FAQ

- Brokerage Charges FAQ

- E-Statements and E-Contracts FAQ

- SGX Advanced Orders FAQ

- US Advanced Orders FAQ

- Contract For Difference Advanced Orders FAQ

- General FAQ

- SGX Circuit Breaker and Error Trade Policy FAQ

- 2FA FAQ

- Specified Investment Products FAQ

- Reclassification of OLIPs to EIPs FAQ

- Young Investors FAQ

- Cyber Security FAQ

Bursa Malaysia FAQ

Account Related

-

01. Are there any processing fees required to open the a KLSE Online trading account?

There is no processing fee for opening a KLSE Online trading account.

There is no processing fee for opening a KLSE Online trading account. -

02. Do I need to first login to LTS Online Trading platform before trading Bursa Malaysia?

No. You can login to trade Bursa Malaysia by clicking on the red login button at the top of our home page.

No. You can login to trade Bursa Malaysia by clicking on the red login button at the top of our home page.

-

03. Can I use my limtan Login ID and Password to access and trade in KLSE?

You will be given a separate User ID and Password.

You will be given a separate User ID and Password.However, please note that access to KLSE is subject to further permissioning and / or documentation. Please contact your Trading Representatives or Online Trading Helpdesk for more information.

-

04. Can I make changes to my KLSE Password and Pin?

Yes. You are required to change the Password and PIN the first time you login to KLSE.

Yes. You are required to change the Password and PIN the first time you login to KLSE.If you would like to change your Password or PIN, you may do so by clicking on "My Profile" on Bursa Website upon login.

-

05. What should I do if I have forgotten my KLSE User ID and/or Password?

If you have forgotten your User ID or Password, please click here to reset.

If you have forgotten your User ID or Password, please click here to reset.Please note that the Request for Electronic Password service is not available for this account.

Please do NOT use Forgot Password on Affin Hwang's login page as these are not available to LTS clients.

-

06. What is an MCD Account?

The MCD account (Malaysian Central Depository) acts as a means of representing ownership and movement of securities.

The MCD account (Malaysian Central Depository) acts as a means of representing ownership and movement of securities. -

07. What should I do if I do not have an MCD Account?

You can open an MCD A/C through Lim & Tan Securities Pte Ltd with the Malaysian Broker, HwangDBS. Currently, we are waiving the charge of S$4.50 required to open the MCD account.

You can open an MCD A/C through Lim & Tan Securities Pte Ltd with the Malaysian Broker, HwangDBS. Currently, we are waiving the charge of S$4.50 required to open the MCD account. -

08. What if I already have MCD Accounts with other Brokers in Malaysia?

You will still need to open an MCD A/C with Hwang DBS through Lim & Tan Securities. Currently, we are waiving the charge of S$4.50 required to open the MCD account.

You will still need to open an MCD A/C with Hwang DBS through Lim & Tan Securities. Currently, we are waiving the charge of S$4.50 required to open the MCD account. -

09. What happens when I click on Reports icon?

This page is currently not available to LTS clients.

This page is currently not available to LTS clients.

-

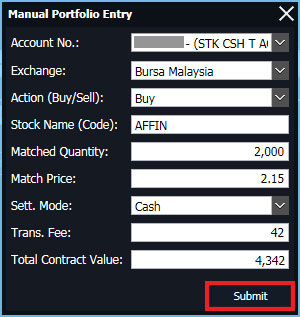

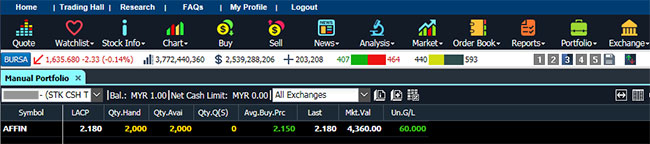

10. Am I able to amend my portfolio?

Yes, you are able to update your portfolio manually. The default brokerage rate of 0.7% is used for the calculations. Do note that the holdings in your portfolio are indicative only as such you will need to check your actual stock holdings prior to placing any orders.

Yes, you are able to update your portfolio manually. The default brokerage rate of 0.7% is used for the calculations. Do note that the holdings in your portfolio are indicative only as such you will need to check your actual stock holdings prior to placing any orders. 1) Please click on the "Portfolio" icon and select the respective screen you wish to view.

2) How do I update the price?

Under Equities Portfolio, select the stock counter and click Detail.

Select the transaction and click Edit.

Key-in the desired price and click "Submit".

3) How do I manually add in a counter to the portfolio?

Under Manual Portfolio, select Add.

Key-in the transaction details and click "Submit".

-

11. How do I view my realised gain/loss?

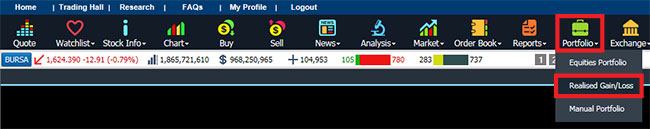

Please click on "Portfolio" and select "Realised Gain/Loss". The default brokerage rate of 0.7% is used for the calculations.

Please click on "Portfolio" and select "Realised Gain/Loss". The default brokerage rate of 0.7% is used for the calculations.

Trading Related

-

01. Do I have to place a deposit to trade KLSE Online?

For Singaporeans and PR, there is no deposit required.

For Singaporeans and PR, there is no deposit required. For foreigners, we will require a cash deposit (min S$5,000 = approximately MYR10, 000). The trading limit for foreigners will be set at five times the deposit placed for KLSE Online.

For example, S$10,000 deposit (MYR20, 000 deposit) = MYR100, 000 Trading Limit

-

02. What are the KLSE Online Brokerage Rates?

The charges are as follows:

The charges are as follows: Commission Rate: 0.5% for all Contract Value (Price x No. of Shares), subject to a minimum of RM60

Contract Stamp: 0.1% of Trade Value (Subject to a Max. of RM 200) and rounding off to the nearest dollar. For example, RM1.20 will be rounded up to RM2.

Clearing Fee: 0.03% of Trade Value subject to a maximum of RM1000 per contract.

Subject to prevailing GST rates

-

03. Important notes for Trading on KLSE

a. All clients trading on the KLSE market will be issued with 2 passwords, one for logging into the system and another for trading. Your original Login ID for the Internet trading platform will be used for KLSE Internet trading. If you have changed your Login ID for the Internet trading platform, please use your original Login ID to log into the KLSE Internet trading platform.

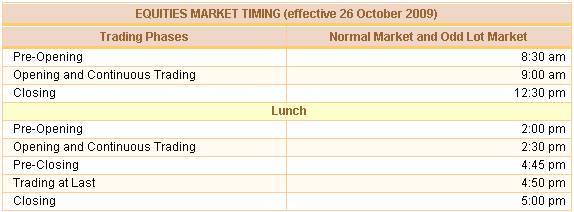

a. All clients trading on the KLSE market will be issued with 2 passwords, one for logging into the system and another for trading. Your original Login ID for the Internet trading platform will be used for KLSE Internet trading. If you have changed your Login ID for the Internet trading platform, please use your original Login ID to log into the KLSE Internet trading platform.b. KLSE Market Timing:

Please refer to: http://www.bursamalaysia.com/website/bm/trading/equities/trading_sessions.jsp

c. All orders not matched by 1230 hrs will automatically be rolled over for the afternoon session. As of 26th Oct 09, the morning session pre-closing and Trading at Last phases have been removed. Please note that there will be no expired status shown inside "Order, Confirmation and Match". The orders will expire at the end of the trading day.

d. Any amendment or withdrawal of orders will require the client to key in the 11-digit SCORE number for each respective order found inside "Order, Confirmation and Match".

e. Please click on the column header once (blue) to sort the favourite list by the desired header field. (The system will sort from smallest to biggest).

f. Please click on the column header twice (pink) to sort the favourite list by the desired header field. (The system will sort from biggest to smallest).

g. In the event that the system slows down, clients are to confirm their orders from "Order, Confirmation and Match" before trying to key in the same order again.

h. To view the latest "Order, Confirmation and Match", please right-click and click the "Refresh" button.

i. The KLSE system will accept orders within 30% of the last done price. As there is no revocation of error trades, clients must be extremely careful when placing their orders.

j. It is strictly illegal to short-sell the KLSE shares. Clients must NOT short sell any KLSE shares. Any short sale position and the resulting consequences will be the full responsibility of the client.

k. All buy or sell trades for each KLSE counter will automatically be amalgamated.

-

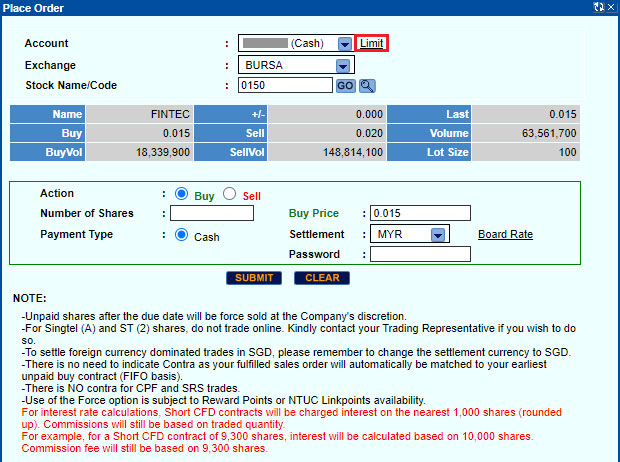

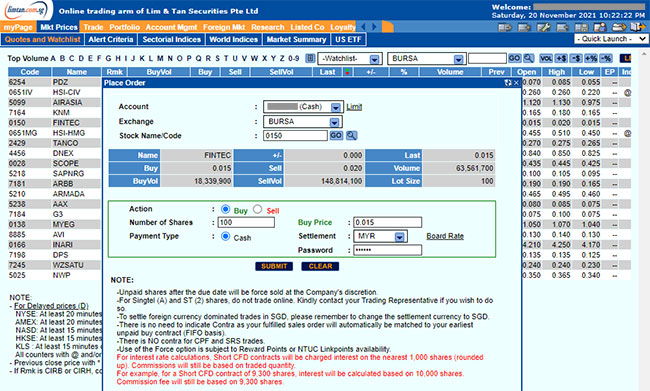

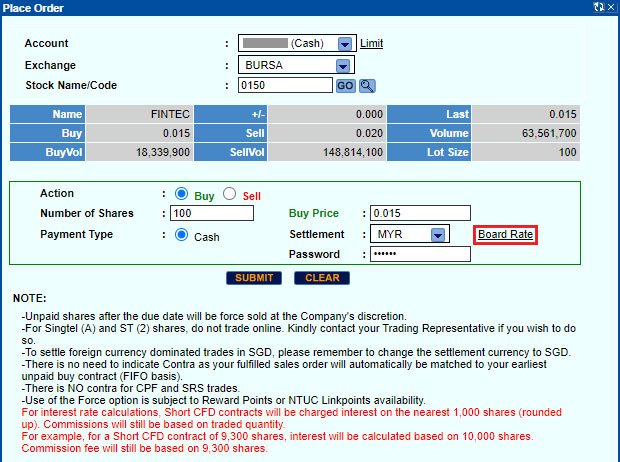

04. How do I place an order in the KLSE Market?

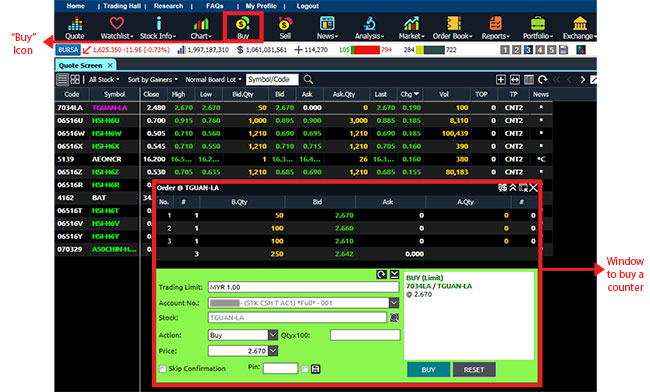

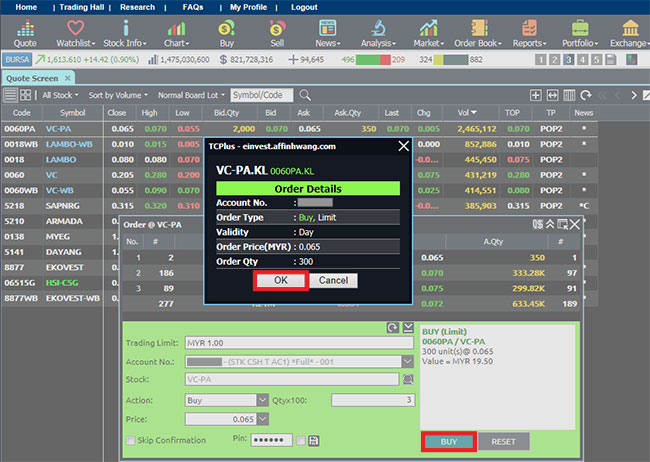

To purchase a counter, you may:

To purchase a counter, you may:

- Click on the counter and then click the "Buy" icon at the top bar or

- Double click on the counter you would like to purchaseA small window will appear.

Note: The quantities of shares will be entered in multiples of hundred. E.g. - to purchase 500 shares, please key in "5" instead of "500".

Once you have keyed in your order, click on the "BUY" button at the bottom right of the purchase window. When a confirmation pop up appears, please make the final check on your purchase and then click "OK".

-

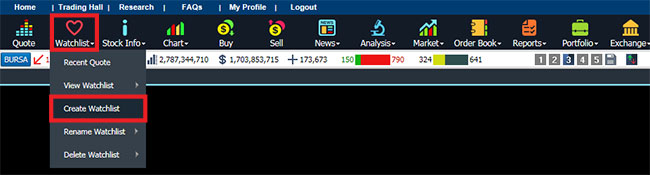

05. How do I create a Watchlist?

To create a Watchlist, click on "Watchlist" and then "Create Watchlist".

To create a Watchlist, click on "Watchlist" and then "Create Watchlist".

Key in the name of your watchlist in the popup screen.

-

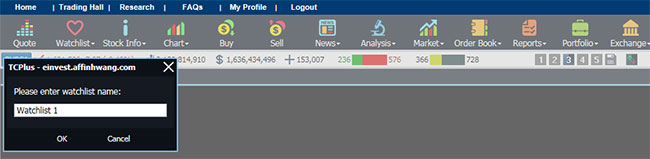

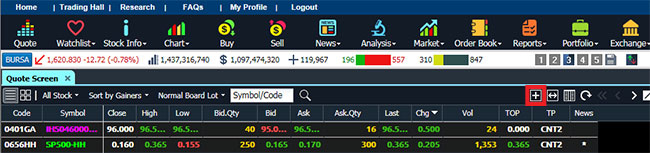

06. How do I add counters to a Watchlist?

On the Quote Screen, click on "+" sign followed by "+" sign on the left of the counter.

On the Quote Screen, click on "+" sign followed by "+" sign on the left of the counter.

A new pop-up will appear. Select a watchlist by clicking on the dropdown menu, and then click on "Add".

-

07. How do I search for a counter?

Key in the name of a counter and click Search.

Key in the name of a counter and click Search.

-

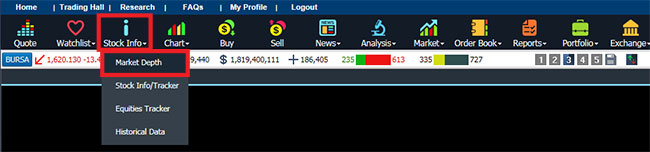

08. How do I view Market Depth information?

To view Market Depth, click on "Stock Info" and then "Market Depth".

To view Market Depth, click on "Stock Info" and then "Market Depth".

-

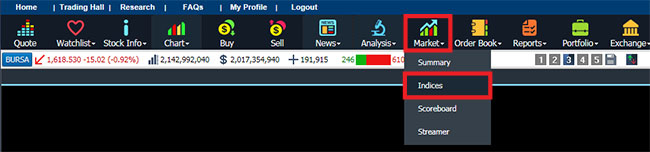

09. How do I view Indices?

Click on "Market" and then "Indices".

Click on "Market" and then "Indices".

-

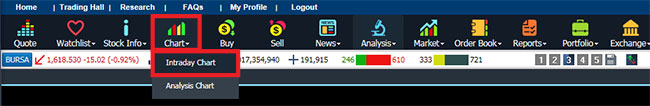

10. How do I view the Intraday Chart?

Click on "Chart" and then "Intraday Chart".

Click on "Chart" and then "Intraday Chart".

-

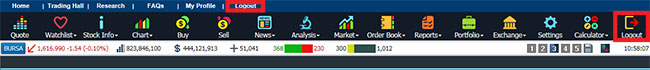

11. How do I logout of the system?

Click on "Logout" at the top right corner of the page or at the top bar.

Click on "Logout" at the top right corner of the page or at the top bar.

Note: All users are encouraged to logout of the system. Due to security measures, there may be future cache issues if a user does not logout properly.

-

12. What is the Extended Order Placement Hours through KLSE Online Trading system?

Normal Order Placement Hours: Monday to Friday. 8.30 a.m. to 5 p.m.

Normal Order Placement Hours: Monday to Friday. 8.30 a.m. to 5 p.m. IEP acts as an indication of the eventual Opening or Closing price, which help investors assess the market demand and supply conditions and allow adjustments of orders accordingly.

Order Placement After Trading Hours

- 1) You may place orders for the next trading day after market closes from 5.05pm onwards. Orders placed after trading hours will be routed to Bursa Malaysia on the next trading day.

- 2) You may view the details of orders placed after trading hours from "Order Status" menu.

- 3) Orders placed after trading hours may be revised or cancelled from "Order Status" menu before the start of the next trading session.

-

13. What is the daily Price Limit?

Price Limits are based on per trading day.

Price Limits are based on per trading day. Stocks Daily Price Limit New Listing including IPOs: Limit Up Limit Down Stock Reference Price Above RM1.00 400%

(5 times Reference Price)30% Stock Reference Price Below RM1.00 *400% or 30 sen whichever is higher Limit Down: *30 sen

(subject to minimum price of 0.5 sen)Existing Stock: Limit Up Limit Down Stock Reference Price Above RM1.00 30% 30% Stock Reference Price Below RM1.00 30 sen 30 sen (subject to minimum

price of 0.5 sen)* Example: If the reference price is RM0.06, the limit up price will be RM0.36 (RM0.06 + RM0.30) and limit down price will be RM0.005 (system minimum price).

-

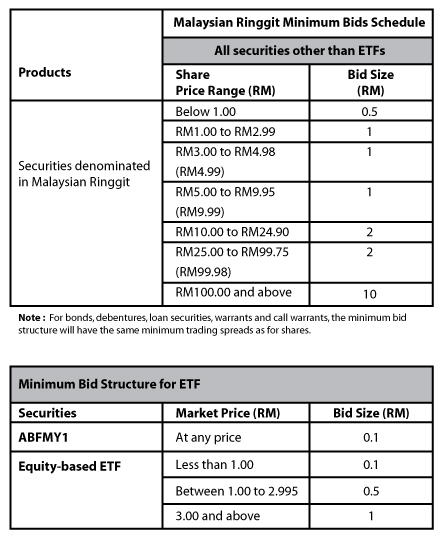

14. What the the bid sizes?

Trading Limit Related

-

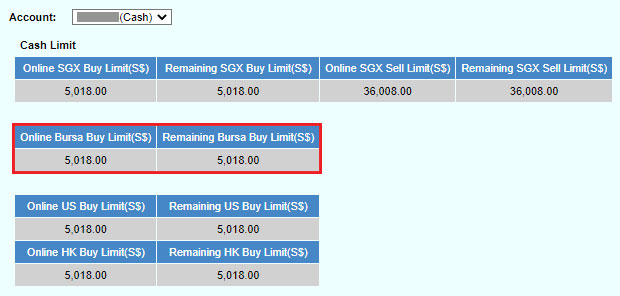

01. What will be my trading limit for the deposits placed?

For Singaporeans and PR, your application will be evaluated and trading limit set by our company.

For Singaporeans and PR, your application will be evaluated and trading limit set by our company. For foreigners, we will require a cash deposit (min S$5,000 = approximately MYR10, 000). The trading limit for foreigners will be set at five times the deposit placed for KLSE Online.

For example, S$10,000 deposit (MYR20, 000 deposit) = MYR100, 000 Trading Limit

What should I do if I want to increase my trading limits?

For Singaporeans and PR, to increase the trading limit, you have to furnish us a copy of your CDP statement, income slip or IR8A tax statement. This is subject to evaluation and approval by our company.

For foreigners, you can give us additional funds (S$ only) by cheque, cash, EPS or Bills Payment through Internet Banking. Please inform the Online Helpdesk (Tel: 6799 8188, Fax: 6538 7730, email: online@limtan.com.sg) once you have sent the funds in.

There will be no intra-day increases in trading limit.

-

02. What should I do if I want to utilize or withdraw my deposit?

Firstly, this will result in the corresponding reduction of the Trading Limit. This will also be possible only if the remaining deposit is sufficient to cover the clients open positions.

Firstly, this will result in the corresponding reduction of the Trading Limit. This will also be possible only if the remaining deposit is sufficient to cover the clients open positions.For the remaining deposit, the trading limit will be based on the next lower thousand.

For example, Initial Deposit S$10,000

Amount Withdrawn (2,450)

Balance Deposit 7,550

For trading limit purposes, the deposit will be S$7,000 (=MYR14, 000) = MYR70, 000 Trading Limit.

Trade Settlement Related

-

01. What are the important dates that I have to be aware of for purchase of shares?

With effect from 29 April 2019, the due date is T+2 market days. Clients can contra up till Due Date, i.e. they must place a corresponding sell contract by Due Date.

With effect from 29 April 2019, the due date is T+2 market days. Clients can contra up till Due Date, i.e. they must place a corresponding sell contract by Due Date.Payment must be received by Lim & Tan Securities by Due Date (D). The Sell-Out date by the Company is D+1 (T+3).

-

02. What are the key dates for sale of shares?

With effect from 29 April 2019, the due date is T+2 market days, i.e. the share sold must be in free balance in their Hwang DBS MCD A/C by T+2.

With effect from 29 April 2019, the due date is T+2 market days, i.e. the share sold must be in free balance in their Hwang DBS MCD A/C by T+2.

For delivery of shares to MCD A/C with Hwang DBS A/C: Scripless T+1 (before 12.30pm)Payment will be made to clients on D+1 (T+3).

Important: Short Selling is not available to clients of LTS.

-

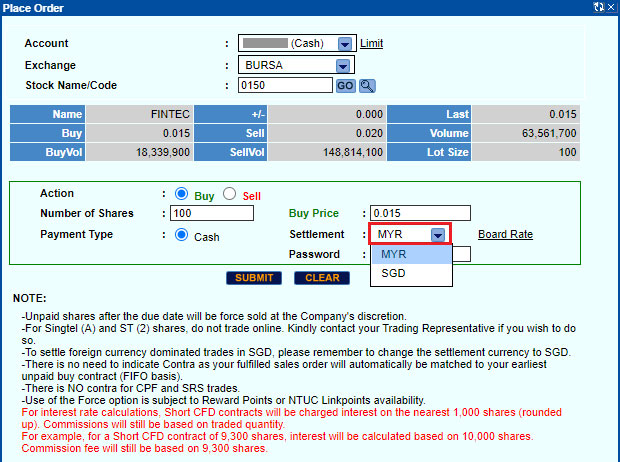

03. Will the settlement amounts be in S$ or MYR?

All settlement amounts, for both purchases and sales, will be defaulted to S$.

All settlement amounts, for both purchases and sales, will be defaulted to S$. -

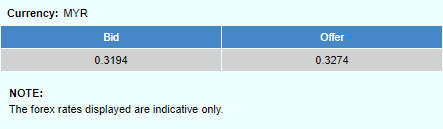

04. What will be the exchange rate used?

The exchange rate used will be the prevailing rate at the time of order fulfillment on the trade date.

The exchange rate used will be the prevailing rate at the time of order fulfillment on the trade date. -

05. What must I do if I want the settlement amount to remain in MYR?

You must inform your Trading Representative on Trade Date to amend the contracts back to MYR. Otherwise, you will have to accept the settlement amounts in S$.

You must inform your Trading Representative on Trade Date to amend the contracts back to MYR. Otherwise, you will have to accept the settlement amounts in S$. -

06. How can I make payment for the purchase of shares?

For S$ settlement, you can make payment through the usual method of cash, cheques or through EPS.

For S$ settlement, you can make payment through the usual method of cash, cheques or through EPS.For MYR settlement, you can pay using Cashiers Orders or personal MYR cheques. For personal cheques, they must be drawn on Malaysian bank branches in KL or JB.

-

07. Are there custody fees charged?

Yes. Monthly foreign custody fee is S$2 per counter, subject to a maximum of S$150 per quarter + GST or 0.0025% pa of market value of shares whichever is applicable.

Yes. Monthly foreign custody fee is S$2 per counter, subject to a maximum of S$150 per quarter + GST or 0.0025% pa of market value of shares whichever is applicable.For clients who conduct at least 6 trades in a quarter in any markets, the monthly fee of S$2 per counter will be waived in any month of that quarter. If there are less than 6 trades per quarter, clients who conduct at least 2 trades in a month, the monthly fee of S$2 per counter will be waived in that month.

System Issue

-

01. What should I do when I am unable to access KLSE Online after login?

To access KL trading after login, you must enable pop-ups (or disable pop up blocker) from your browser. The steps are shown under Q2 under the Troubleshooting FAQ.

To access KL trading after login, you must enable pop-ups (or disable pop up blocker) from your browser. The steps are shown under Q2 under the Troubleshooting FAQ. -

02. What should I do when the system is not available?

Please contact your Trading Representative to check on the status of your orders or to place new orders.

Please contact your Trading Representative to check on the status of your orders or to place new orders.

Trust Account

-

01. Will there be interest credited to credit balance in my Trust Account?

Interest (if any) will be computed and credited to trust account on a daily basis. Where applicable, we will pay interest at our published interest rate, calculated on daily balances. For avoidance of doubt, the published interest rate is determined by us, and subject to change from time to time at our sole and absolute discretion.

Interest (if any) will be computed and credited to trust account on a daily basis. Where applicable, we will pay interest at our published interest rate, calculated on daily balances. For avoidance of doubt, the published interest rate is determined by us, and subject to change from time to time at our sole and absolute discretion.The current published MYR interest rate is 1.00% p.a.

This advertisement has not been reviewed by the Monetary Authority of Singapore.