FAQ

- Brokerage Charges FAQ

- E-Statements and E-Contracts FAQ

- SGX Advanced Orders FAQ

- US Advanced Orders FAQ

- Contract For Difference Advanced Orders FAQ

- General FAQ

- SGX Circuit Breaker and Error Trade Policy FAQ

- 2FA FAQ

- Specified Investment Products FAQ

- Reclassification of OLIPs to EIPs FAQ

- Young Investors FAQ

- Cyber Security FAQ

SGX ADVANCED ORDERS FAQ

General Information on Advanced Orders

-

01. WHAT ADVANCED ORDER TYPES ARE AVAILABLE?

The Advanced Order types available are:

The Advanced Order types available are:- Limit Order

- Market Order

- Market – to- Limit Order

-

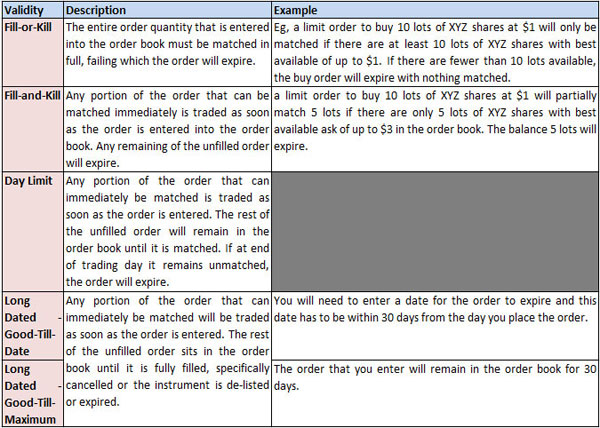

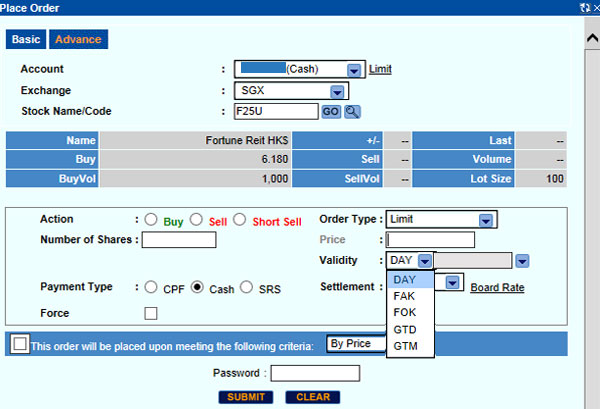

02. WHAT ARE THE ORDER VALIDITIES FOR THE ADVANCED ORDER TYPES?

a)

Day Order

a)

Day Order

The order is only valid for the day that it is entered into the order book. If the order is not matched, it will expire at the end of trading day. As such, you will need to re-enter your order again on each trading day.

b) Fill and Kill (FAK)

The order will be matched with as much quantity as possible and any unmatched quantity will be cancelled.

c) Fill or Kill (FOK)

The order will be matched in its entire quantity or be completely cancelled. There is no partially filled order.

d) Long Dated Order - Good till Day (GTD/ Good till Maximum (GTM)

Long dated orders allow clients to place an order that will stay in the order book for a specific number of calendar days or until the order is fully filled, specifically cancelled or the instrument has corporate actions, is de-listed or expired, whichever is earlier.- GTD – Clients are required to insert a date that is within 30 days from the day the order is placed. If GTD is selected. In line with SGX’s regulatory rules, GTD orders that have an expiry of more than 30 calendar days from the day they were entered will be rejected by the system.

- GTM – These are orders that will stay in the order book for a maximum of 30 calendar days or until it is fully filled, specifically cancelled or the instrument has corporate actions, is delisted or expired, whichever is earlier. You are not required to insert a date as the order will expire 30 calendar days later.

-

03. WHAT ARE PRICE TRIGGERED ORDERS?

Price Triggered Orders (PTOs) allow market participants to buy or sell an instrument when the trigger price condition is reached.

Price Triggered Orders (PTOs) allow market participants to buy or sell an instrument when the trigger price condition is reached.- PTOs can only be entered, modified, cancelled and triggered during Open phase.

- PTOs cannot be entered, modified, cancelled and triggered during a trading halt.

- It is not visible to the market before it is converted to the specific order.

- Once the price meets the condition that was set up, the Price Triggered Order will be converted to an active tradable order.

- PTOs can be entered with any order type and validity for the to-be-triggered order. However, validation of the allowable order type and validity for the to-be-triggered order will be done upon activation of the order.

- PTOs not activated by end of the trading day will be automatically deleted from the system. That is, there are no long dated PTOs.

SGX currently offers 2 types of Price Triggered Orders (PTOs), namely, Stop Orders and If-Touched Orders.

-

04. WHICH ORDER TRIGGERING CONDITIONS ARE AVAILABLE FOR US TO PLACE THE ADVANCED ORDERS?

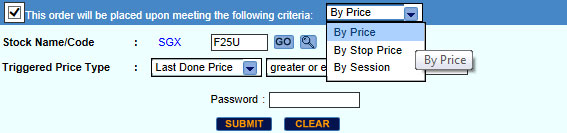

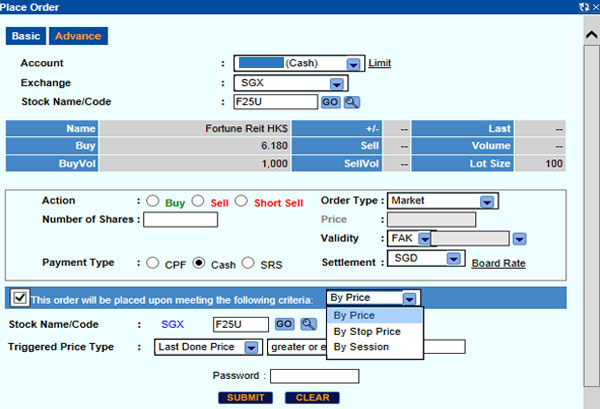

There are 3 order triggering conditions available: Price, Stop Price & Session.

There are 3 order triggering conditions available: Price, Stop Price & Session. a) Price

b) Stop Price

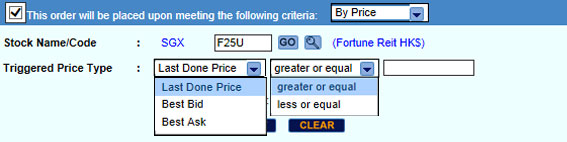

A Price order is an instruction containing a target price and quantity that will convert into an actual order in the order book once the target price is met.

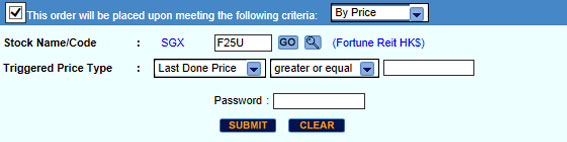

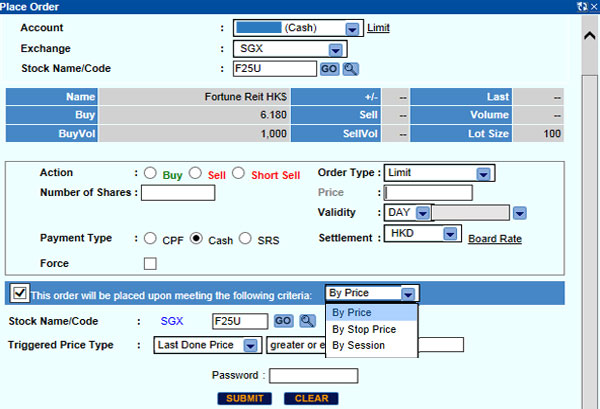

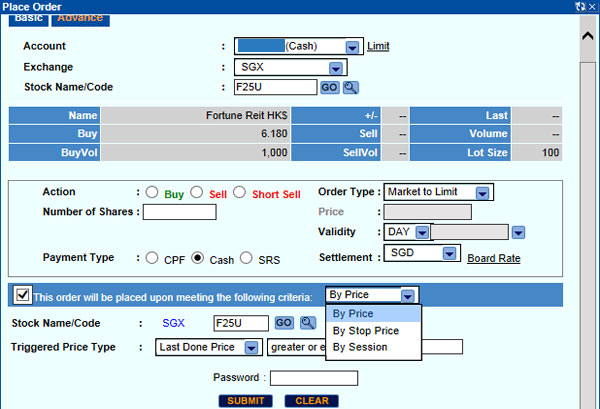

Step 1. Tick checkbox

Step 2. Select criteria: Price

Step 3. Choose triggered price type

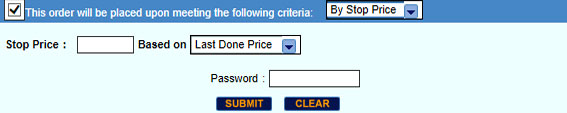

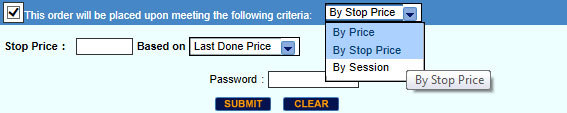

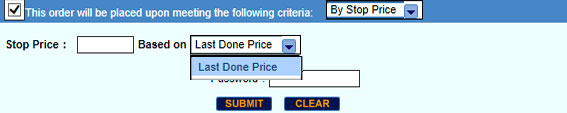

A Stop Price order is an order which will be traded at the specified price or better after a given stop price has been reached.

Step 1. Tick checkbox

Step 2. Select Stop Price

Step 3. Enter Stop Price

The default is Last done price

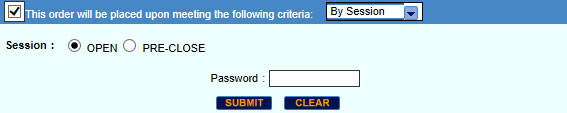

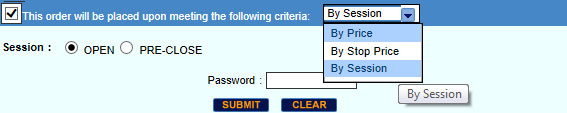

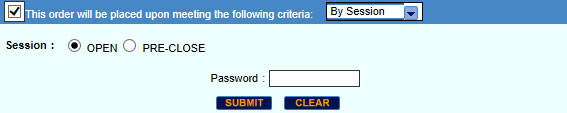

c) Session

A Session Order allows you to specify the session that you wish to trigger your order before trading session starts. It will expire at the end of trading day if it is not triggered to SGX.

SESSION STATE ORDER SESSION THAT ORDER IS TRIGGERED TIME THAT ORDER WILL BE TRIGGERED TO SGX "Open" session when Open session starts at 9:00hrs "Pre-Close" session when Pre-Close session starts at 17:00hrs or 12:00hrs for half day trading

Step 1. Tick checkbox

Step 2. Select Session

Step 3. Select open or pre-close

-

05. WHAT ARE THE RISKS INVOLVED IF I USE LONG DATED (GTD/GTM) ORDERS?

a) The order will be left on the order book for a period of time. During this period, market conditions could change and this may cause the order to become unfavourable.

a) The order will be left on the order book for a period of time. During this period, market conditions could change and this may cause the order to become unfavourable.

b) If the order is partially filled each day and brokerage is charged on each that a trade is fulfilled, the order will incur higher transaction costs.

c) If there are corporate actions in the stocks/units or if the validity of the orders expire, the long dated orders will be purged and the order status will be reflected as "Expired" in your order book.

d) As we do not have access to your CDP account, you will need to ensure that sufficient shares are available in your CDP account for your GTD/GTM cash orders. If there are insufficient shares, there is a risk of short selling if you place a GTD/GTM order.

e) As we do not have access to the shareholdings and funds available in your CPF / SRS Investment Accounts, you will need to ensure that sufficient shares and limits are available in these accounts for your GTD/GTM orders. If there are insufficient shares, there is a risk of short selling if you place a GTD / GTM orders. If you have a buy GTM/GTD order, there is the risk that the order, after fulfilled, is revoked to a cash trade due to insufficient limits/funds. -

06. WHICH ACCOUNT TYPE ARE ADVANCED ORDERS AVAILABLE FOR ONLINE TRADING?

Currently this is available for Cash, CCT, CFD and Margin accounts only. They are not available for Accounts under other bank's financing arrangement.

Currently this is available for Cash, CCT, CFD and Margin accounts only. They are not available for Accounts under other bank's financing arrangement. -

07. WHICH MARKETS CAN I PLACE ADVANCED ORDERS?

This is currently available for US and SGX Stock Market.

This is currently available for US and SGX Stock Market.

For US Advanced order FAQ, please click here -

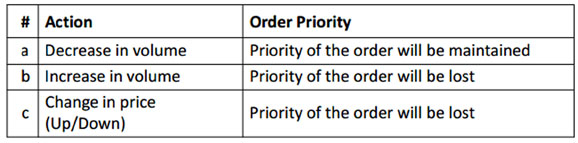

08. CAN I AMEND ADVANCED ORDERS?

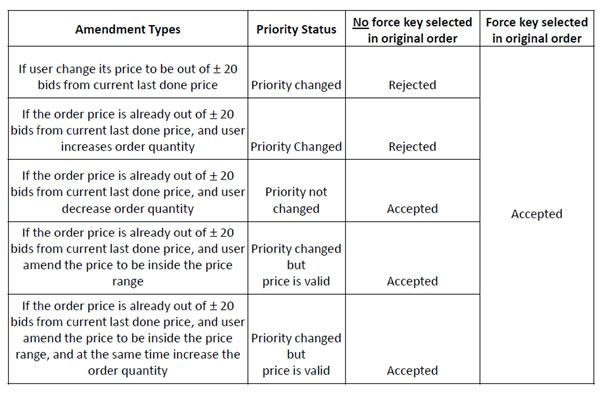

Yes, you can amend the price and quantity. However please note the conditions on the possible change of the priority of orders. The revised order price will also be checked against the force order range and if no force key was used in the original order, any order with a revised price more than 30 bids from the current last done price will be rejected by SGX.

Yes, you can amend the price and quantity. However please note the conditions on the possible change of the priority of orders. The revised order price will also be checked against the force order range and if no force key was used in the original order, any order with a revised price more than 30 bids from the current last done price will be rejected by SGX.

-

09. WHAT IS THE IMPACT OF FORCEKEY FOR ADVANCED ORDERS?

-

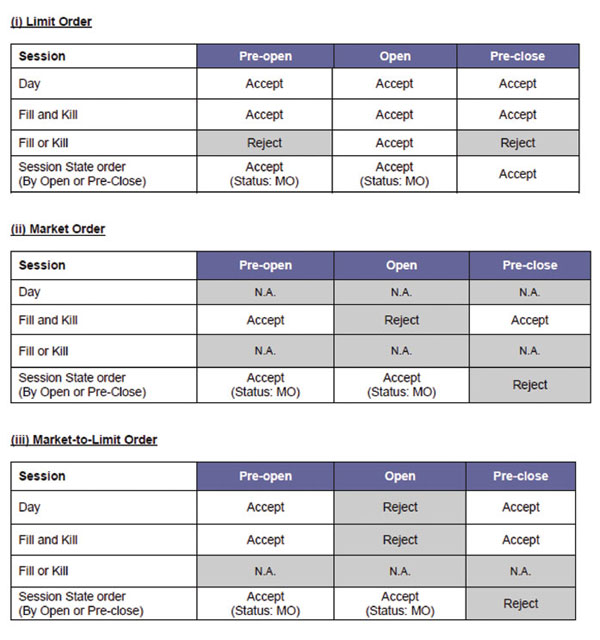

10. WHAT TYPE OF ORDER CAN I SUBMIT DURING PRE-OPEN, OPEN AND PRE-CLOSE SESSIONS?

Limit Orders

-

01. WHAT IS A LIMIT ORDER?

A limit order allows a buy or sell of a stock at a specified price or better.

A limit order allows a buy or sell of a stock at a specified price or better. -

02. HOW DOES A LIMIT ORDER WORK FOR THE DIFFERENT VALIDITY TYPES?

-

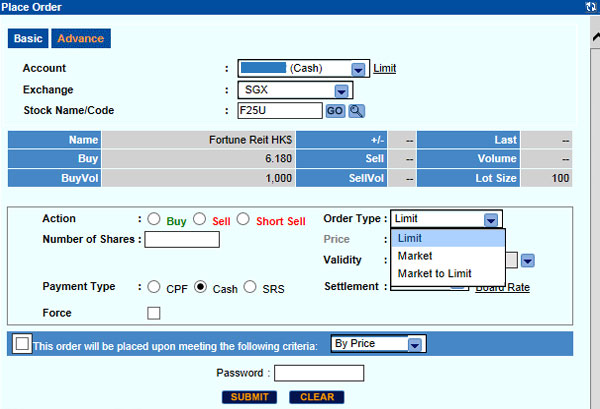

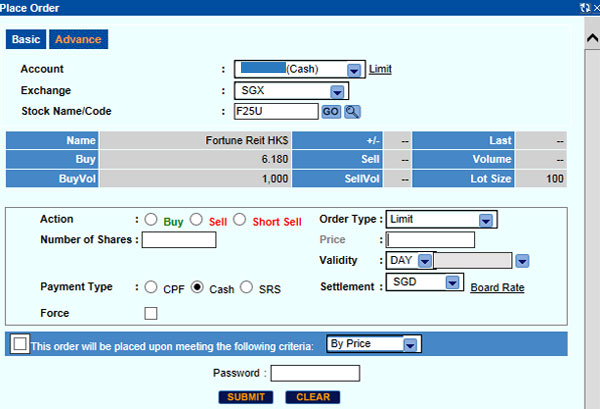

03. HOW DO I PLACE A LIMIT ORDER?

Step 1. Choose order type Limit

Step 2. Enter price

Step 3. Choose Validity

Step 4. (optional) If opting for Price Trigger Orders, please check box for Order Triggering Conditions

Market Orders

-

01. WHAT IS A MARKET ORDER?

A market order is entered with a quantity but without a price and it will be traded at the best price currently available in the market.

A market order is entered with a quantity but without a price and it will be traded at the best price currently available in the market. -

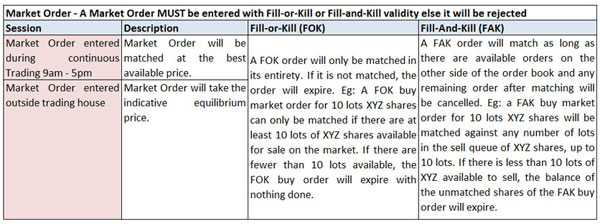

02. HOW DOES A MARKET ORDER WORK WITH THE DIFFERENT VALIDITY TYPES?

-

03. WHAT ARE THE RISKS IF I USE MARKET ORDERS?

a) There is no guarantee what price the order will be filled at. A buy order can be filled at a much higher price than intended or a sell order can be filled at a much lower price than intended.

a) There is no guarantee what price the order will be filled at. A buy order can be filled at a much higher price than intended or a sell order can be filled at a much lower price than intended.

b)Prices change quickly during a volatile market. As such the price executed may be different from the last done price before the order was entered. This is especially so for illiquid counters with a thin order book and/or wide bid-ask spread.

c)The order may be matched across multiple investors on the opposite side of the transaction and this may result in the order being done at different prices.

-

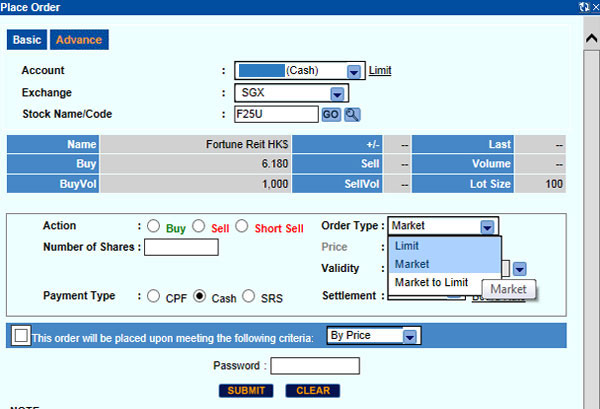

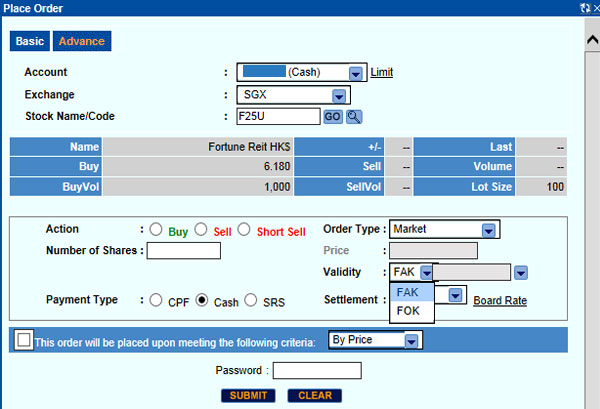

04. HOW DO I PLACE A MARKET ORDER?

Step 1. Choose order type: Market

Step 2. Select either FAK or FOK.

Step 3. (optional) If opting for Price Trigger Orders, please check box for Order Triggering Conditions

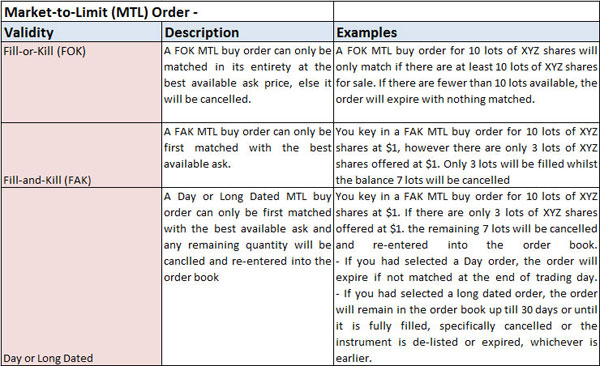

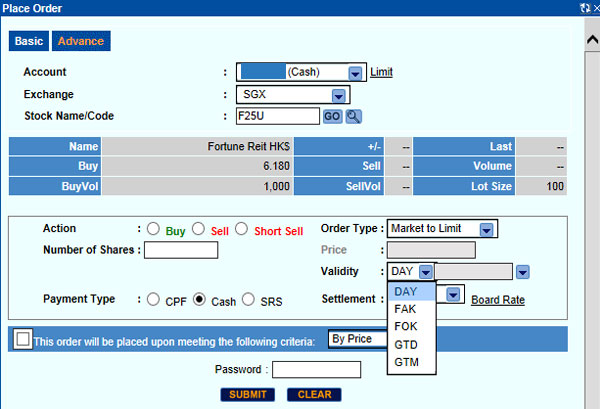

Market-To-Limit (MTL) Orders

-

01. WHAT IS A MARKET-TO-LIMIT (MTL) ORDER?

A market-to-limit (MTL) order is entered with a quantity but without a price. It will only match at the current best bid or ask price. If the order is only partially filled after matching at the current best price, the remaining quantity will be converted to a Limit Order and the last done price will be the limit price.

A market-to-limit (MTL) order is entered with a quantity but without a price. It will only match at the current best bid or ask price. If the order is only partially filled after matching at the current best price, the remaining quantity will be converted to a Limit Order and the last done price will be the limit price.

A MTL order can only be entered during Pre-Open (8.30am – 8.58am), Open and Pre-Close (5pm – 5.04pm or 12pm – 12.04pm for half day trading) sessions.

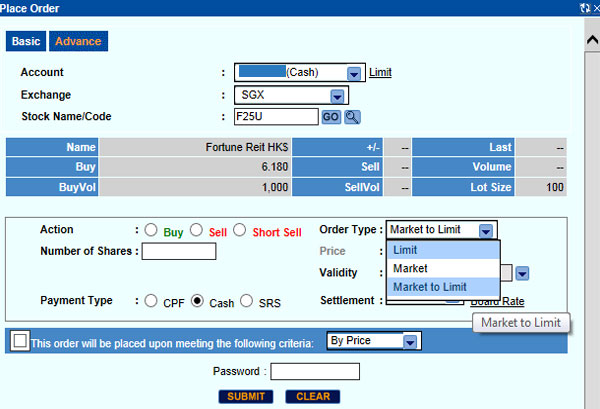

A MTL Order can be entered with a Fill-or-Kill (FOK), Fill-and-Kill (FAK), day or long dated time validity. -

02. HOW DOES A MTL ORDER WORK WITH THE DIFFERENT VALIDITY TYPES?

-

03. HOW DO I PLACE A MARKET-TO-LIMIT ORDER?

Step 1. Choose order type: Market

Step 2. Select validity

Step 3. (optional) If opting for Price Trigger Orders, please check box for Order Triggering Conditions

This advertisement has not been reviewed by the Monetary Authority of Singapore.