as you are not allowed to short these products.

-

03. How will I know the quantity of shares that I own? Will my Trading Representative be able to confirm if I have indicated correctly?

You can check your holdings with CDP. Your Trading Representative will not be able to confirm if you have indicated correctly as he does not have full access to your holdings in CDP.

You can check your holdings with CDP. Your Trading Representative will not be able to confirm if you have indicated correctly as he does not have full access to your holdings in CDP. -

04. If I do not own the full quantity of securities to be sold, do I place 1 sell order or 2 separate sell orders?

If you do not own the full quantity of securities to be sold, you will need to enter 2 separate sell orders, with the short sale order marked accordingly. One order is for the portion that you own in full (normal sell order) and the other order is for the portion that you do not own (short sell order).

If you do not own the full quantity of securities to be sold, you will need to enter 2 separate sell orders, with the short sale order marked accordingly. One order is for the portion that you own in full (normal sell order) and the other order is for the portion that you do not own (short sell order).

Example

If you own 5,000 shares but would like enter an order for 8,000 shares, you will need to enter 2 orders, ie one normal sell order for 5,000 shares and another Short Sell order to sell 3,000 shares. -

05. WHEN SHOULD I INDICATE MY SELL ORDER AS A SELL AND WHEN AS A SHORT SELL?

The marking of your sell orders should be based on what you know about your positions at the time of order entry.

The marking of your sell orders should be based on what you know about your positions at the time of order entry.

Example

(a) A client holds 5,000 shares of Stock A. He puts in a sell order for 5,000 shares of Stock A. This is a normal sell order. He also puts in a buy order for 3,000 shares of Stock A.

(b) Subsequently he enters a sell order for 2,000 shares of Stock A. At the point where he enters the sell order, the buy order for 3,000 shares of Stock A has not been filled. The client should mark this sell order as a Short Sell Order. -

06. What if I have indicated the wrong sell order type?

If your order has been submitted but not fulfilled, you will have to withdraw your order and enter a new order.

If your order has been submitted but not fulfilled, you will have to withdraw your order and enter a new order.

If your order has been fulfilled, please contact your Trading Representative by 4pm, Trade Date + 1

Please note that you are expected to accurately disclose the nature of your sell orders. Any delibrate wrongful marking of sell orders may be construed as intent to manipulate the market or false reporting to the exchange and both are offences under Section 330 (1) of the Securities and Futures Act. -

07. What happens when I short-sell?

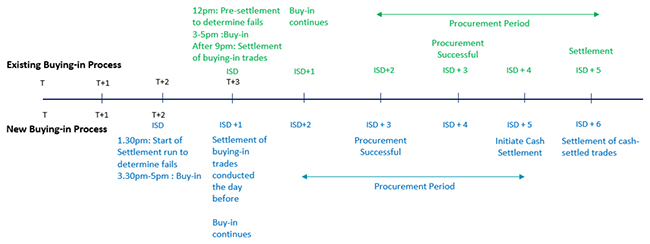

If you are unable to cover back the short position on the same trading day, and if securities are not available for settlement on T+2, CDP will conduct buying-in between 3.30pm to 5pm on the intended settlement date (T+2).

If you are unable to cover back the short position on the same trading day, and if securities are not available for settlement on T+2, CDP will conduct buying-in between 3.30pm to 5pm on the intended settlement date (T+2).Where the Intended Settlement Day falls on a day with half day trading, there will be no buying-in conducted on the first day scheduled for buying-in (i.e. the Intended Settlement Day). Any buying-in will be conducted only on the second day scheduled for buying-in (i.e. the Market Day following the Intended Settlement Day). There shall only be one day of buying-in.

Please refer to Practice Note 6.7.2(1A), 6.7.4(8), 6.7.7A and 6.7.11 - Buying-in, Procurement and Cash Settlement if Intended Settlement Day is Day with Half Day Trading for more information.

In rare instances where shares could not be bought-in or procured after Intended Settlement Day +5 (T+7), cash settlement of the sell trade will be initiated.

For more information on cash settlement, please refer to SGX Post Trade Modernisation - Implementation of Securities Settlement and Depository System FAQ.

-

08. What is the penalty imposed by SGX for failed delivery?

If the buying-in is completed by SGX at the end of Trade Date +2, no penalty will be imposed. However, if the buying-in by SGX is unsuccessful on Trade Date +2, SGX will continue on Trade Date +3 and Trade Date +4. A penalty, of the higher of S$1000 or 5% of the value of the failed trade not bought in will be imposed.

If the buying-in is completed by SGX at the end of Trade Date +2, no penalty will be imposed. However, if the buying-in by SGX is unsuccessful on Trade Date +2, SGX will continue on Trade Date +3 and Trade Date +4. A penalty, of the higher of S$1000 or 5% of the value of the failed trade not bought in will be imposed. -

09. What is the penalty imposed by SGX for failed delivery in Buy-In market?

For failed delivery in Buy-in market, the minimum penalty fee is S$5,000 or 10% of the value of the failed trade.

For failed delivery in Buy-in market, the minimum penalty fee is S$5,000 or 10% of the value of the failed trade. -

10. When will the penalty not be imposed?

With effect from settlements due on Monday, 29 February 2016, SGX will not impose a penalty if both the following criteria are met: (1) the failed contract value is SGD$10,000 and below; and (2) the end-client has not failed to deliver securities before.

With effect from settlements due on Monday, 29 February 2016, SGX will not impose a penalty if both the following criteria are met: (1) the failed contract value is SGD$10,000 and below; and (2) the end-client has not failed to deliver securities before. -

11. What is the buying-in processing fees and the brokerage charged for failed trades?

SGX imposes a processing fee of S$75 + GST for each failed contract. With effect from 2 January 2019, the brokerage fee for buying-in contract will be increased from 0.75% to 1% which comprises of SGX commission of 0.75% and LTS commission of 0.25% + GST, where applicable.

SGX imposes a processing fee of S$75 + GST for each failed contract. With effect from 2 January 2019, the brokerage fee for buying-in contract will be increased from 0.75% to 1% which comprises of SGX commission of 0.75% and LTS commission of 0.25% + GST, where applicable. -

12. How is buying-in conducted by SGX for a short position?

SGX conducts buying-in on each market day, in the Buying-in Market, from 3.30pm - 5pm. SGX publishes on its website daily at 2.30pm, a list of shares to be bought-in.

SGX conducts buying-in on each market day, in the Buying-in Market, from 3.30pm - 5pm. SGX publishes on its website daily at 2.30pm, a list of shares to be bought-in. The buying-in bid price, as determined by CDP, will be 2 minimum bids above the highest of the following:

(a) the closing price of the previous day;

(b) the reference transacted price,

(c) the reference bid price; and

(d) in respect of a contract made in the buy-in market on the previous Market Day for which delivery failed, the transacted price of that contract.

The reference transacted price and the reference bid price will be any of the last transacted prices and bid prices within the 1 hour preceding the commencement of buying-in, as determined by CDP.Where necessary, CDP shall have the discretion to make adjustments to any of the prices to cater for corporate actions on the particular security.

If the securities are not obtained after the commencement of buying-in, CDP shall have absolute discretion to raise the buying-in price bid by 2 minimum bids, as determined by SGX-ST, from the following, in order to facilitate the successful buying-in of the securities:

(a) the prevailing buying-in bid price;

(b) the transacted price in the ready market; or

(c) the bid price in the ready market,

at such time as determined by CDP, from time to time throughout the buying-in session until the securities are bought or delivered to CDP.If the securities cannot be obtained during the Settlement Day and unless the securities are withdrawn from buying-in, the buying-in shall continue on the following Market Day with the buying-in bid price at the commencement of buying-in and CDP shall have absolute discretion to raise the buying-in bid price after the commencement of buying-in.

SGX will publish on its website the list of shares it had bought-in, the volume and dollar value at 8.30am the following market day.

-

13. What happens if SGX is unable to complete the buying-in and requires Lim & Tan to procure the shares?

In the event that SGX is unable to buy-in the shares by Trade Date +3 (Intended Settlement Date ISD+1), CDP will require Lim & Tan Securities to procure the securities. If the trade remains unsettled, CDP will initiate cash settlement of the failed trade on T+7 (ISD+5) and effect cash settlement on T+8 (ISD+6). In addition, if the shares remain unavailable for delivery by T+7 (ISD+5), a further penalty of $5,000 may be imposed by CDP. This shall be borne by the client.

In the event that SGX is unable to buy-in the shares by Trade Date +3 (Intended Settlement Date ISD+1), CDP will require Lim & Tan Securities to procure the securities. If the trade remains unsettled, CDP will initiate cash settlement of the failed trade on T+7 (ISD+5) and effect cash settlement on T+8 (ISD+6). In addition, if the shares remain unavailable for delivery by T+7 (ISD+5), a further penalty of $5,000 may be imposed by CDP. This shall be borne by the client.

Trust Account

-

01. Where can I view my daily trust movement ledgers?

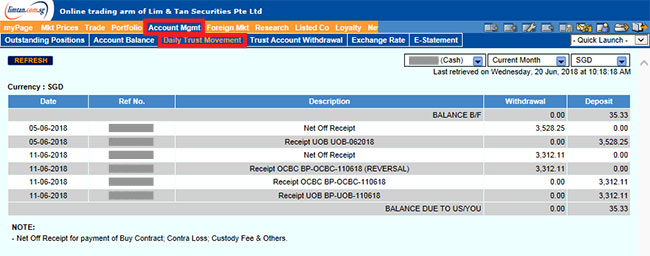

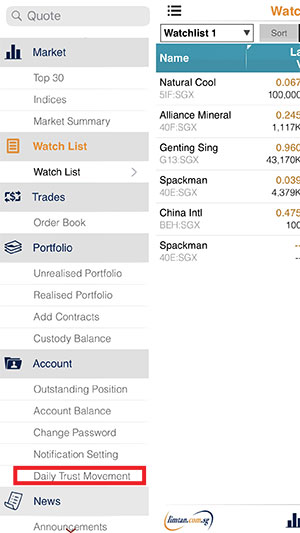

You can view your daily trust movement ledgers from the following:

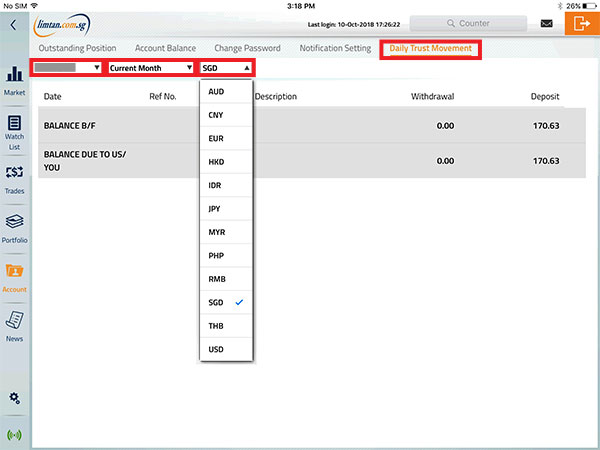

You can view your daily trust movement ledgers from the following:Under Account Management -> Daily Trust Movement

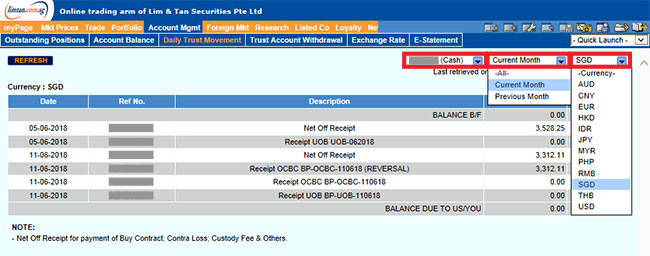

Click on the dropdown button to select the type of accounts, available period and currency for viewing.

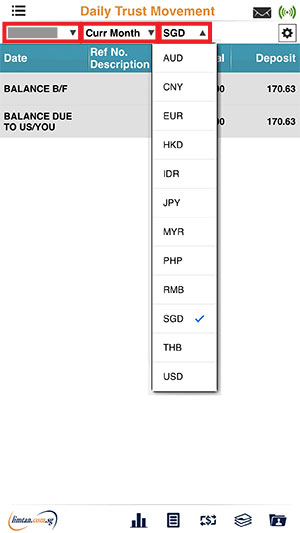

iPhone mobile app:

Tap on the dropdown button to select the type of accounts, available period and currency for viewing.

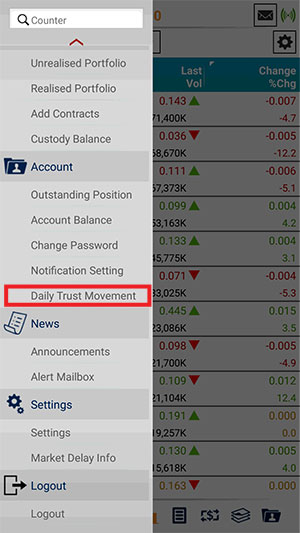

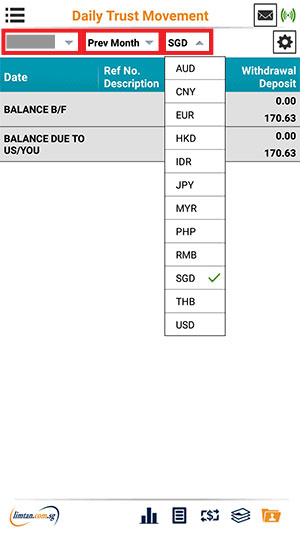

Android mobile app:

Tap on the dropdown button to select the type of accounts, available period and currency for viewing.

iPad mobile app:

Tap on the dropdown button to select the type of accounts, available period and currency for viewing.

New posting of ledgers will be available for viewing on the next working day.

-

02. Can I access daily trust movement ledgers for all of my online and broker-assisted trading accounts?

You will be able to view daily trust movement ledgers for all Online trading accounts only.

You will be able to view daily trust movement ledgers for all Online trading accounts only. -

03. How long will my daily trust movement ledgers be available for viewing?

You can view your daily trust movement ledgers up to 60 calendar days.

You can view your daily trust movement ledgers up to 60 calendar days. -

04. Will there be interest credited to credit balance in my Trust Account?

Interest (if any) will be computed and credited to trust account on a daily basis. Where applicable, we will pay interest at our published interest rate, calculated on daily balances. For avoidance of doubt, the published interest rate is determined by us, and subject to change from time to time at our sole and absolute discretion.CurrencyRate (W.E.F. 1 Nov 2025)SGD0.60% p.a.MYR1.00% p.aHKD0.25% p.a.USD1.00% p.a.

Interest (if any) will be computed and credited to trust account on a daily basis. Where applicable, we will pay interest at our published interest rate, calculated on daily balances. For avoidance of doubt, the published interest rate is determined by us, and subject to change from time to time at our sole and absolute discretion.CurrencyRate (W.E.F. 1 Nov 2025)SGD0.60% p.a.MYR1.00% p.aHKD0.25% p.a.USD1.00% p.a.

-

05. How do I withdraw the funds from my Trust Account?

To withdraw your funds, click on "Account Mgmt" on the navigation menu and click on "Trust Account Withdrawal". Please click here for a step by step withdrawal guide.

To withdraw your funds, click on "Account Mgmt" on the navigation menu and click on "Trust Account Withdrawal". Please click here for a step by step withdrawal guide. Please note that this online service is only available for CASH accounts. For Margin and CFD withdrawals, please contact your Trading Representative.

-

06. Is the withdrawal request subject to further approval before it is processed?

Yes. This is subject to your Trading Representative's review and approval.

Yes. This is subject to your Trading Representative's review and approval. -

07. How can I check the status of my withdrawal request?

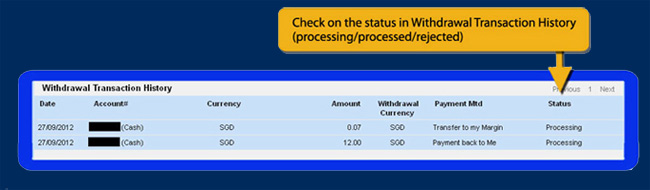

Your withdrawal request will be processed within 2 working days. You can refer to "Withdrawal Transaction History" located at the bottom of the page for the updated status of your request.

Your withdrawal request will be processed within 2 working days. You can refer to "Withdrawal Transaction History" located at the bottom of the page for the updated status of your request.

TRADING OF EMPERADOR SHARES WITH PRIMARY LISTING IN PHILIPPINE STOCK EXCHANGE

-

01. What are the foreign fees payable (FFP) for selling of Philippine Shares listed on SGX?

The following charges are applicable on sale of Philippine shares listed on the SGX market (Sell Trades):-

The following charges are applicable on sale of Philippine shares listed on the SGX market (Sell Trades):-(i) Stock Transaction Tax at 0.10% on gross proceeds

(ii) Receiving Agent Fee at 0.03% on gross proceeds -

02. Are the shares fungible?

Yes. Please click for SGX Cross Border Securities Transfer form for more information.

Yes. Please click for SGX Cross Border Securities Transfer form for more information. -

03. Will there be any tax on dividend?

The dividends credited via CDP will be net of the dividend tax of 25% for non-resident individuals not engaged in trade or business in the Philippines.

The dividends credited via CDP will be net of the dividend tax of 25% for non-resident individuals not engaged in trade or business in the Philippines.

This advertisement has not been reviewed by the Monetary Authority of Singapore.