FAQ

- Brokerage Charges FAQ

- E-Statements and E-Contracts FAQ

- SGX Advanced Orders FAQ

- US Advanced Orders FAQ

- Contract For Difference Advanced Orders FAQ

- General FAQ

- SGX Circuit Breaker and Error Trade Policy FAQ

- 2FA FAQ

- Specified Investment Products FAQ

- Reclassification of OLIPs to EIPs FAQ

- Young Investors FAQ

- Cyber Security FAQ

GENERAL FAQ

Opening An Account With limtan.com.sg

-

01. What is limtan.com.sg?

It is an online share trading system specially designed to give investors total control over their investment decisions. Investors can place their orders and make account enquiries at their own convenience, at any time and from any location. Investors can access the same limtan.com.sg Online Trading account using the Internet.

It is an online share trading system specially designed to give investors total control over their investment decisions. Investors can place their orders and make account enquiries at their own convenience, at any time and from any location. Investors can access the same limtan.com.sg Online Trading account using the Internet. -

02. What are the brokerage charges?

Online Trading Rates

Online Trading Rates Contract Size Rates* Effective Rates* (Less 5% Mileage) Minimum $25 $23.75 Up to $50,000 0.28% 0.266% > $50,000 - $100,000 0.22% 0.209% > $100,000 0.18% 0.171% * Subject to Changes

Advisory Trading Rates

Contract Size Rates* Minimum S$40 Up to $50,000 0.50% > $50,000 - $100,000 0.40% > $100,000 0.25% * Subject to Changes

Shares traded on SGX under Clob International

Contract Size Rates* Settlement in AUD Settlement in HKD Settlement in USD Up to AUD50k Up to HKD200k Up to USD25k 0.28% >AUD50K to AUD100K >HKD200K to HKD400K >USD25K to USD50K 0.22% >AUD100K >HKD400K >USD50K 0.18%; Minimum Brokerage AUD25 HKD100 USD12.50 * Subject to Changes

Additional charges:

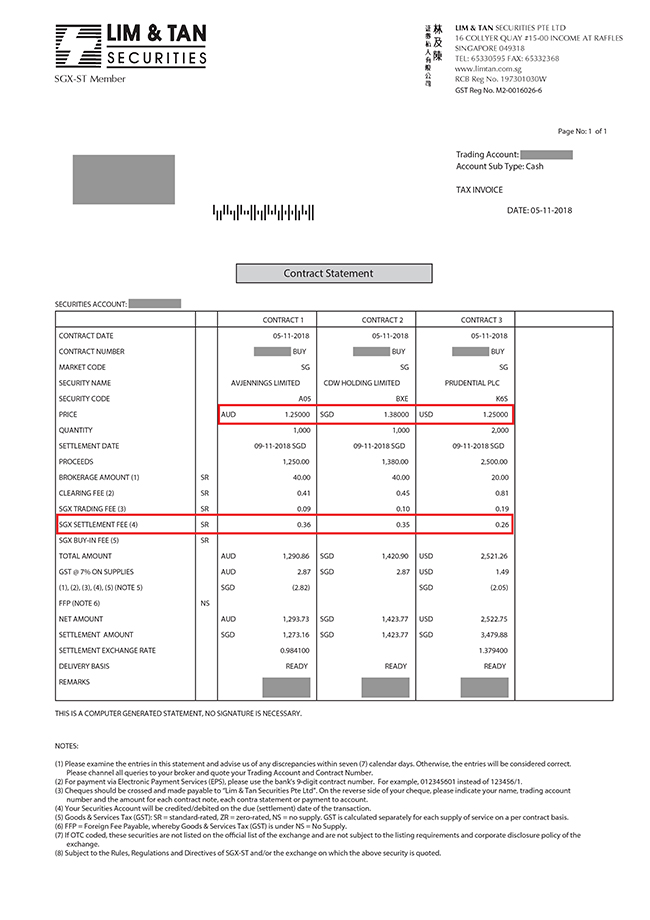

SGX Trading Fee1 (Contract Value x 0.0075%)

1except for Structured Warrants which will be at 0.001% of trade value.

CDP Clearing Fee2 (Contract Value x 0.0325%)

SGX Settlement Fee (S$0.35 or equivalent in foreign currency per contract)

GST ((Brokerage + SGX Trading Fee + Clearing Fee + SGX Settlement Fee) x prevailing GST rate)

2except for Structured Warrants which will be at 0.004% of the contract value with no cap.SGX will waive Clearing Fees for all Exchange Traded Funds (ETFs) traded on SGX from 1 June - 31 December 2015

Please click here to download a copy of the Schedule of Charges.

-

03. What is the securities clearing fee?

Securities Clearing Fee

Securities Clearing Fee The Securities Clearing Fee is at 0.0325% of the contract value subject to a maximum of S$600. Fee structure is applicable to all trades (except futures, options and structured warrants) done on / after 12 February 2010.

For non-S$ contracts, the equivalent maximum clearing fee cap shall be as follows:

Settlement Currency Clearing Fee* @ 0.0325%, subject to a maximum of Australia Dollar (AUD) AUD 470.00 British Pound (GBP) GBP 265.00 Canadian Dollar (CAD) CAD 455.00 Euro (EUR) EUR 294.00 Hong Kong Dollar (HKD) HKD 3,342.00 United States Dollar (USD) USD 431.00 Japanese Yen (YEN) YEN 38,363.00 * Subject to Changes

-

04. What is the SGX Settlement Fee?

With effect from 1 December 2018, SGX will be imposing a settlement fee of S$0.35 or equivalent in foreign currency per contract.

With effect from 1 December 2018, SGX will be imposing a settlement fee of S$0.35 or equivalent in foreign currency per contract.

-

05. Who can I call if I need help?

Our Online Helpdesk (Tel: +65 6799 8188) is open from 8.30 am to 5.45 pm, Monday to Friday, to answer any questions you may have. Alternatively, you can fax us at +65 6538 7730 or email us here.

Our Online Helpdesk (Tel: +65 6799 8188) is open from 8.30 am to 5.45 pm, Monday to Friday, to answer any questions you may have. Alternatively, you can fax us at +65 6538 7730 or email us here. -

06. Who can open a limtan.com.sg online trading account?

Anyone who is above 21 years old and with no record of delinquency can open a limtan.com.sg online trading account.

Anyone who is above 21 years old and with no record of delinquency can open a limtan.com.sg online trading account. -

07. How does an existing client open a new online trading account?

Log in to your online trading account with your existing Online Trading Login ID and Password via "LIM & TAN TRADING LOGIN" button on limtan.com.sg - go to "Open New Account" under "Account Mgmt".

Log in to your online trading account with your existing Online Trading Login ID and Password via "LIM & TAN TRADING LOGIN" button on limtan.com.sg - go to "Open New Account" under "Account Mgmt".

You will be directed to an Electronic Account Opening Form. For more information on how to fill up the form, you may refer to our User Guide HERE.

-

08. How will I get my Login ID and Password?

For Individual accounts: All new accounts will receive the Login ID via email upon successful account creation.

All new accounts will receive the Login ID via email upon successful account creation.

- Where a valid email address and Mobile number have been provided in the Account Opening form, you can request for a new password via the Electronic Password issuance process on our website. Please refer to General FAQ - Electronic Password for more details.

- If a valid email address and/or Mobile number has not been provided, you will receive your password in a physical Pin Mailer sent by post.

For Joint and Corporate accounts:

- You will receive your password in a physical Pin Mailer sent by post.

-

09. How can I update my mailing address?

Complete CDP's Update of Particulars Form and attach any one of the following documents in (a) to (c) that contains the new mailing address and mail it to us.

Complete CDP's Update of Particulars Form and attach any one of the following documents in (a) to (c) that contains the new mailing address and mail it to us.(a) Singapore NRIC or Malaysian IC; or

(b) Passport; or

(c) Statement dated within last 3 months from Government body (e.g. CPF/IRAS)Note: The above is also required for update of Residential Address if Residential Address is the same as Mailing Address.

Lim & Tan Securities Pte Ltd

16 Collyer Quay

#15-00

Collyer Quay Centre

Singapore 049318Alternatively, you may login to your CDP Internet Service account, select "View Details" under the "Portfolio" tab, click "Update" to make the changes.

-

10. How to update my email address and contact number?

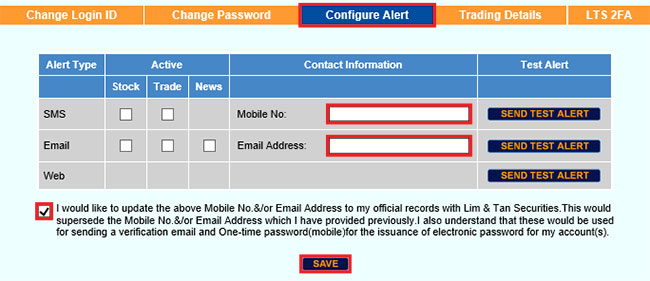

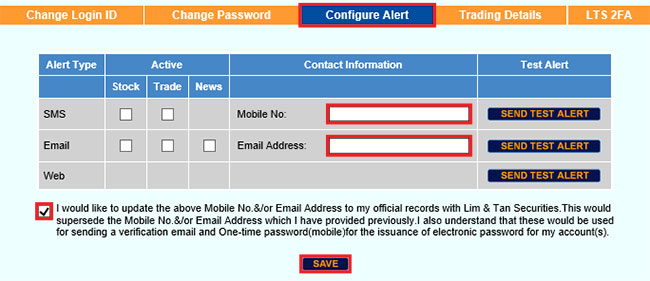

Log in to your trading account, select "Personal Configurations", "Configure Alert" and update the email address and mobile number. Checked on the box "I would like to update the above Mobile No. &/or Email Address to my official records with Lim & Tan Securities..." and click "Save".

Log in to your trading account, select "Personal Configurations", "Configure Alert" and update the email address and mobile number. Checked on the box "I would like to update the above Mobile No. &/or Email Address to my official records with Lim & Tan Securities..." and click "Save".

If you do not have an Online trading account, kindly complete the "Update of Particulars" form and mail the completed form to:

Lim & Tan Securities Pte Ltd

16 Collyer Quay

#15-00

Collyer Quay Centre

Singapore 049318 -

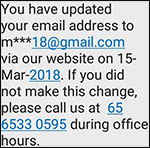

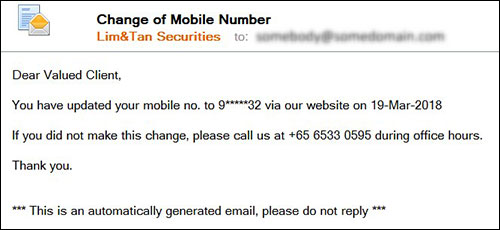

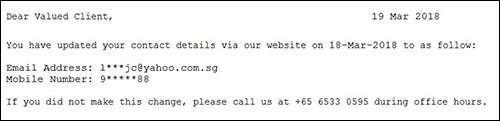

11. Will I get any notification when I update my email address and/or mobile number?

Customer who Add/Change/

RemoveChanges done Customer will receive Email Address Previous day a) A SMS on the next day OR

b) A pin mailer within 3 working days (if no records of email address)Sample SMS notification sent to customer:

Mobile Number Previous day a) An email notification on the next day OR

b) A pin mailer within 3 working days (if no records of mobile number)Sample email notification sent to customer:

Both Email and Mobile Previous day A pin mailer within 3 working days Sample pin mailer notification sent to customer:

-

12. What would I have to pay to open a limtan.com.sg online trading account?

Opening an online trading account with limtan.com.sg is FREE.

Opening an online trading account with limtan.com.sg is FREE. -

13. What is the Initial Deposit required?

Waiver of deposit is subject to Management's approval.

Waiver of deposit is subject to Management's approval.Foreigners will need to place a 50% collateral. For instance, a collateral of $1,000 will allow the foreign investor a trading limit of $2,000. Notwithstanding the deposit, the trading limit is still subject to Management's approval.

-

14. What are the payment modes available?

We accept payment via: Cheque Please make cheque payable to 'Lim & Tan Securities Pte Ltd' EPS For payments to Lim & Tan Securities, you can use Electronic Payment for Shares service (EPS) available at ATMs or through the banks' Internet Banking website. Payment due to you will be credited directly into your bank account. Available at: DBS/POSB, OCBC, UOB, Citibank, Maybank

Download Application FormGIRO Outgoing payments and incoming funds are automatically directed to your bank account. Please ensure you have enough funds on the Due Date of the contract.

Available banks: DBS/POSB, OCBC, UOB

Please refer to General FAQ - GIRO for more details.Bill Payments Bills Payment service is only for payments and available on the Internet Banking services with selected banks. Available banks: DBS/POSB, Maybank, OCBC, Standard Chartered, UOB. PayNow PayNow service is only for payments in SGD and available on the Internet Banking services with selected banks. Available banks: Bank of China, Citibank Singapore Limited, DBS Bank/POSB, HSBC, Industrial and Commercial Bank of China Limited, Maybank, OCBC Bank, Standard Chartered Bank and UOB.

GIRO

-

01. How can I opt for this service?

This service is only available to clients with either DBS/POSB/OCBC/UOB account.

This service is only available to clients with either DBS/POSB/OCBC/UOB account.With effect from 9 November 2020, clients with either DBS/POSB account will be able to apply for e-GIRO service online. Please refer to Qn 7 below for step by step guide.

-

02. Which account type are available for GIRO service?

GIRO service is available for Cash Trading accounts only.

GIRO service is available for Cash Trading accounts only. -

03. Can I have both EPS and GIRO?

No, you can only opt for one service. If you opt for GIRO, we will have to deactivate your EPS linkage before the GIRO can be activated.

No, you can only opt for one service. If you opt for GIRO, we will have to deactivate your EPS linkage before the GIRO can be activated. -

04. How long does it take for the GIRO application to be activated?

Your GIRO service via physical form will only be activated approximately two to three weeks after you have submitted your application. DBS/POSB e-GIRO service online will be activated two working days from date of application. We will inform you in writing once the application has been approved by the bank.

Your GIRO service via physical form will only be activated approximately two to three weeks after you have submitted your application. DBS/POSB e-GIRO service online will be activated two working days from date of application. We will inform you in writing once the application has been approved by the bank. -

05. How do I make payment in the meantime?

Prior to the activation of the GIRO facility, you can make payment by cheque or by Bill Payment service via Internet Banking with selected banks.

Prior to the activation of the GIRO facility, you can make payment by cheque or by Bill Payment service via Internet Banking with selected banks. -

06. How do I obtain the GIRO deduction form?

For client who do not want to apply e-GIRO for DBS/POSB i.e. non e-GIRO for DBS/POSB, OCBC and UOB, please download the form here.

For client who do not want to apply e-GIRO for DBS/POSB i.e. non e-GIRO for DBS/POSB, OCBC and UOB, please download the form here.Alternatively, you can request for the form through your Trading Representative or call our Online Trading Helpdesk at +65 6799 8188 if you have an online trading account.

The form will then have to be completed and mailed back to Lim & Tan Securities Pte Ltd.

The mailing address is as follows:

Lim & Tan Securities Pte Ltd

16 Collyer Quay

#15-00

Collyer Quay Centre

Singapore 049318

Attention: _______________ (Please indicate the name of your Trading Representative or the Online Department) -

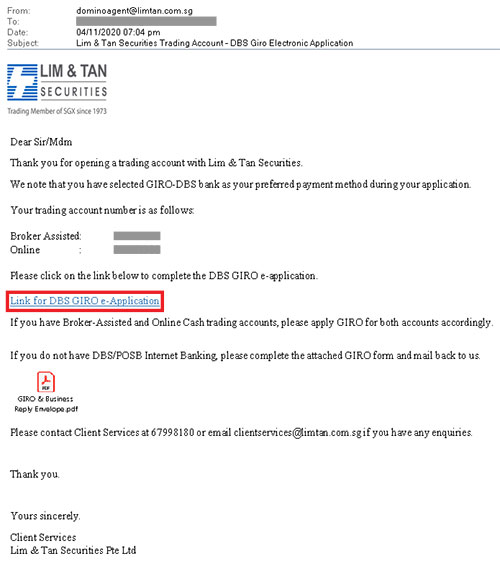

07. How do I apply e-GIRO service online for DBS/POSB?

For New Lim & Tan Securities clients who have selected GIRO-DBS bank as the preferred payment method during the account application:

For New Lim & Tan Securities clients who have selected GIRO-DBS bank as the preferred payment method during the account application:

You will receive an email with instruction on how to apply GIRO online when your account is approved.Sample email sent to client:

Upon clicking on "Link for DBS GIRO e-Application", please refer to Step 2 and 3 below.

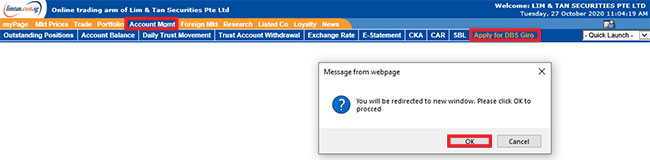

For Existing Lim & Tan Securities clients:

1. Select "Account Mgmt" followed by "Apply for DBS Giro". Upon clicking on "Apply for DBS Giro", a prompt screen will appear. Please click "OK" to proceed.

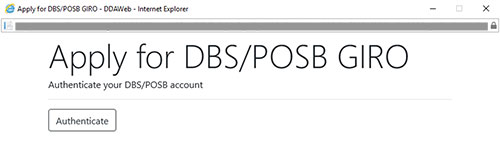

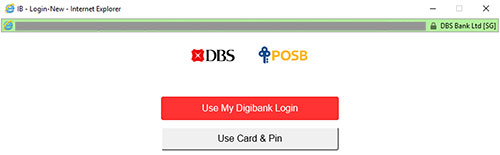

2. Select either "Use My Digibank Login" or "Use Card & Pin" to login to your bank account.

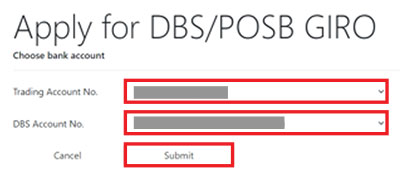

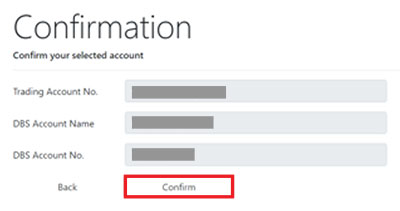

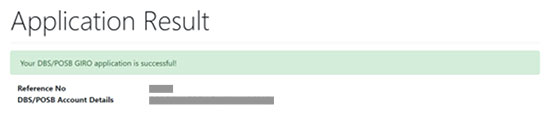

3. Select the Trading Account No. and DBS Account No. and click "Submit". Upon confirmation, click on "Confirm".

-

08. When will the bank deduct my account for my purchases?

The bank will deduct the funds in the morning of the second trading day after due date (D+2 market days). You must ensure that there are sufficient funds in your account for the GIRO deductions.

The bank will deduct the funds in the morning of the second trading day after due date (D+2 market days). You must ensure that there are sufficient funds in your account for the GIRO deductions. -

09. What happens if there are insufficient funds in my bank account for the GIRO deduction?

If there are insufficient funds in your bank account, the GIRO deduction will fail, i.e. no funds will be deducted from your bank account for onward payment to Lim & Tan Securities. The bank will not be able to make partial payment.

If there are insufficient funds in your bank account, the GIRO deduction will fail, i.e. no funds will be deducted from your bank account for onward payment to Lim & Tan Securities. The bank will not be able to make partial payment. -

10. When will I receive my sales proceeds?

The bank will credit the funds into your bank account one day after due date (D+1 market day).

The bank will credit the funds into your bank account one day after due date (D+1 market day). -

11. Can I do contra?

Yes, contra will be allowed up till due date, i.e. trade date +2 market days.

Yes, contra will be allowed up till due date, i.e. trade date +2 market days. -

12. When will I receive or be deducted for my contra gains?

The bank will credit/deduct the funds two days after contra date for contra gains and losses respectively.

The bank will credit/deduct the funds two days after contra date for contra gains and losses respectively.

PayNow

-

01. What is PayNow?

PayNow is a fund transfer service that enable retail customers of participating banks to send and receive Singapore Dollars funds from one bank to another using their mobile number / Singapore NRIC / Unique Entity Number (UEN) / Unique QR Code.

PayNow is a fund transfer service that enable retail customers of participating banks to send and receive Singapore Dollars funds from one bank to another using their mobile number / Singapore NRIC / Unique Entity Number (UEN) / Unique QR Code.The nine participating banks in Singapore - Bank of China, Citibank Singapore Limited, DBS Bank/POSB, HSBC, Industrial and Commercial Bank of China Limited, Maybank, OCBC Bank, Standard Chartered Bank and UOB.

-

02. How do I make payment using PayNow?

PayNow through UEN:

PayNow through UEN:

1. Log in to your bank's existing internet banking or mobile banking app. Click on "PayNow".

2. At the PayNow transfer screen, select "Unique Entity Number (UEN)".

3. Enter Lim & Tan Securities' UEN "197301030W".

4. Enter the amount to be transferred and Customer Reference/Reference number i.e. your 7-digit Trading Account number (E.g. 0012345).

5. Verify that the Payee/Entity Name is correct. i.e. "LIM & TAN SECURITIES PTE LTD - TRUST A/C" before confirming the transfer.PayNow through SGQR:

1. Log in to your bank's existing mobile banking app. Click on "Scan & Pay" or "QR Pay".

2. Scan the QR code using your bank's app.

3. Enter the amount to be transferred and Customer Reference/Reference number i.e. your 7-digit Trading Account number (E.g. 0012345).

4. Verify that the Payee/Entity Name is correct. i.e. "LIM & TAN SECURITIES PTE LTD - TRUST A/C" before confirming the transfer. -

03. Are there any limits to the amount I can pay via PayNow?

For payment via PayNow through UEN, the maximum transfer limit is S$200,000 per transaction, similar to FAST transfer. However, the transfer limit for PayNow is subject to the transfer policies of the respective banks and/or also the transfer limits that you have set for your account.

For payment via PayNow through UEN, the maximum transfer limit is S$200,000 per transaction, similar to FAST transfer. However, the transfer limit for PayNow is subject to the transfer policies of the respective banks and/or also the transfer limits that you have set for your account.Please check with your bank if you are unable to pay the selected amount via PayNow.

For payment via PayNow through SGQR, the maximum transfer limit is S$200,000 per transaction for most banks or up to the pre-set daily limit whichever is lower.

For payment more than S$1,000, 2FA is required by all banks.

Electronic Password

-

01. If I am a new client, how will I get my password?

For Individual accounts:

For Individual accounts:

- Where a valid email address and Mobile number have been provided in the Account Opening form, you can request for a new password via the Electronic Password issuance process on our website. Please refer to Qn 4 below for step by step guide.

- If a valid email address and/or Mobile number has not been provided, you will receive your password in a physical Pin Mailer sent by post.

For Joint and Corporate accounts:

- You will receive your password in a physical Pin Mailer sent by post.

-

02. What should I do if I have forgotten my Password?

If you have forgotten your Password, here are the ways to request for a new one:

If you have forgotten your Password, here are the ways to request for a new one:

1. For Individual Account with valid email and Mobile number on record with LTS

Electronic Password issuance: Please click here to request for a new one. A verification email and SMS will be sent to your email address and Mobile number in our records. Click on the link provided in the email for verification.

Upon successful verification, your new password will be sent to your Mobile number. Please refer to Qn 4 below for step by step guide.

If you have an Individual Account and are not sure if you have a valid email and Mobile number on record with LTS, please check with your Trading Representative or the Online Trading Helpdesk.

2. For Joint/Corporate Account or Individual Account with no email address and/or Mobile number

Post: Please click here to request for a new one. Your old password will be permanently disabled and the new password will be mailed to your mailing address in our records within 2 - 3 working days.

Please note that the Electronic Password will not be eligible for clients who do not have a valid email address or Mobile number. All other types of account holders (e.g. Joint or Corporate account holders) will also not be eligible for the Electronic Password.

-

03. Are there accounts which are not eligible for this service?

Yes. Joint and Corporate accounts will not be eligible for this service. For new clients, you will receive your password in a physical Pin Mailer sent by post.

Yes. Joint and Corporate accounts will not be eligible for this service. For new clients, you will receive your password in a physical Pin Mailer sent by post.For existing Joint and Corporate accounts which require a reissuance of password, please click here to request. The reissued password will be sent via post.

-

04. How do I request for a new password?

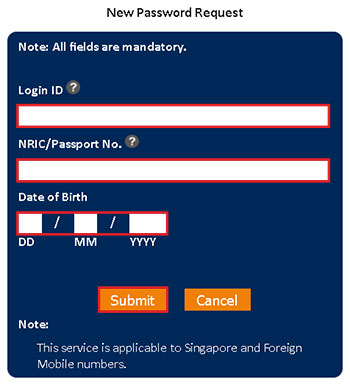

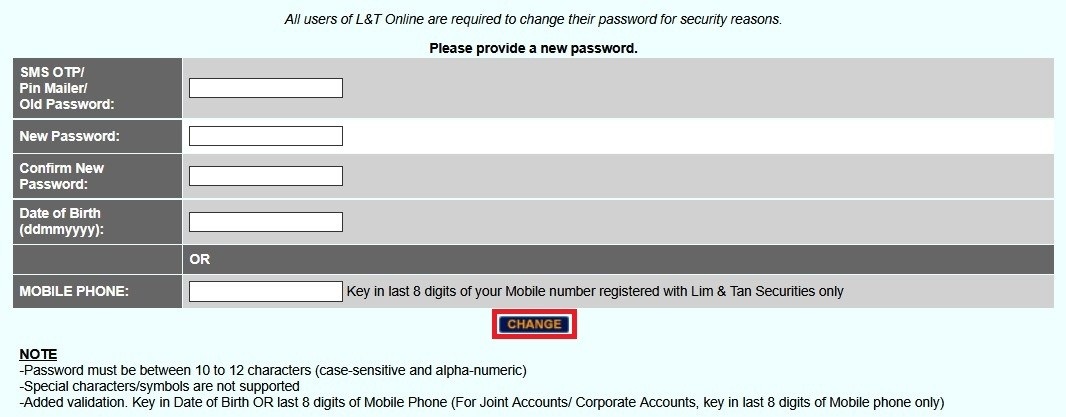

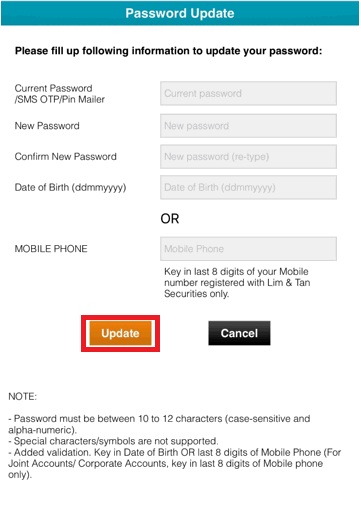

To request for a new password, click "Request for Electronic Password" on the top right hand corner.

To request for a new password, click "Request for Electronic Password" on the top right hand corner.

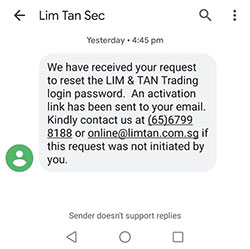

Enter your Login ID, NRIC/Passport No., Date of Birth and select "Submit". A verification email and SMS will be sent to your email address and Mobile number in our records. (If you do not have a valid email address or Mobile number, please click here to request for a new password via post.)

Once submission has been received, you will receive the following pop-up message

and SMS message.

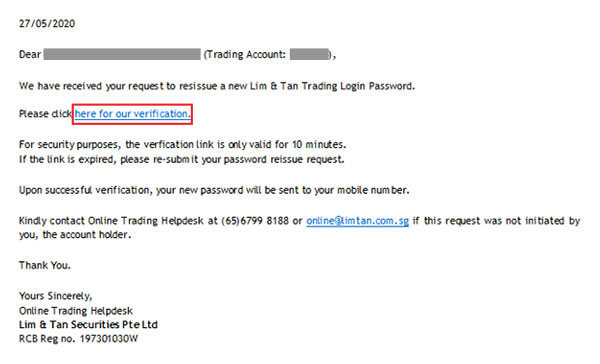

Please check your email, and click on the link provided in the email for verification. For security purposes, the verification link is only valid for 10 minutes. If the link is expired, please re-submit your Request for Electronic Password.

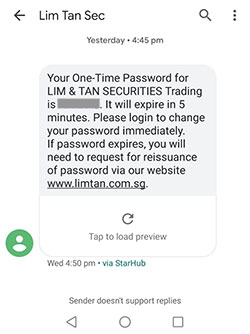

Upon successful verification, your new one-time password will be sent to your Mobile number. The new password will expire in 5 minutes. For security purposes, you will be required to change your password after your successful login.

-

05. What should I do if I did not receive the verification email or SMS after several attempts?

Please contact your Trading Representative or our Online Trading Helpdesk at +65 6799 8188 to check that your email address or Mobile number registered with Lim & Tan Securities is up to date.

Please contact your Trading Representative or our Online Trading Helpdesk at +65 6799 8188 to check that your email address or Mobile number registered with Lim & Tan Securities is up to date.Alternatively, you may request for a new password via post by clicking here.

-

06. I have not registered my mobile number with LTS. Am I eligible for this service?

No. You will not be eligible for this service if you have not registered your mobile number with Lim & Tan Securities (LTS).

No. You will not be eligible for this service if you have not registered your mobile number with Lim & Tan Securities (LTS).However, you may request for a new password via post by clicking here.

-

07. If I have an individual account but need to update my email address and/or mobile number, how can I do this?

You can update your email address and/or mobile number under "Personal Configurations" icon on the trading platform.

You can update your email address and/or mobile number under "Personal Configurations" icon on the trading platform.

-

08. Can I use the Request for Electronic Password service to request for a new password if my account is disabled due to multiple failed login attempts?

Yes, you may request for a new password if your account is disabled.

Yes, you may request for a new password if your account is disabled. -

09. Is there a validity period for the verification email link or One-Time Password before it expires?

For security purposes, the verification link and one-time password is only valid for 10 and 5 minutes respectively. If the link or one-time password is expired, please re-submit your Request for Electronic Password by clicking here.

For security purposes, the verification link and one-time password is only valid for 10 and 5 minutes respectively. If the link or one-time password is expired, please re-submit your Request for Electronic Password by clicking here. -

10. What shall I do if my account is disabled due to multiple failed attempts when trying to change my password?

Please click here to submit your Password Reactivation request or contact our Online Trading Helpdesk at +65 6799 8188 for assistance if you have reached the maximum number of attempts at submitting a valid One-Time Password (OTP).

Please click here to submit your Password Reactivation request or contact our Online Trading Helpdesk at +65 6799 8188 for assistance if you have reached the maximum number of attempts at submitting a valid One-Time Password (OTP).

This advertisement has not been reviewed by the Monetary Authority of Singapore.