FAQ

- Brokerage Charges FAQ

- E-Statements and E-Contracts FAQ

- SGX Advanced Orders FAQ

- US Advanced Orders FAQ

- Contract For Difference Advanced Orders FAQ

- General FAQ

- SGX Circuit Breaker and Error Trade Policy FAQ

- 2FA FAQ

- Specified Investment Products FAQ

- Reclassification of OLIPs to EIPs FAQ

- Young Investors FAQ

- Cyber Security FAQ

CASH COLLATERALISED TRADING FAQ

-

01. What are the markets available for Cash Collateralised Trading (CCT) Account?

You can trade equities listed on the Singapore Exchange (SGX), Shanghai-Hong Kong Stock Connect (SH-HK), US Markets (NYSE, Nasdaq, AMEX), Hong Kong Exchanges and Clearing Limited (HKEX) and Bursa Malaysia (KLSE).

You can trade equities listed on the Singapore Exchange (SGX), Shanghai-Hong Kong Stock Connect (SH-HK), US Markets (NYSE, Nasdaq, AMEX), Hong Kong Exchanges and Clearing Limited (HKEX) and Bursa Malaysia (KLSE). -

02. What are the brokerage rates for Cash Collateralised Trading (CCT) Account?

SGX Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.12% 0.114% Minimum Commission S$15 S$14.25 Other Charges S$ SGX Trading Fee Contract Value x 0.0075% CDP Clearing Fee Contract Value x 0.0325% SGX Settlement Fee S$0.35 or equivalent in foreign currency per contract GST (Brokerage + SGX Trading Fee + Clearing Fee + SGX Settlement Fee) x prevailing GST rate *Subject to Changes

Standard Non-Intraday US Markets Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.3% per trade 0.285% Minimum Commission US$20 US$19 Other Charges US$ GST [Brokerage + US Trading Activity Fee (for SELL order only) + Financial Transaction Tax] x prevailing GST rate US Trading Activity Fee (for SELL order only) US$0.000195 per share (Subject to minimum US$0.01 and maximum US$9.79 per contract) (w.e.f. 1 Jan 2026) Financial Transaction Tax 0.3% (Buy orders only, applicable for French/Italian ADRs) *Subject to Changes

Additional charges:

10% gross proceeds withholding on sales of PTPs by non-US resident account holders, unless a qualified notice exception is provided by a Publicly Traded Partnerships (PTP).

Please click here to view the list of PTPs.

Standard Non-Intraday HK Market Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.25% 0.2375% Minimum Commission HK$100 HK$95 Other Charges HK$ GST [Brokerage + Stamp Duty + SFC & FRC Transaction Levy + Trading Fee + CCASS Fee + Financial Transaction Tax*] x prevailing GST rate Stamp Duty HK$1.00 per HK$1,000 SFC & FRC Transaction Levy 0.00285% Trading Fee 0.00565% (w.e.f. 1 Jan 2023) CCASS Fee 0.0042% (w.e.f. 30 June 2025) Financial Transaction Tax*

(applicable for Italian counters)(Buy Trades) Additional 0.10% on gross proceeds *Subject to Changes

Bursa Market Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.25% per trade 0.2375% Minimum Commission MYR 40 MYR 38 Other Charges MYR GST [Brokerage + Stamp Duty + Clearing Fee] x prevailing GST rate Stamp Duty MYR 1.00 per MYR 1,000 Clearing Fee 0.03% of Trade Value (Subject to a maximum of MYR 1000 per contract) Malaysia Sales and Service Tax (SST) effective 1 Oct 2025 Brokerage and clearing fees on REITS, ETFs, WARRANTS and STRUCTURED WARRANTS are subject to SST of 8% *Subject to Changes

SH-HK Stock Connect Online Brokerage Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Commission 0.25% 0.2375% Minimum Commission CNY 88 CNY 83.60 Other Charges CNY GST [Brokerage + Trading Fee + Clearing Fee + Stamp Duty + Handling Fee + Securities Management Fee + Transfer Fee] x prevailing GST rate Stamp Duty 0.05% of the consideration of a transaction on the seller (SAT) Handling Fee 0.00341% of the consideration of a transaction per side (SSE) Securities Management Fee 0.002% of the consideration of the transaction per side (CSRC) Transfer Fee (i) 0.001% of the consideration of the transaction per side (ChinaClear)

(ii) 0.002% of the consideration of the transaction per side (HKSCC)*Subject to Changes

You are also eligible to earn Reward Points for brokerage paid to LTS for online trades made under CCT account. Click here for more information on our Rewards Programme.

-

03. Is there any interest paid on the cash placed in my trust account?

Interest payable for funds in your trust account is based on LTS' prevailing rates and is calculated on a daily rest basis. Current interest rates as follow:CurrencyRate (W.E.F. 1 Mar 2026)SGD0.38% p.a.MYR1.00% p.aHKD0.25% p.a.USD1.00% p.a.

Interest payable for funds in your trust account is based on LTS' prevailing rates and is calculated on a daily rest basis. Current interest rates as follow:CurrencyRate (W.E.F. 1 Mar 2026)SGD0.38% p.a.MYR1.00% p.aHKD0.25% p.a.USD1.00% p.a.

-

04. I have a Cash account with LTS. Can I open a CCT account?

Yes, you may open a CCT account in addition to your existing Cash account. Please note that shares purchased through the CCT account will be custodised in LTS Sub-account and/or LTS Foreign custody account while shares purchased through the Cash account are custodised in your individual global securities account with CDP.

Yes, you may open a CCT account in addition to your existing Cash account. Please note that shares purchased through the CCT account will be custodised in LTS Sub-account and/or LTS Foreign custody account while shares purchased through the Cash account are custodised in your individual global securities account with CDP. SGX:

SGX:

Anyone who is 18 years old and above. SH-HK:

SH-HK:

Anyone who is 21 years old and above are allowed to trade eligible SSE securities through SH-HK. US & HKEX:

US & HKEX:

Anyone who is above 21 years old and with no record of delinquency. BURSA:

BURSA:

Anyone who is 21 years old and above are allowed to trade eligible Bursa securities through Bursa Market. -

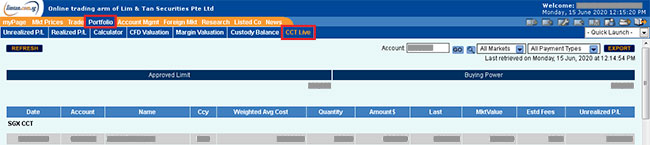

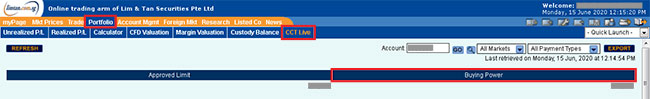

05. What is CCT Live?

CCT Live is a live version of the unrealised portfolio of the CCT account. It also displays the current buying power as well as the approved limit of the CCT account.

CCT Live is a live version of the unrealised portfolio of the CCT account. It also displays the current buying power as well as the approved limit of the CCT account.

-

06. What is the buying power and how does it determine my trading limits?

The buying power automatically calculates the amount of trading that can be done for a CCT account.

The buying power automatically calculates the amount of trading that can be done for a CCT account.This is based on the opening balance of cash in the trust accounts and automatically deducts for any buy order that has been placed and reinstates for any sell orders that has been fulfilled.

If any placed orders are withdrawn within the trading day, the approved balance for that order (based on Price X Quantity of that order) will be automatically reinstated.

-

07. Why is there a trading limit on top of Approved Balance?

A trading limit is assigned to the CCT account for purpose of managing the maximum risk for the account. The amount of orders that can be placed will still be based on the Approved Balance.

A trading limit is assigned to the CCT account for purpose of managing the maximum risk for the account. The amount of orders that can be placed will still be based on the Approved Balance. -

08. Can I open a CCT account without opening a Cash account with LTS?

Yes. However, you are encouraged to open a Cash account in addition to the CCT account. Please note that shares purchased through CCT account are custodised in LTS Sub-account and/or LTS Foreign custody account while shares purchased through the Cash account are custodised in your individual global securities account with CDP.

Yes. However, you are encouraged to open a Cash account in addition to the CCT account. Please note that shares purchased through CCT account are custodised in LTS Sub-account and/or LTS Foreign custody account while shares purchased through the Cash account are custodised in your individual global securities account with CDP.A CCT account can also be opened by Joint Account holders.

-

09. How do I make payment for my purchases and how will the sales proceeds be paid to me?

SGX:

SGX:

Payment for your purchases will be deducted from the funds in your trust account on Due Date +1 (D+1). Similarly, sales proceeds will be credited to your trust account on D+1. SH-HK:

SH-HK:

Payment for your purchases will be deducted from the funds in your trust account on Trade Date +1 (T+1). Foreign exchange at our prevailing board rates will be used in the event that there is insufficient funds in your trust account of the specified settlement currency.Sales proceeds will be credited to your trust account on T+1.

US:

US:

Payment for your purchases will be deducted from the funds in your trust account on Trade Date +2 (T+2). Foreign exchange at our prevailing board rates will be used in the event that there is insufficient funds in your trust account of the specified settlement currency.If your sales proceed is in S$, we will credit your bank account if you have opt for the GIRO/ EPS facility. Otherwise a cheque payment will be made in your name.

If your sales proceed is in US $, a cheque payment will be made in your name.

HKEX:

HKEX:

Payment for your purchases will be deducted from the funds in your trust account on Trade Date +2 (T+2). Foreign exchange at our prevailing board rates will be used in the event that there is insufficient funds in your trust account of the specified settlement currency.As your sales proceed is in S$, we will credit your bank account if you have opted for GIRO/ EPS facility. Otherwise a cheque payment will be made in your name.

BURSA:

BURSA:

Payment for your purchases will be deducted from the funds in your trust account on Trade Date +2 (T+2). Foreign exchange at our prevailing board rates will be used in the event that there is insufficient funds in your trust account of the specified settlement currency.Sales proceeds will be credited to your trust account on T+1.

-

10. Is contra allowed?

Contra is allowed for SGX trades only.

Contra is allowed for SGX trades only. -

11. Can I use CPF/SRS funds to trade in a CCT account?

No. If you would like to trade using your CPF/SRS funds, you need to open a Cash account with LTS. Different brokerage rates will apply.

No. If you would like to trade using your CPF/SRS funds, you need to open a Cash account with LTS. Different brokerage rates will apply. -

12. Will my purchases be custodised with LTS?

SGX:

SGX:

Shares purchased shall be custodised in LTS' Sub-account. Only custodised shares may be sold in the account. There is no charge for maintaining the Sub-account. SH-HK, US, HKEX & BURSA:

SH-HK, US, HKEX & BURSA:

Shares purchased shall be custodised in LTS' Foreign custody account. Only custodised shares may be sold in the account. Foreign custody fees will be waived. -

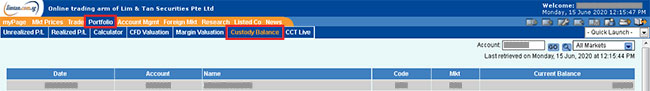

13. Where can I view the shares custodised in my CCT account?

To view the shares custodised in your CCT account, click on "Portfolio" on the navigation menu and click on "Custody Balance".

To view the shares custodised in your CCT account, click on "Portfolio" on the navigation menu and click on "Custody Balance".

-

14. Am I still entitled to dividends, rights and bonus on my CCT account shareholdings?

Yes, you will be informed of the details of the corporate actions by mail and any rights shares or scrip dividends will be credited to LTS's Sub-account and/or LTS Foreign custody account.

Yes, you will be informed of the details of the corporate actions by mail and any rights shares or scrip dividends will be credited to LTS's Sub-account and/or LTS Foreign custody account.Cash dividends will be credited to your trust account.

-

15. My shares are held in my global securities account (GSA) with CDP. Can I sell these shares through the CCT account?

No, transfer of shares from your GSA with CDP to LTS' Sub-account is not allowed.

No, transfer of shares from your GSA with CDP to LTS' Sub-account is not allowed. -

16. How do I withdraw funds from my CCT account?

To withdraw funds from your CCT account, click on "Account Mgmt" on the navigation menu and click on "CCT Withdrawal".

To withdraw funds from your CCT account, click on "Account Mgmt" on the navigation menu and click on "CCT Withdrawal".Please click here for a step by step CCT withdrawal guide.

-

17. What are the SGX and US Advanced Orders?

This advertisement has not been reviewed by the Monetary Authority of Singapore.