FAQ

- Brokerage Charges FAQ

- E-Statements and E-Contracts FAQ

- SGX Advanced Orders FAQ

- US Advanced Orders FAQ

- Contract For Difference Advanced Orders FAQ

- General FAQ

- SGX Circuit Breaker and Error Trade Policy FAQ

- 2FA FAQ

- Specified Investment Products FAQ

- Reclassification of OLIPs to EIPs FAQ

- Young Investors FAQ

- Cyber Security FAQ

Shanghai-Hong Kong Stock Connect (SH-HK) Trading FAQ

Trading in the Shanghai-Hong Kong Stock Connect - What you should know?

-

01. What is Shanghai-Hong Kong Stock Connect (SH-HK)?

It is a cross-boundary investment channel that connects the Shanghai Stock Exchange and the Hong Kong Stock Exchange. Developed by Hong Kong Exchanges and Clearing Limited (HKEX), Shanghai Stock Exchange (SSE) and China Securities Depository and Clearing Corporation Limited (ChinaClear), the Shanghai-Hong Kong Stock Connect (SH-HK) allows investors in their respective markets to trade eligible securities listed in the other’s market.

It is a cross-boundary investment channel that connects the Shanghai Stock Exchange and the Hong Kong Stock Exchange. Developed by Hong Kong Exchanges and Clearing Limited (HKEX), Shanghai Stock Exchange (SSE) and China Securities Depository and Clearing Corporation Limited (ChinaClear), the Shanghai-Hong Kong Stock Connect (SH-HK) allows investors in their respective markets to trade eligible securities listed in the other’s market. -

02. Who is eligible to trade in the Shanghai-Hong Kong Stock Connect (SH-HK)?

Anyone who is 21 years old and above are allowed to trade eligible SSE securities through SH-HK.

Anyone who is 21 years old and above are allowed to trade eligible SSE securities through SH-HK. -

03. What is the SH-HK Stock Connect online brokerage rates?

SH-HK Stock Connect Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.25% 0.2375% Minimum Commission CNY 88 CNY 83.60 Other Charges CNY GST [Brokerage + Trading Fee + Clearing Fee + Stamp Duty + Handling Fee + Securities Management Fee + Transfer Fee] x prevailing GST rate Stamp Duty 0.05% of the consideration of a transaction on the seller (SAT) Handling Fee 0.00341% of the consideration of a transaction per side (SSE) Securities Management Fee 0.002% of the consideration of the transaction per side (CSRC) Transfer Fee (i) 0.001% of the consideration of the transaction per side (ChinaClear)

(ii) 0.002% of the consideration of the transaction per side (HKSCC)*Subject to Changes

Account Related

-

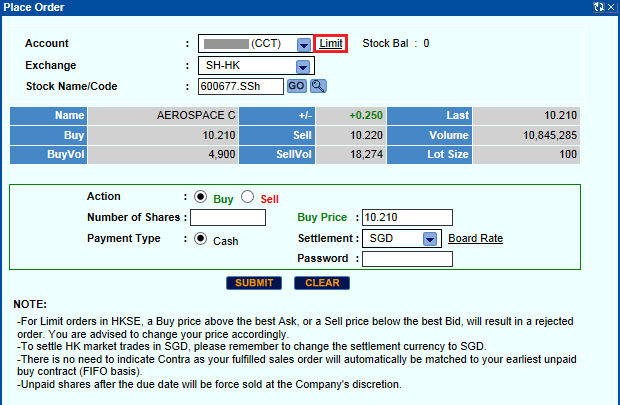

01. How do I trade in the Shanghai-Hong Kong Stock Connect (SH-HK)?

You will need to have either a Cash Collateralised Trading (CCT) account or an Online Cash trading account before you can trade in SH-HK. If you do not have a CCT or Online Cash trading account, please visit Lim & Tan Securities or come by our various roadshow location islandwide. You may also call our Online Trading Helpdesk (Tel: +65 6799 8188) to obtain a set of forms. The forms can also be downloaded here.

You will need to have either a Cash Collateralised Trading (CCT) account or an Online Cash trading account before you can trade in SH-HK. If you do not have a CCT or Online Cash trading account, please visit Lim & Tan Securities or come by our various roadshow location islandwide. You may also call our Online Trading Helpdesk (Tel: +65 6799 8188) to obtain a set of forms. The forms can also be downloaded here. -

02. What is a Cash Collateralised Trading (CCT) account?

For more information on CCT account, please click here.

For more information on CCT account, please click here. -

03. Are there any processing fees required to open a Cash Collateralised Trading (CCT) account or an Online Cash trading account?

There is no processing fee for opening either of the above accounts.

There is no processing fee for opening either of the above accounts. -

04. Can I use my existing limtan login ID and password to access and trade in Shanghai-Hong Kong Stock Connect (SH-HK)?

Yes. You can use the same limtan Login ID and Password to access and trade in SH-HK Market via all our Online Trading channels.

Yes. You can use the same limtan Login ID and Password to access and trade in SH-HK Market via all our Online Trading channels. -

05. Can I make changes to any of the Login ID and password?

Yes. You are required to change the Login Password the first time you login to limtan.com.sg

Yes. You are required to change the Login Password the first time you login to limtan.com.sg -

06. What should I do if I have forgotten my Login ID and/or Password?

If you have forgotten your Login ID, please click here to reset.

If you have forgotten your Login ID, please click here to reset.If you have forgotten your Password, here are the ways to request for a new one:

1. For Individual Account with valid email and Mobile number on record with LTS

Electronic Password issuance: Please click here to request for a new one. A verification email and SMS will be sent to your email address and Mobile number in our records. Click on the link provided in the email for verification.

Upon successful verification, your new password will be sent to your Mobile number. Please refer to General FAQ - Electronic Password Qn 4 for step by step guide.

If you have an Individual Account and are not sure if you have a valid email and Mobile number on record with LTS, please check with your Trading Representative or the Online Trading Helpdesk.

2. For Joint/Corporate Account or Individual Account with no email address and/or Mobile number

Post: Please click here to request for a new one. Your old password will be permanently disabled and the new password will be mailed to your mailing address in our records within 2 - 3 working days.

Please note that the Electronic Password will not be eligible for clients who do not have a valid email address or Mobile number. All other types of account holders (e.g. Joint or Corporate account holders) will also not be eligible for the Electronic Password.

Trading Related

-

01. What are the securities eligible for trading through Shanghai-Hong Kong Stock Connect (SH-HK)?

All constituent stocks of the SSE 180 Index, SSE 380 Index and all the SSE-listed A shares that are not included as constituent stocker of the relevant indices but which have corresponding H shares listed on SEHK can be traded via the Shanghai-Hong Kong Stock Connect, except for the following:

All constituent stocks of the SSE 180 Index, SSE 380 Index and all the SSE-listed A shares that are not included as constituent stocker of the relevant indices but which have corresponding H shares listed on SEHK can be traded via the Shanghai-Hong Kong Stock Connect, except for the following:a. SSE-listed shares which are not traded in CNY; and

b. SSE-listed shares which are under risk alertFor more details on eligible stocks under Shanghai-Hong Kong Stock Connect (SH-HK), please click here.

-

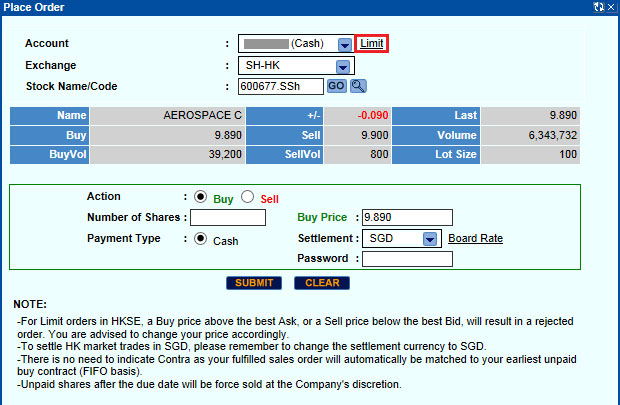

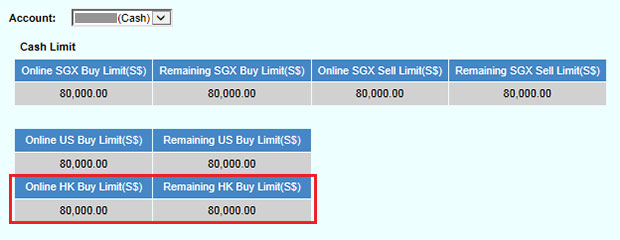

02. What is my trading limit for SH-HK Market?

SH-HK trades are subject to the HK market limit set in SGD for each Online trading account.

SH-HK trades are subject to the HK market limit set in SGD for each Online trading account.

The trading limit for your CCT account is based on the available cash in the trust account.

-

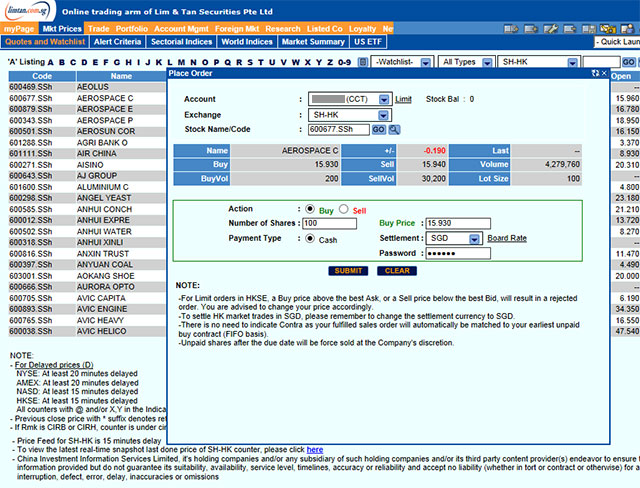

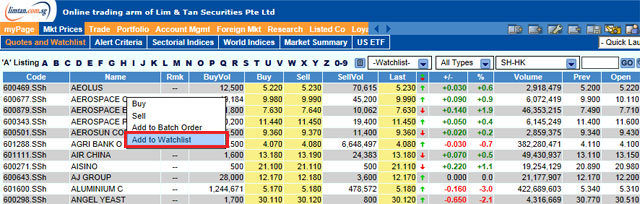

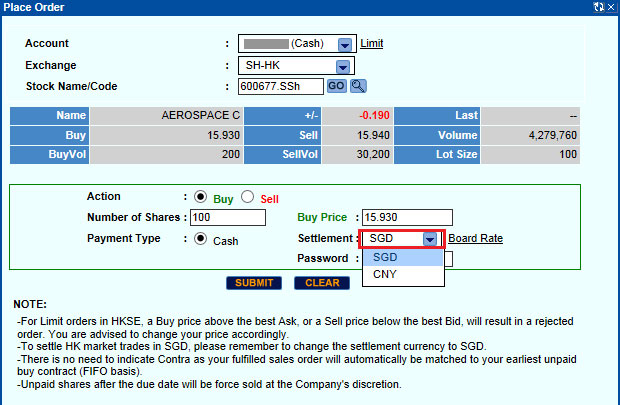

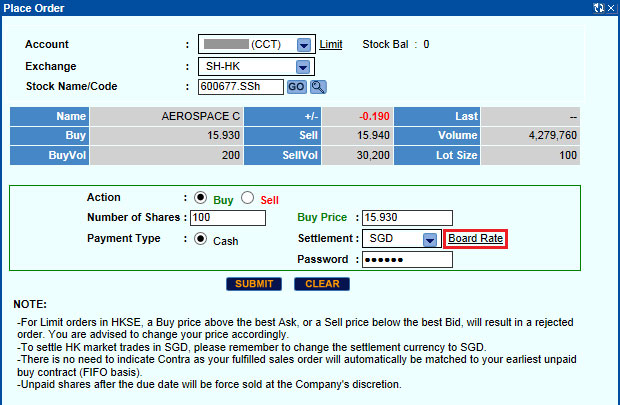

03. How do I access and place an order for securities under SH-HK?

You may login to our Online trading platform, click under ‘Market’ to access a drop down list to select ‘SH-HK’.

You may login to our Online trading platform, click under ‘Market’ to access a drop down list to select ‘SH-HK’.

Click on the stock name you would like to trade in and a ‘Place Order’ window will appear. Select Buy or Sell action, indicate the number of shares, price, and settlement. Enter your password again to submit the order.

For your own convenience, you may wish to search for your desired SH-HK counter, do a right click to add to any of your existing 'Watchlist'.

-

04. How do I place advanced orders?

Advance order is not available.

Advance order is not available.

-

05. What are the trading hours?

Trading is conducted on Monday to Friday (excluding non-Northbound Trading days) at the following times:

Trading is conducted on Monday to Friday (excluding non-Northbound Trading days) at the following times:

SSE Trading Session SSE Trading Hours Time for EPs to input Northbound orders Opening Call Auction 09:15 a.m. to 09:25 a.m. 09:10 a.m. to 11:30 a.m. Continuous Auction (Morning) 09:30 a.m. to 11:30 a.m. 09:10 a.m. to 11:30 a.m. Continuous Auction (Afternoon) 01:00 p.m. to 03:00 p.m. 12:55 p.m. to 03:00 p.m. -

06. What is the holiday arrangement?

Trading on SH-HK can only be done on days where both SSE and SEHK are open for trading and banking services are available in both markets on the corresponding settlement day.

Trading on SH-HK can only be done on days where both SSE and SEHK are open for trading and banking services are available in both markets on the corresponding settlement day.Please click here for the trading calendar.

-

07. Is the Price Data live?

No. There will be a 15 minutes delay for SH-HK Stock Connect price feed.

No. There will be a 15 minutes delay for SH-HK Stock Connect price feed.To view the latest real-time snapshot last done price of SH-HK counter, please click here.

-

08. What are the lot size for trading under Shanghai-Hong Kong Stock Connect (SH-HK)?

SSE securities are traded in board lot size of 100 Shares.

SSE securities are traded in board lot size of 100 Shares.

Buy orders must be placed in board lot.Odd lot trading is available for sell orders in the SH-HK Stock Connect. However, it is not accepted by our Online Trading platform. You may contact your Trading Representative to place order.

-

09. What order types are available?

Only limit orders are available at the moment.

Only limit orders are available at the moment. -

10. Is Day trading allowed?

Day trading is not allowed. Shares bought on T-day can only be sold on and after T+1 day.

Day trading is not allowed. Shares bought on T-day can only be sold on and after T+1 day. -

11. What is the maximum/minimum price I can submit for my order?

For SSE Securities, there is a general price limit of +/- 10% base on the previous closing price.

For SSE Securities, there is a general price limit of +/- 10% base on the previous closing price.The upper and lower price limit will remain the same intra-day and all orders must be at or within the price limit. Any order with a price beyond the price limit will be rejected by SSE.

-

12. What is the validity period of my order(s)?

The validity of your order(s) is for one trading day. Order(s) will expire automatically at the end of each trading day.

The validity of your order(s) is for one trading day. Order(s) will expire automatically at the end of each trading day. -

13. How do I know my order has been filled?

All filled orders will automatically be updated under the status of your ‘Order Book’.

All filled orders will automatically be updated under the status of your ‘Order Book’.Please check your ‘Order Book’ for the actual quantity filled.

-

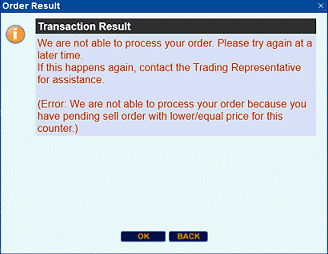

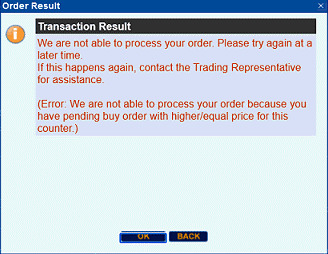

14. Will there be instances where the order will be rejected to prevent potential matching of my own orders?

Yes. If you are placing a buy order and have a pending sell order with lower/equal price for this counter, the order will be rejected. If you are placing a sell order and have a pending buy order with higher/equal price for this counter, your order will be rejected.

Yes. If you are placing a buy order and have a pending sell order with lower/equal price for this counter, the order will be rejected. If you are placing a sell order and have a pending buy order with higher/equal price for this counter, your order will be rejected.

This applies to all limit orders placed in all your accounts under the same login to the Online Trading system.

The system messages that will be shown is as follows:

Buy Order Matched Trade Error Message: Sell Order Matched Trade Error Message:

-

15. What is the minimum tick size for SH-HK?

The tick size is set at CNY 0.01.

The tick size is set at CNY 0.01. -

16. Will I be able to amalgamate my SH-HK trades?

There is an amalgamation of orders for SSE shares for trade done on the same counter (buy/sell) and on the same trading day. All buy orders of the same stock fulfilled on the same day will be amalgamated into one contract. The same applies to all sales orders of the same stock fulfilled on the same day.

There is an amalgamation of orders for SSE shares for trade done on the same counter (buy/sell) and on the same trading day. All buy orders of the same stock fulfilled on the same day will be amalgamated into one contract. The same applies to all sales orders of the same stock fulfilled on the same day. -

17. How do I amend or withdraw orders?

No amendments can be made after the order has been placed. The order will need to be withdrawn and resubmitted if there are any changes to be made.

No amendments can be made after the order has been placed. The order will need to be withdrawn and resubmitted if there are any changes to be made.Please note that only quantities which have not been fulfilled can be withdrawn.

-

18. Why is my order rejected?

Order rejection may be due to the following:

Order rejection may be due to the following:a. Exceeding of daily quota for cross-boundary trades under SH-HK

b. Order with price input beyond the general price limit, base on previous closing price

c. Placing of buy order for restricted SSE securities

d. Dynamic price checking for buy orders

e. Trading suspensionShould your order be rejected, please contact your Trading Representative for assistance.

Trading Settlement Related

-

01. What is the Settlement Date for the SH-HK Stock Connect?

Shares purchase will be due for delivery on Transaction date +1 Market days (T+1). All purchases must be settled by due date.

Shares purchase will be due for delivery on Transaction date +1 Market days (T+1). All purchases must be settled by due date."T" denotes the Transaction Date. For e.g. If you purchase SH-HK shares on Monday (T day), the due date for your contract is on Tuesday (T+1). However, if the due date coincides with a public holiday, the due date is the subsequent Market day.

-

02. Is short selling allowed?

Short selling is not allowed.

Short selling is not allowed. -

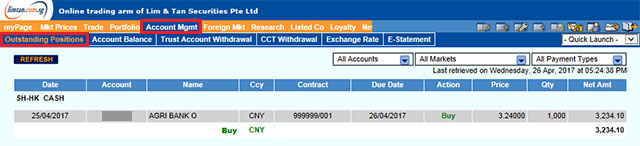

03. How will I know how much is the settlement amount?

You will receive a hardcopy Contract Note from LTS. You will also be able to find the information displayed at "Account Mgmt" under "Outstanding Positions".

You will receive a hardcopy Contract Note from LTS. You will also be able to find the information displayed at "Account Mgmt" under "Outstanding Positions".

-

04. What is the settlement currency for my purchases and sales?

The settlement currency in the 'Place Order' screen will be defaulted to SGD. If you wish to settle in CNY, please remember to change the settlement currency to CNY before you submit your order.

The settlement currency in the 'Place Order' screen will be defaulted to SGD. If you wish to settle in CNY, please remember to change the settlement currency to CNY before you submit your order.

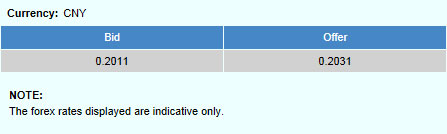

To see the indicative foreign exchange rate, please click on "Board Rate".

-

05. What if I want to change the settlement currency?

You are able to change the settlement currency by calling your Trading Representative on trade date or by 10am on T+1.

You are able to change the settlement currency by calling your Trading Representative on trade date or by 10am on T+1. -

06. How do I make payment for my purchases?

CCT Account:

CCT Account:

Payment for your purchases will be deducted from the funds in your trust account on Trade Date +1 (T+1). Foreign exchange at our prevailing board rates will be used in the event that there is insufficient funds in your trust account of the specified settlement currency.Sales proceeds will be credited to your trust account on T+1.

Online Cash Trading Account:

Cash, Singapore dollar and Chinese Yuan (CNY) cheque for payment must reach LTS before 5pm (Singapore Time) latest by T+2.For S$ settlement: GIRO/EPS/Cheque/Cashier's Order.

For CNY settlement:

Cash payment can only be made at our Cashier Counter.

Opening hours: 8:30am to 5:45pm (Monday to Friday, excluding Public Holidays)- TT (all charges are to be borne by client)

- CNY cheque - drawn in Hong Kong (courier charges are to be borne by client)

As your sales proceed is in S$, we will credit your bank account if you have opted for GIRO/ EPS facility. Otherwise a cheque payment will be made in your name.

-

07. What will happen to my shares after I have made payment for it?

The shares will be kept in our foreign custody by next working day after payment.

The shares will be kept in our foreign custody by next working day after payment. -

08. Are there any charges for keeping my shares in the safe custody of LTS?

Yes. Monthly foreign custody fee is S$2 per counter, subject to a maximum of S$150 per quarter + GST or 0.0025% pa of market value of shares whichever is applicable.

Yes. Monthly foreign custody fee is S$2 per counter, subject to a maximum of S$150 per quarter + GST or 0.0025% pa of market value of shares whichever is applicable.For clients who conduct at least 6 trades in a quarter in any markets, the monthly fee of S$2 per counter will be waived in any month of that quarter. If there are less than 6 trades per quarter, clients who conduct at least 2 trades in a month, the monthly fee of S$2 per counter will be waived in that month.

-

09. How will I be billed for custody charges if I hold foreign shares in two separate accounts?

The custody charges will be levied on a per account basis. If you hold foreign shares in two separate accounts, you will be billed according to the shareholdings in each account.

The custody charges will be levied on a per account basis. If you hold foreign shares in two separate accounts, you will be billed according to the shareholdings in each account. -

10. How do I make payment for the custody charges?

You may pay by any of the following payment methods:

You may pay by any of the following payment methods: - Cash

- Cheque

- Electronic Payment of Shares (EPS)

Cash payment can only be made at our Cashier Counter.

Opening hours: 8:30 a.m. to 5:45 p.m. (Monday to Friday, excluding Public Holidays)Outstanding custody fees will also be auto-netted against any payments due to you. Where there are no outgoing payments, the deductions of outstanding custody fees will be from any available funds in the Trust account.

-

11. Can I transfer the SH-HK shares in from other Broker(s) to my Online Trading account at LTS? Will there be any charges for shares transferred into LTS?

Yes, transfer request is allowed. For transfer details, you may contact our Operations department - Settlement at 6437 0145/148.

Yes, transfer request is allowed. For transfer details, you may contact our Operations department - Settlement at 6437 0145/148.There are no charges for shares transferred into LTS. However, there are transfer fees imposed by the delivering securities firm.

-

12. Will there be any charges for shares transferred out from LTS?

Yes, there is a transfer fee of S$50 + GST per counter and foreign broker fees + GST (stock value 0.01% subject to minimum HK$3 and handling fee HK$400 per counter). For more details, you may contact Operations department - Settlement at 6437 0145/148.

Yes, there is a transfer fee of S$50 + GST per counter and foreign broker fees + GST (stock value 0.01% subject to minimum HK$3 and handling fee HK$400 per counter). For more details, you may contact Operations department - Settlement at 6437 0145/148. -

13. Can I contra my purchases?

Contra trading is not allowed for both intra-day and inter-day.

Contra trading is not allowed for both intra-day and inter-day. -

14. What will happen if I do not pay on time?

Unpaid shares after the due date will be force sold at the Company's discretion.

Unpaid shares after the due date will be force sold at the Company's discretion. -

15. Are there any Dividend Handling Fee for dividend received?

Yes. Dividend Handling Fee will be charged. Dividend Amount Dividend Charges + Foreign broker fees and taxes (if applicable) Below S$10 S$3.00 + GST S$10 to S$500 S$5.00 + GST Above S$500 1% subject to max. of S$100 + GST Note: Dividends are subjected to a withholding tax of 30%.

All fees and charges are subject to revision without prior notice. -

16. How much is the Corporate Action charges?

Service charge on cash offer/expiry of warrants/rights application is S$10 per counter + GST.

Service charge on cash offer/expiry of warrants/rights application is S$10 per counter + GST. -

17. Are there any other Nominee Services and Corporate Actions charges?

Yes. There are Nominee Services and Corporate Actions fees charged by Foreign Broker.

Yes. There are Nominee Services and Corporate Actions fees charged by Foreign Broker.Dividend Collection/Scrip Dividend Collection Collection Fee Between 0.5% to 1% of Total Div. Amount (Min HK$30, Max HK$2,500) Scrip Fee HK$2.5/Lot (HK$1.5 is collected by HK Clearing) Dividend Collection/Scrip Dividend Collection (Stock Option) Collection Fee Between 0.5% to 1% of Total Div. Amount (Min HK$30, Max HK$2,500) Bonus Collection/Bonus Warrant Collection Handling Charges HK$30 Scrip Fee HK$2.5/Lot (HK$1.5 is collected by HK Clearing) Rights Collection Scrip Fee HK$2.5/Lot (HK$1.5 is collected by HK Clearing) Rights Subscription Handling Charges HK$30 Corporation Action Fee HK$1.2/Lot (HK$0.8 is collected by HK Clearing) Warrant/Covered Warrant Conversion Handling Charges HK$30 Corporation Action Fee HK$1.2/Lot (HK$0.8 is collected by HK Clearing) Accept Cash Offer Handling Charges HK$30 Corporation Action Fee HK$1.2/Lot (HK$0.8 is collected by HK Clearing) Stamp Duty 0.13% of Transaction Amount [round up to the nearest dollar (Effective from 1 August 2021)] -

18. What are the fees and taxes applicable to trading and clearing of SSE Securities?

Items Rate Charged by Stamp Duty 0.05% of the consideration of a transaction on the seller SAT Handling Fee 0.00341% of the consideration of a transaction per side SSE Securities Management Fee 0.002% of the consideration of a transaction per side CSRC Transfer Fees 0.001% of the consideration of a transaction per side ChinaClear 0.002% of the consideration of a transaction per side HKSCC Source: https://www.hkex.com.hk/-/media/HKEX-Market/Services/Circulars-and-Notices/Participant-and-Members-Circulars/SEHK/2015/67-15-SEHK-NB-Fee-reduction.pdf

This advertisement has not been reviewed by the Monetary Authority of Singapore.